Tax Calculator USA 2025

Filing Information

Income Information

Deductions

Tax Credits

Your Estimated Tax Results

Tax Bracket Breakdown

Disclaimer: This tool provides estimates based on 2024 IRS tax brackets and rules. For exact calculations, consult a tax professional or IRS.gov. Tax laws change frequently. Verify all figures with official IRS publications (e.g., Publication 17).

IRS Circular 230 Notice: This calculator is not intended to provide legal, accounting, or tax advice. Users should consult a licensed professional for official filings.

Data Privacy: No user data is stored or shared with the IRS. Calculations are performed locally in your browser.

Need Help? Email Us

taxcalculatorsusa@gmail.com

Be tax ready all year long with these free tax calculators

Bonus Tax Calculator

Easily calculate your bonus tax rate to make smart financial decisions.

Crypto Tax Calculator

Easily calculate your crypto tax rate to make smart financial decisions.

Reverse Tax Calculator

Easily calculate your tax rate to make smart financial decisions.

Virginia Tax Calculator

Easily calculate your tax rate to make smart financial decisions.

Tax Calculator USA

A tax calculator in USA is an online tool that helps individuals and businesses estimate their federal and state tax liability with accuracy. The best tax calculators in 2025 provide tailored support for salaried employees, freelancers, crypto investors, small business owners, and landlords. These platforms simplify tax planning by integrating IRS rules, updated tax brackets, and deductions, giving users reliable projections to avoid surprises. With features like capital gains tracking, rental income calculations, and W-2 or 1099 inputs, a USA tax calculator is essential for managing finances and reducing costly errors.

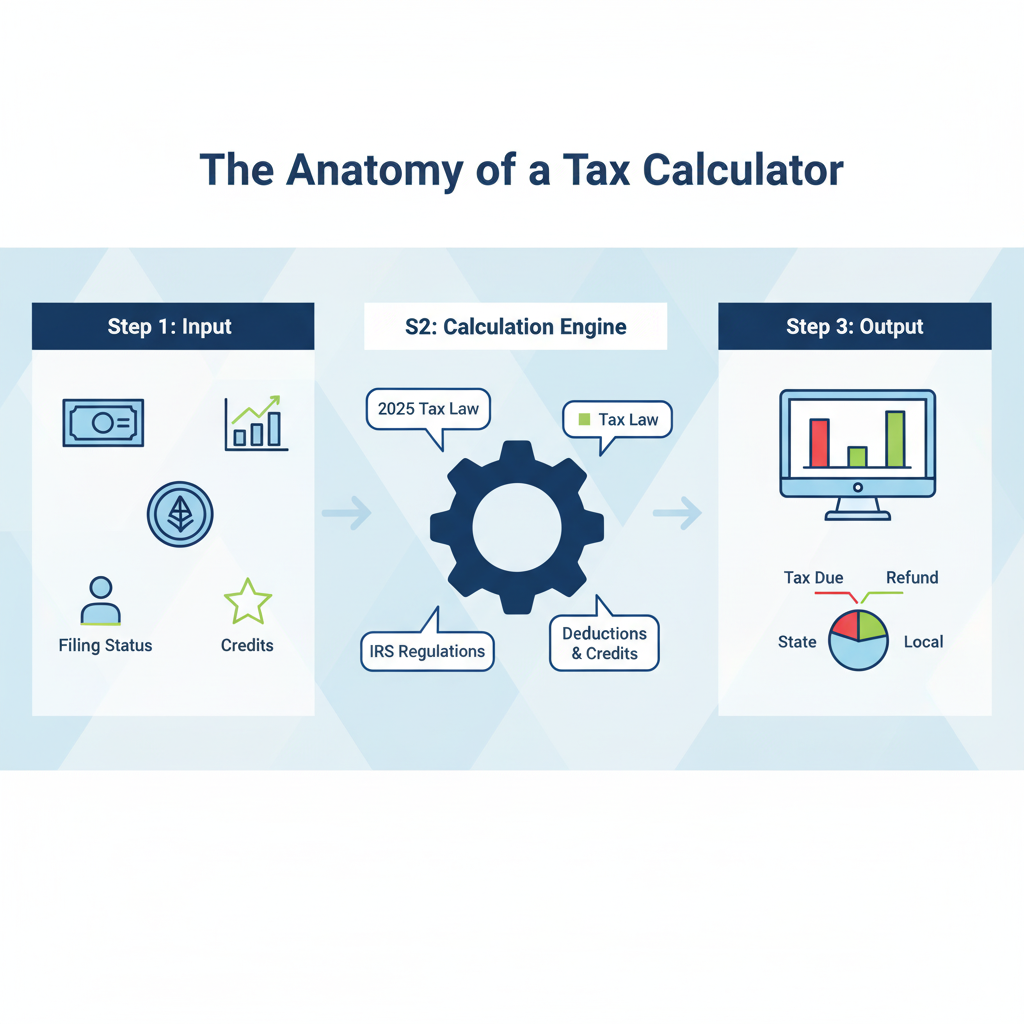

What Is a Tax Calculator and How Does It Work?

