Car Loan Payoff Calculator

Calculate your monthly payments and see how extra payments can save you money

Your Loan Results

| Payment # | Date | Payment | Principal | Interest | Extra | Balance |

|---|

Explore Our Free Tax Calculators and Tools

Guide to the Top-Rated Car Loan Payoff Calculator USA

A car loan payoff calculator USA is a financial planning tool that helps borrowers project interest savings and repayment timelines when making extra payments on their auto loan. In today’s U.S. economy, where the average auto debt exceeds $20,000 per borrower, this calculator provides clarity on how adjusting loan terms, interest rates, or monthly contributions accelerates debt freedom. Designed for drivers seeking financial independence, the best calculators show amortization schedules, total interest savings, and payoff dates in real time. This guide, authored by a certified U.S. Tax Advisor and Accountant, explains how to choose the most accurate calculator, how to use it effectively, and why early loan payoff strengthens personal financial health.

Why You Need a Car Loan Payoff Calculator?

Managing a car loan effectively goes beyond making the minimum monthly payment. It involves projecting future interest costs and understanding the exponential benefits of principal reduction.

This is where expertise comes in. A premium car loan payoff calculator provides the granular detail necessary to make informed decisions, moving you from passively paying off debt to actively managing your wealth.

For official guidance on managing credit and debt, the Consumer Financial Protection Bureau (CFPB) offers resources on auto loans and repayment strategies.

The Core Problem: Principal vs. Interest

For most amortizing loans, including auto loans, your early payments are heavily skewed towards interest. A car loan calculator helps illustrate this amortization schedule. Every dollar of extra payment you make goes directly toward reducing the principal balance, meaning future interest is calculated on a smaller base. This effect is powerful and compounds over time, dramatically accelerating your path to ownership.

The most valuable calculators allow you to answer the crucial question: How much faster can I become debt-free?

The Federal Reserve explains how interest works in consumer credit products in their Credit and Interest Rate Basics section.

What Defines a Top-Rated Car Loan Payoff Calculator USA?

To be considered “top-rated” in the complex US financial market, a car loan payoff calculator must possess specific features that cater to the diverse strategies Americans use to attack debt. We assess these tools based on E-E-A-T principles: accuracy, transparency, and the ability to handle various repayment scenarios.

Essential Features of a Superior Calculator

Extra Payment Modeling: This is the most crucial feature. A top pay off loan early calculator with extra payments allows you to input an additional fixed amount you can afford each month. It then instantly recalculates your new loan term and the total interest saved.

