401(k) Loan Calculator

Loan Details

Loan Summary

| Loan Amount: | $--- |

| Interest Rate: | ---% |

| Loan Term: | --- |

| Number of Payments: | --- |

Amortization Schedule

| Payment # | Payment Date | Payment Amount | Principal | Interest | Remaining Balance |

|---|

Important Disclaimer

This calculator is for educational purposes only and should not be considered financial advice. 401(k) loan terms vary by plan. Consult your plan administrator for specific rules and limitations. The IRS limits 401(k) loans to the lesser of $50,000 or 50% of your vested balance. Defaulting on a 401(k) loan may have significant tax consequences. We recommend consulting with a qualified financial advisor before taking a 401(k) loan.

Explore Our Free Tax Calculators and Tools

The Essential Guide to 401(k) Loan Calculator

A 401(k) loan calculator is a practical tool that allows employees to calculate 401(k) loan repayment costs before borrowing from their retirement plan. By entering details such as loan amount, interest rate, and repayment term, users can estimate 401(k) loan payments and view a personalized repayment schedule. This tool highlights how borrowing affects monthly cash flow, long-term retirement savings, and compound growth. Using a 401(k) loan calculator helps individuals compare options, evaluate the true cost of borrowing from a 401(k), and make informed financial decisions with confidence.

What Is a 401(k) Loan?

A 401(k) loan allows you to borrow money from your own 401(k) retirement account. Unlike traditional loans, you are essentially borrowing from yourself, and the interest you pay goes back into your own account, not to a financial institution.

How it works: Your plan administrator sets the rules for eligibility, but generally, you must be an active participant in the 401(k) plan. There are also borrowing limits, typically up to 50% of your vested balance or $50,000, whichever is less (per IRS rules). Repayment terms are usually fixed, often with a five-year maximum, though loans for a primary residence may have longer terms. While the interest you pay goes back to you, it’s crucial to understand that your borrowed money is no longer invested and growing within the market during the loan term.

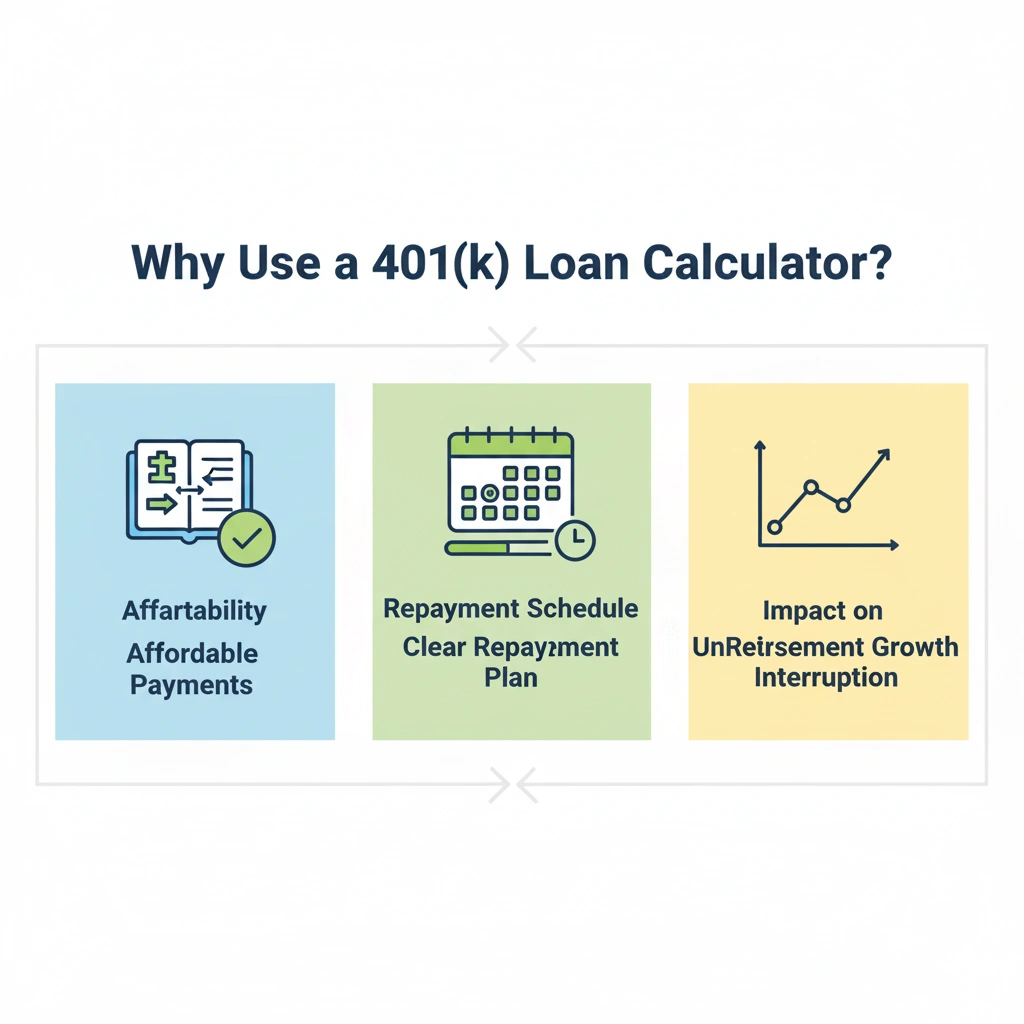

Why Use a 401(k) Loan Calculator?