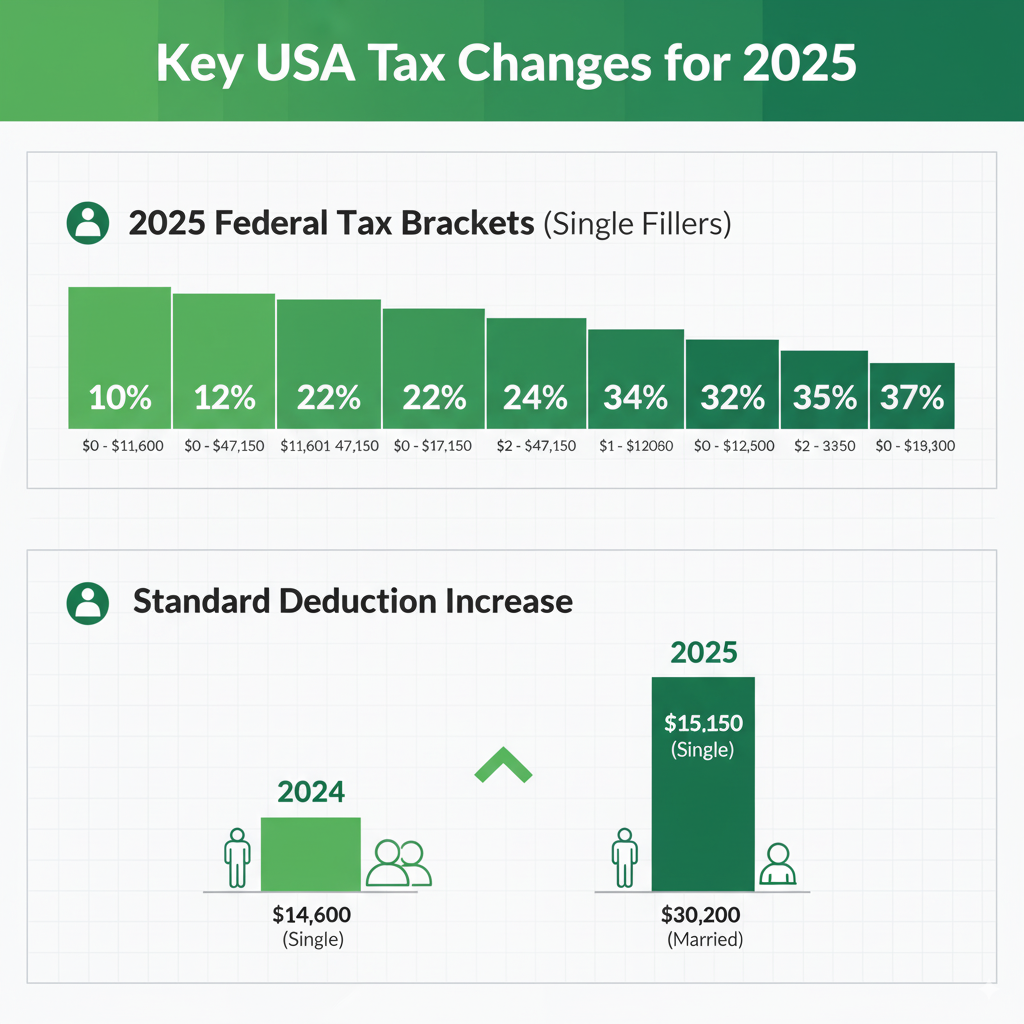

A USA tax calculator is an online tool that uses the latest IRS rules and regulations to estimate how much tax you’ll owe—or how much of a refund you might receive—based on your income, filing status, deductions, and credits. These tools are powered by algorithms that apply the official 2025 tax brackets and standard deduction amounts to your financial data, providing a real-time snapshot of your tax liability.

Key Insight: For the 2025 tax year, the standard deduction has increased to $15,000 for single filers and $30,000 for married couples filing jointly. This is a crucial detail for anyone using a tax calculator for planning.