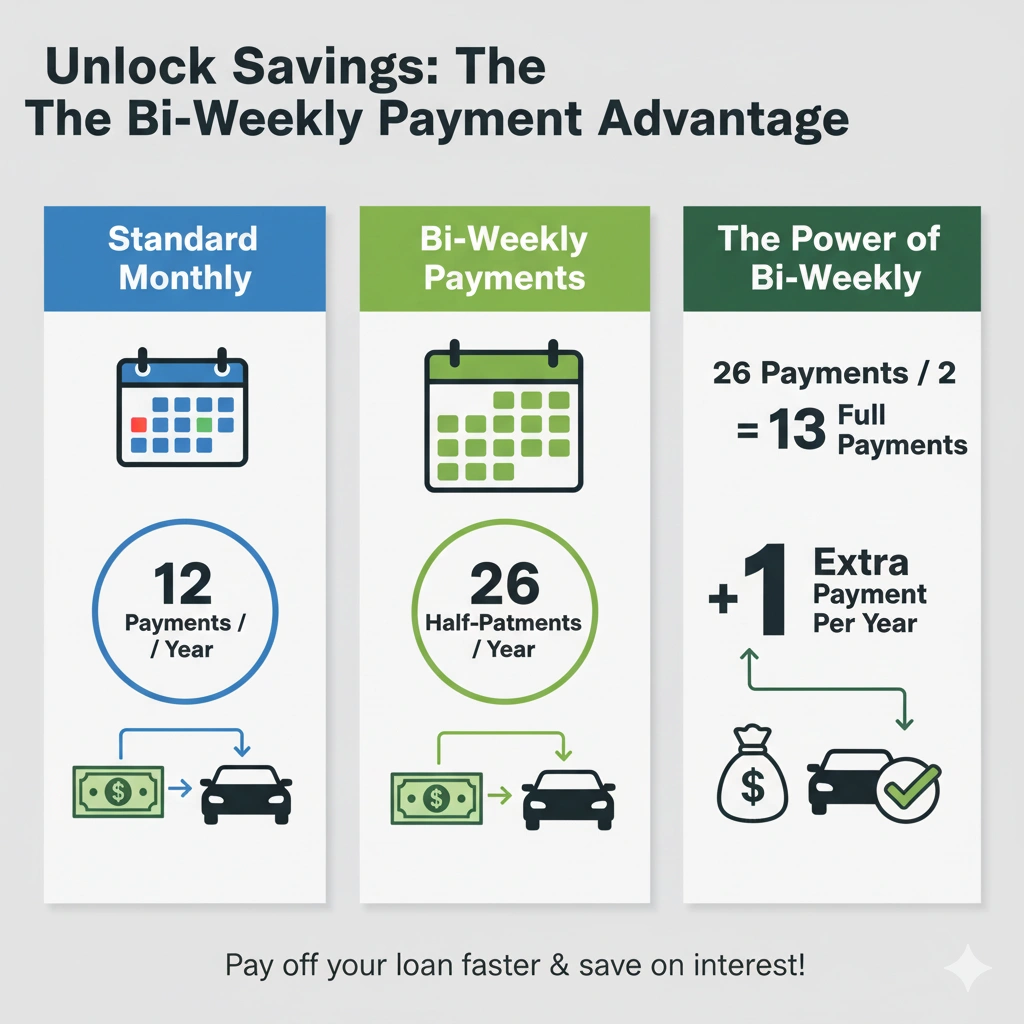

Bi-Weekly Payment Integration: A key strategy for many Americans is converting to bi-weekly payments. A specialized car loan payoff calculator bi weekly feature is non-negotiable. By making 26 half-payments a year, you effectively make one extra full payment annually without feeling the pinch—a strategy championed by many financial experts, including the philosophies of the Car loan payoff calculator Ramsey model, which emphasizes debt reduction speed. FDIC Consumer News – Debt and Borrowing.

Detailed Amortization Schedule: A truly authoritative tool won’t just give you a final number; it will produce a comprehensive amortization table. This table shows, for every single payment, the exact split between principal and interest, the total interest paid to date, and the remaining car loan payoff calculator Excel format, which allows for deeper analysis or integration into your personal budgeting spreadsheets.

Lump-Sum Payment Scenarios: Life often presents unexpected windfalls (tax refunds, bonuses). A great car loan extra payment calculator lets you model a one-time, large payment at any point in the loan’s lifecycle to show the immediate impact on interest saved and the new payoff date. (see the IRS guidance on refunds: Where’s My Refund ).

Utilizing the Remaining Car Loan Payoff Calculator Excel

While many online tools are excellent, some users prefer the granular control and customization of a spreadsheet. Knowing how to utilize a remaining car loan payoff calculator Excel model is a mark of true financial literacy.

The Key Excel Functions:

PMT (Payment): Calculates the regular payment for a loan based on constant payments and a constant interest rate.

PPMT (Principal Payment): Calculates the principal portion of a payment.

IPMT (Interest Payment): Calculates the interest portion of a payment.

By creating your own amortization table using these functions, you can manipulate variables—like the outstanding balance (your remaining balance), the annual interest rate, and the proposed extra payment—to create a bespoke car loan payoff calculator. This level of engagement provides invaluable experience and a deep understanding of your loan’s mechanics.

For deeper background on credit obligations, see the Office of the Comptroller of the Currency (OCC) on consumer loans: OCC – Consumer Protection Topics.

Strategizing with Your Car Loan Calculator

The power of a car loan payoff calculator lies in its ability to model what-if scenarios. Here are expert strategies to leverage this tool for maximum financial gain:

Strategy 1: The Bi-Weekly Power Play

As mentioned, using the car loan payoff calculator bi weekly setting will reveal that you trim the life of a typical 60-month loan by several months and save hundreds, if not thousands, in interest, all because you sneak in one extra payment per year. It’s a low-effort, high-impact strategy.