The primary benefit of using a 401(k) loan calculator is to estimate your loan’s true cost and impact. It provides a clear picture of:

- Affordability: Can you comfortably manage the monthly or bi-weekly payments without straining your budget?

- Repayment Schedule: How long will it take to repay the loan, and what will the total interest paid amount to?

- Impact on Retirement Savings: While the interest goes back to your account, the calculator helps you visualize the temporary halt in your investment growth.

By inputting various scenarios, you can adjust loan amounts and repayment periods to find a solution that aligns with your financial goals and capabilities, aiding in crucial budgeting and planning.

How to Use a 401k Loan Calculator

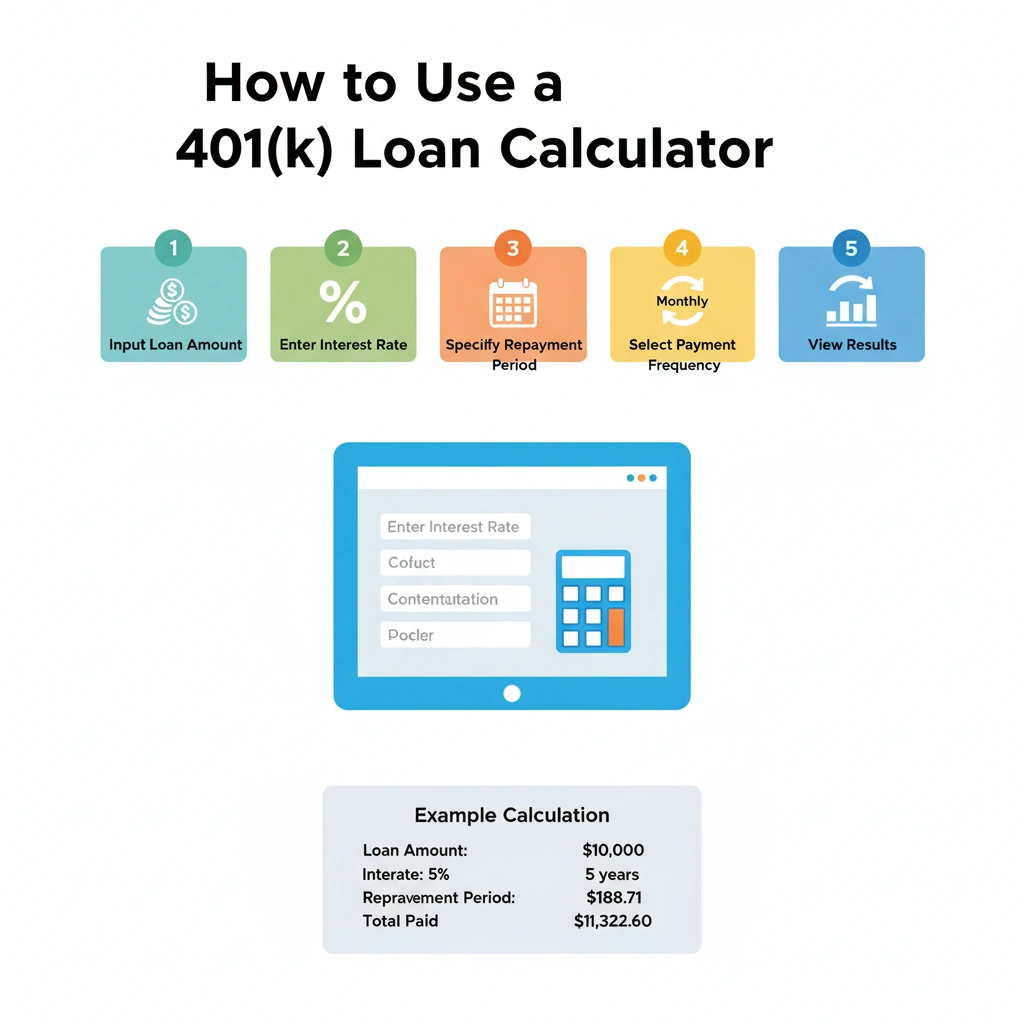

Using a 401(k) loan calculator is a straightforward process, typically involving a few key steps:

- Access the Calculator: Find a reputable online 401(k) loan calculator (many financial institutions offer them).