The Best Free Tax USA Calculators to Use in 2025

While these tools are a great starting point for simple returns, remember that for complex financial situations, a professional consultation is always a good idea. For taxpayers with straightforward needs (like W-2 income and no itemized deductions), these free calculators are excellent.

IRS Free File Calculator: A reliable, official source.

TurboTax Free Tax Tool: Known for its user-friendly interface.

H&R Block Free Tax Calculator: A popular choice from a trusted brand.

FreeTaxUSA: A longstanding favorite for no-cost federal filing.

These calculators are essential for quick planning and financial forecasting, helping taxpayers stay compliant and avoid over- or underpayment.

Understanding the USA Income Tax Calculator

The USA income tax calculator comes in many forms, but they primarily focus on federal and state liabilities. A salary tax calculator helps you understand how much federal and state income tax will be withheld from your paycheck, as well as deductions for Social Security and Medicare.

For example, a salaried individual earning a mid-range income would use this tool to see how their marginal tax rate of 22% or 24% applies to their earnings, helping them make informed decisions about their W-4 withholding. This level of detail makes a tax calculator USA a must-have tool whether you’re evaluating a job offer or budgeting for expenses.

Business & Corporate Tax Calculator USA (For Small Businesses and Corporations)

For small business owners and corporations, staying on top of taxes is non-negotiable. A corporate tax calculator helps estimate how much your company owes based on current rates and reported profits. The ability to forecast quarterly tax payments and plan for deductions like the 100% bonus depreciation for new equipment (a key provision extended for 2025) is invaluable for financial health.

Using an up-to-date tool ensures your business stays compliant with the latest policies, which can shift year to year.

Cryptocurrency Tax Calculator USA: Navigating Crypto Tax Rules

If you’re a crypto investor, the IRS is paying close attention. The use of a dedicated cryptocurrency tax calculator is essential if you’ve mined, traded, or staked crypto. A quality tool will not only import transactions from your wallets and exchanges but also accurately distinguish between short-term and long-term capital gains, which are taxed at different rates.

This is critical because a long-term capital gain (held for over a year) is taxed at a lower rate than a short-term gain (held for less than a year), a nuance a standard calculator might miss.

USA Import Tax Calculator & Sales Tax Tools

For online shoppers and e-commerce sellers, understanding additional fees is key. A USA import tax calculator helps estimate customs duties, excise taxes, and tariffs based on a product’s type and origin. This is distinct from a sales tax calculator, which determines the tax you’ll pay on domestic purchases.

For example, a seller must use a sales tax tool to calculate the correct tax rate based on a customer’s location, ensuring they remain compliant with state and local tax laws across the country.

Rental Income Tax Calculator USA: A Must for Landlords

If you own rental properties, a rental income tax calculator can simplify tax planning significantly. These tools help landlords factor in key deductions like mortgage interest, property taxes, and repairs. Crucially, they also account for depreciation, a non-cash expense that allows you to deduct the cost of the property over its useful life, significantly lowering your taxable income.

This level of detail makes a dedicated calculator a powerful tool for staying organized and financially prepared.