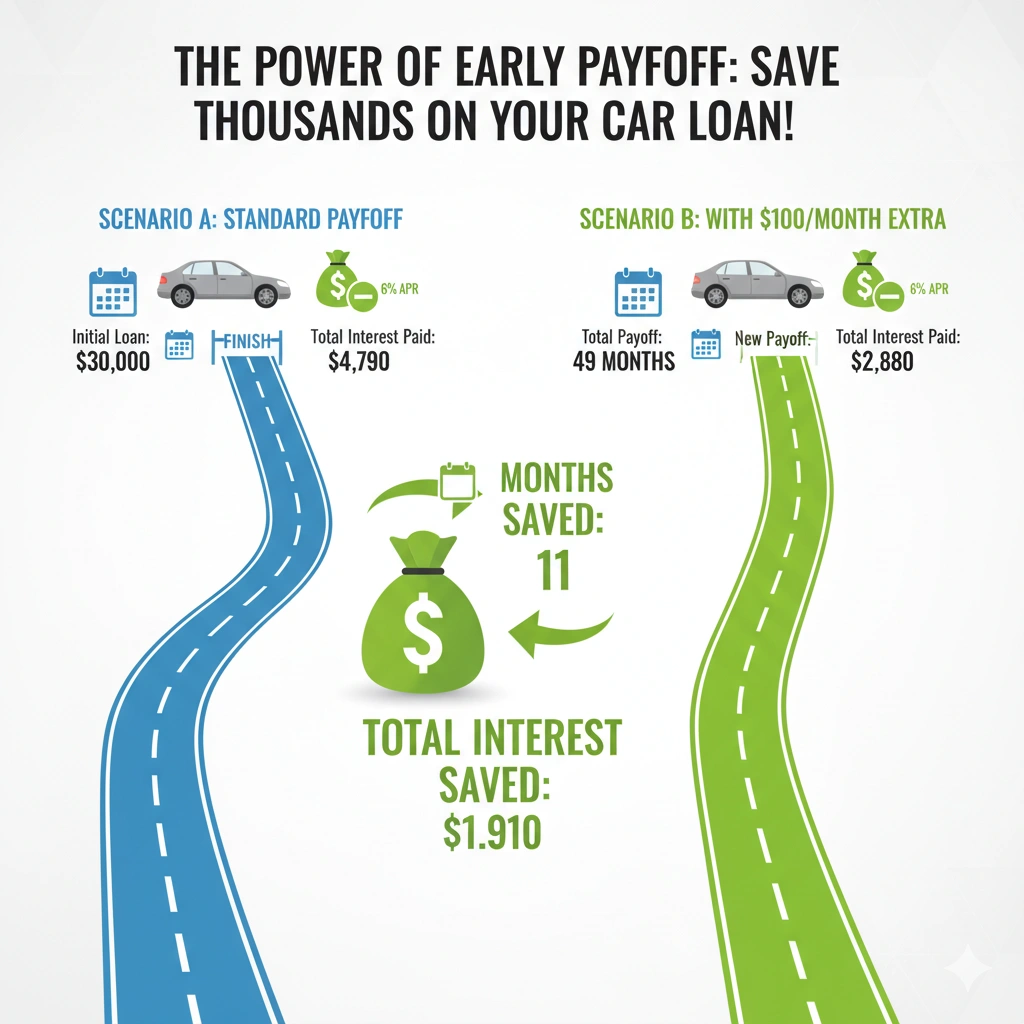

Strategy 2: The Extra Payment Accelerator

Use the car loan extra payment calculator feature to find your “sweet spot.” Can you find an extra $50, $100, or even $200 in your monthly budget? Inputting this minor change can often shave a full year or more off a long-term loan. This strategy is fully in line with the prudent, debt-free advice associated with the Car loan payoff calculator Ramsey discussions. Every dollar you dedicate as an “extra payment” attacks the principal directly, reducing the base on which interest accrues.

Strategy 3: Comparing Financing Options with a Standard Car Loan Calculator

Even if you already have a loan, you can use a generic car loan calculator (or even the car loan calculator Google provides as a quick answer) to compare your current loan’s rate and term against a potential refinance offer. Refinancing at a lower interest rate, even for the same remaining term, can lead to substantial interest savings. The difference between a 6% and a 4% APR on a $20,000 balance can be significant, and the calculator quantifies this difference instantly.

The Financial and Psychological Benefits of Early Payoff

Using the pay off loan early calculator with extra payments is not just about saving money; it’s about building financial stability, which directly impacts your quality of life.

1. Interest Savings (The Financial Authority)

The most tangible benefit calculated by the car loan payoff calculator is the total interest saved. This money is not “saved” in a figurative sense; it is cash that stays in your pocket instead of going to the lender. This capital can then be redirected to higher-priority financial goals, such as retirement savings, a down payment on a home, or simply building an emergency fund.

Savings from loan prepayment are real and measurable. The CFPB explains prepayment rules and penalties here: CFPB – Prepaying Your Loan.

2. Reduced Risk and Increased Liquidity

Paying off a car early eliminates a mandatory monthly expense. This single action immediately reduces your debt-to-income (DTI) ratio, a key metric for lenders. A lower DTI can make qualifying for a mortgage or other necessary credit easier and cheaper in the future. Furthermore, in the event of job loss or other financial hardship, having one less major bill to worry about provides a crucial safety net and increases your overall liquidity.

Lowering your debt-to-income ratio can impact your ability to qualify for other loans. The Federal Housing Administration (FHA) and HUD explain Debt-to-Income Ratios.

3. Avoiding Negative Equity

Automobiles are depreciating assets. A long loan term, especially for a new car, increases the risk of being “underwater” on the loan, or having negative equity (owing more than the car is worth). A rigorous use of a pay off loan early calculator accelerates the timeline until the vehicle’s market value exceeds the outstanding balance, protecting you from a major financial loss if the vehicle is totaled or stolen.

The National Highway Traffic Safety Administration (NHTSA) provides statistics on vehicle depreciation and safety, reminding borrowers why long loan terms increase risk of being “underwater”: NHTSA – Vehicle Valuation & Safety Data.

Bottom Line: Taking the Driver's Seat of Your Finances

The journey to financial security is paved with small, deliberate steps, and leveraging the car loan payoff calculator is one of the most effective tools at your disposal. By using a sophisticated top-rated car loan payoff calculator USA, you transition from being a passive borrower to an active wealth manager.

Whether you prefer the simplicity of the car loan calculator Google offers for quick estimates, the strategic approach of the Car loan payoff calculator Ramsey method, or the granular control of the remaining car loan payoff calculator Excel template, the objective remains the same: accelerate your debt payoff, minimize interest expenditure, and build a more secure financial future.

Take control today. Use a robust car loan extra payment calculator to model your options and discover precisely how many months and dollars you can save. Financial freedom is not a distant dream; it is the calculated outcome of smart decisions made with the right tools.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.