- Input Loan Amount: Enter the total amount you intend to borrow.

- Enter Interest Rate: Provide the interest rate your plan charges (often prime rate plus 1%). See Federal Reserve Data on the Prime Rate.

- Specify Repayment Period: Choose your desired repayment term (e.g., 1 year, 3 years, 5 years).

- Select Payment Frequency: Indicate whether you’ll be making monthly or bi-weekly payments.

Example Calculation:

Let’s say you borrow $10,000 at a 5% interest rate over 5 years (60 months). A calculator would typically show you:

- Monthly Payment: Approximately $188.71

- Total Interest Paid: Approximately $1,322.60

- Total Paid: Approximately $11,322.60

This immediate feedback allows you to assess the feasibility of the loan.

Types of 401k Loan Calculators

Different calculators serve specific purposes, helping you analyze various aspects of your potential loan.

a. 401k Loan Interest Rate Calculator

This type of calculator specifically focuses on the total interest you will pay over the life of the loan. It’s crucial to remember that this interest is paid back into your own 401(k) account, effectively increasing your retirement savings. However, it’s important to weigh this against the lost investment gains from the money you borrowed.

b. 401k Loan Payment Calculator

The most common type, a payment calculator, helps you estimate your monthly or bi-weekly payments based on the loan amount, interest rate, and repayment period. This is invaluable for budgeting, allowing you to adjust the loan terms to find a payment that comfortably fits within your current financial obligations.

c. 401k Loan Calculator with Bi-Weekly Payments

Many individuals prefer to make bi-weekly payments, as it can subtly reduce the overall interest paid and shorten the repayment term. This calculator demonstrates the amortization differences between monthly and bi-weekly payments, showcasing how more frequent, smaller payments can impact your financial outcome.

Popular Tools: Fidelity 401k Loan Calculator

Among the many available tools, the Fidelity 401(k) Loan Calculator is a popular and user-friendly option. It offers a clear interface, allowing users to easily input loan details and receive immediate estimates of payments and total interest. Its intuitive design and comprehensive results make it a preferred choice for many seeking to understand their 401(k) loan options. Many other reputable financial institutions also provide similar, reliable calculators.

How to Calculate 401k Loan Payments Manually

While online calculators are convenient, understanding the underlying principles of loan calculation can be beneficial. A basic manual calculation for a fixed-rate loan involves understanding principal, interest, and term.

The most common formula for calculating a fixed-rate loan payment is:

M=P[i(1+i)n]/[(1+i)n–1]

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (annual rate / 12)

- n = Total number of payments (loan term in years * 12)

When to use manual vs. online calculators: Manual calculation is useful for a deeper understanding of the mechanics or for quick estimations. However, for accuracy and convenience, especially with varying interest rates or complex terms, online calculators are always recommended.

Frequently Asked Questions (FAQs):

Q1: What is a good interest rate on a 401k loan?

The interest rate on a 401(k) loan is typically set by your plan administrator, often at the prime rate plus 1%. Since the interest is paid back to your own account, a “good” rate is less about saving money on interest and more about what your plan offers.

Q2: Can I change my loan repayment schedule from monthly to bi-weekly?

This depends on your plan administrator’s rules. Some plans offer flexibility in repayment schedules, while others may require you to stick to the initial terms. Always check with your plan administrator or HR department.

Q3: Is the 401k loan interest really paid to myself?

Yes, the interest you pay on a 401(k) loan is credited back to your 401(k) account. This means you are essentially paying interest to yourself, rather than to a lender.

Q4: Can I take multiple 401k loans?

Your plan’s rules will dictate whether you can take multiple 401(k) loans. Some plans allow it, while others restrict participants to one loan at a time. The total outstanding loan balance will still be subject to the borrowing limits set by IRS.

Q5: What happens if I leave my job with an unpaid 401k loan?

This is a critical consideration. If you leave your job with an outstanding 401(k) loan, you typically have a short grace period (often 60-90 days) to repay the full balance. If you fail to do so, the outstanding loan amount is considered a taxable distribution, and you may also incur a 10% early withdrawal penalty if you are under 59 ½. (IRS Guidance).

Bottom Line

A 401(k) loan can provide much-needed liquidity in certain situations, but it’s a decision that requires careful consideration. The importance of using a 401(k) loan calculator cannot be overstated. These tools empower you to accurately estimate payments, understand the true cost, and assess the impact on your retirement savings. Before committing to a 401(k) loan, utilize these calculators to explore various loan amounts, interest rates, and repayment periods. By doing so, you can choose the right loan terms that align with your financial situation and help secure your future.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.