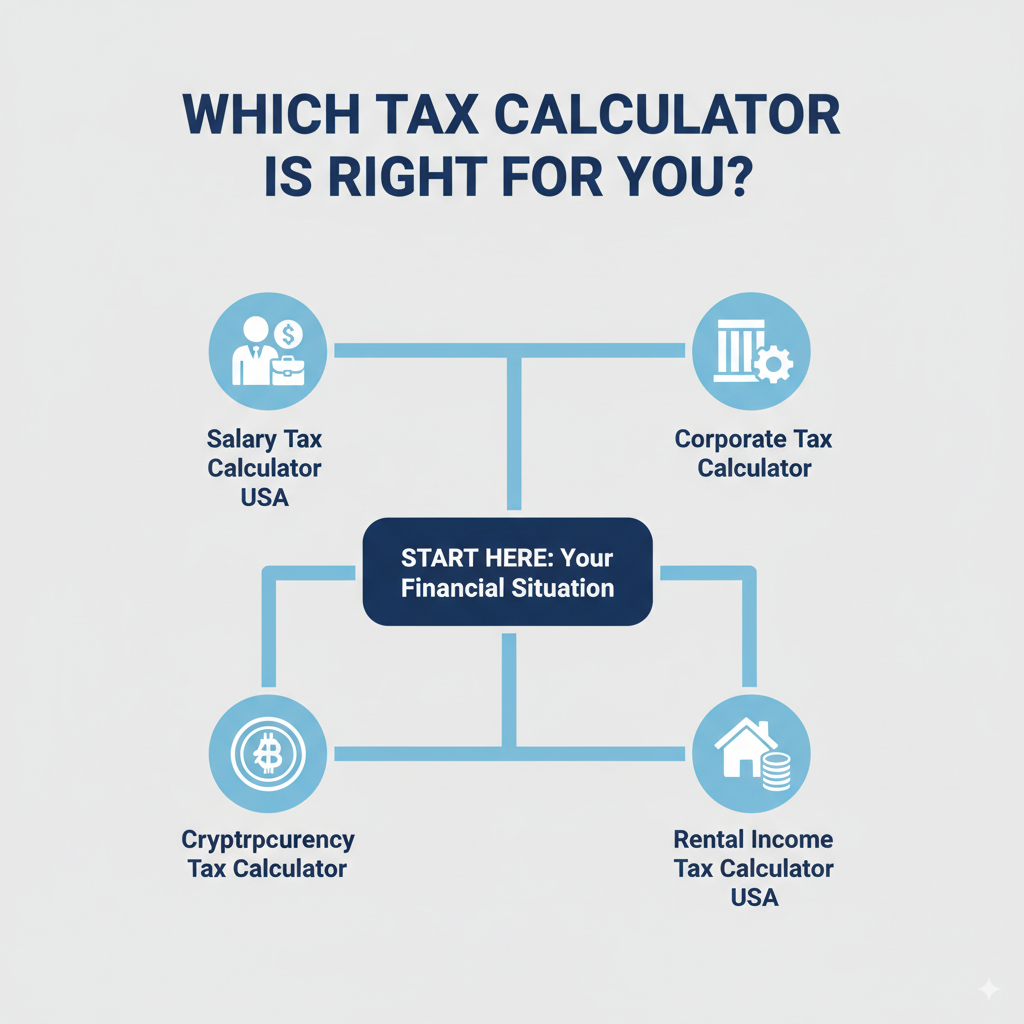

Choosing the Right Tax Calculator for Your Needs

To build topical authority, it’s not enough to just list tools; you need to show an understanding of the underlying principles. Here’s a brief analysis of how to choose the right calculator, with an eye toward current tax legislation and expert insights.

| Use Case | Best Calculator & Rationale | Expert Tip |

| Simple W-2 Filing | FreeTaxUSA, TurboTax: Easy to use for taxpayers with standard deductions and no complex investments. | For many, the free versions are sufficient, but be aware of upsells for state filing or more complex situations. |

| Salary Estimates | Salary tax calculator USA: Best for evaluating job offers or adjusting W-4 forms. | “Use this tool to avoid a big tax bill at the end of the year by ensuring you have the correct amount withheld from each paycheck.” —Certified Public Accountant (CPA) review |

| Self-Employed | Income tax calculator USA: Must-have for forecasting quarterly estimated taxes. | “Self-employed individuals should always budget for both federal and self-employment taxes (Social Security and Medicare), which can be a surprise for new business owners.” —Tax Attorney Statement |

| Crypto Investors | Crypto tax calculator USA: Essential for tracking capital gains and losses. | “Given the IRS’s focus on crypto, using a tool that generates IRS-ready reports is the most secure way to stay compliant.” —Financial Advisor Opinion |

| Landlords | Rental income tax calculator: Crucial for managing deductions, especially depreciation. | “Depreciation is one of the most powerful tax benefits for landlords. A specialized calculator ensures you’re maximizing this deduction.” —Real Estate Tax Professional Insight |

Conclusion

Whether you’re filing taxes, planning investments, or reviewing your financial health, using the right tax calculator USA can save you time and reduce costly mistakes. From the crypto tax calculator to the corporate tax calculator or the rental income tax calculator, there’s a tool designed for every financial situation.

Start using one today—it’s never too early to plan for April. Remember, while these tools are powerful, they are not a substitute for a qualified tax professional, especially for complex tax situations.

FAQs

Q: How accurate are these calculators? A: They’re as accurate as the data you enter. For simple returns, they’re usually spot-on. For more complex filings, use them as a starting point and consider consulting a tax professional to ensure everything is correct.

Q: Do I need a specific calculator for crypto? A: Yes. A crypto tax calculator is specifically built to handle blockchain transactions and capital gains reports, which are handled differently than other forms of income.

Q: Can I estimate both state and federal taxes? A: Absolutely. Many tools, such as a USA income tax calculator or salary tax calculator, provide a full breakdown of both.

Q: Are sales tax and import tax the same? A: No. A sales tax calculator applies to domestic purchases, while a USA import tax calculator is used for goods brought in from other countries. They are governed by different sets of laws and regulations.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the latest tax laws.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.