California Overtime Calculator

Daily Hours Worked

Pay Calculation Results

Daily Breakdown

`; days.forEach((day, index) => { if (dailyHours[index] > 0) { const dayName = day.charAt(0).toUpperCase() + day.slice(1); const breakdown = dailyBreakdown[index]; resultHTML += `- Regular: ${breakdown.regular.toFixed(2)} hours

${breakdown.overtime > 0 ? `- Daily OT (1.5×): ${breakdown.overtime.toFixed(2)} hours

` : ''} ${breakdown.double > 0 ? `- Double Time (2×): ${breakdown.double.toFixed(2)} hours

` : ''} ${index === seventhDayIndex ? `7th consecutive day premium pay applies

` : ''}

Explore Our Free Tax Calculators and Tools

California Overtime Calculator – How to Calculate Overtime Pay in California

California overtime laws under the California Labor Code impose strict requirements on employers to pay non-exempt workers time-and-a-half after 8 hours in a workday or 40 hours in a workweek, and double time after 12 daily hours or 7 consecutive workdays. Businesses that miscalculate overtime face costly penalties, wage claims, and lawsuits. Our California overtime calculator helps employers verify compliance, accurately estimate labor costs, and avoid violations of state overtime rules.

What is Overtime in California?

California has some of the most employee-friendly overtime laws in the U.S. According to the California Labor Code, Section 510, overtime pay is mandatory in the following situations:

Over 8 hours in a single workday – time and a half

Over 12 hours in a single workday – double time

Over 40 hours in a single workweek – time and a half

7 consecutive days of work – time and a half for the first 8 hours, double time beyond that

These rules apply to non-exempt employees, and employers must comply or face penalties under the California Division of Labor Standards Enforcement (DLSE).

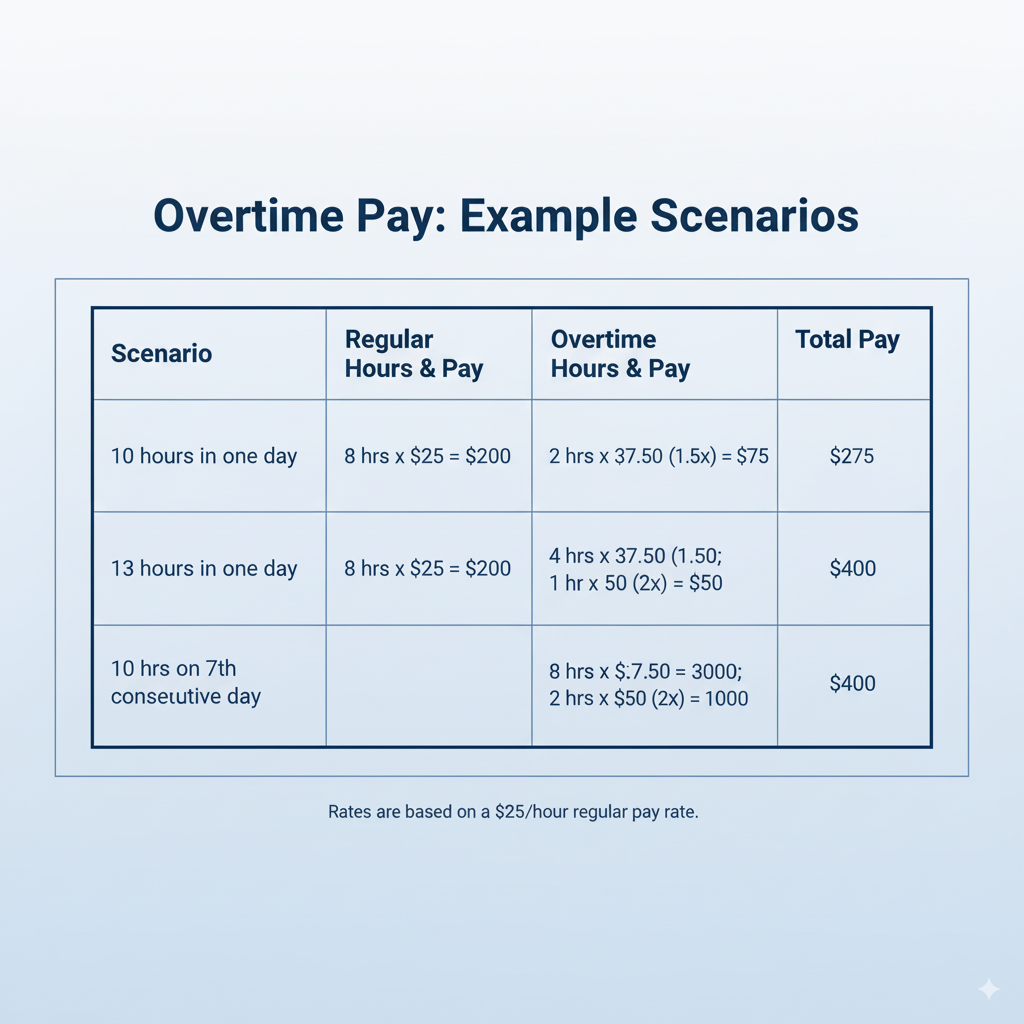

How is Overtime Calculated in California?

Let’s break down the various rules California uses to calculate overtime:

Daily Overtime

1.5x pay after 8 hours worked in a single day

2x pay after 12 hours worked in a single day

Weekly Overtime

1.5x pay for hours worked over 40 in a workweek

7th Consecutive Day Rule

If an employee works 7 days in a row:

1.5x pay for the first 8 hours

2x pay for any hours beyond 8 on that day

Step-by-Step Guide – How to Calculate Overtime Pay in California

Step 1: Determine Regular Rate of Pay

Start with the employee’s hourly wage. If the employee earns bonuses or commissions, those must also be factored in under California Code of Regulations, Title 8, Section 11040.

Example:

If the hourly rate is $20, then:

Time and a half = $20 × 1.5 = $30/hour

Double time = $20 × 2 = $40/hour

Step 2: Identify Overtime Hours

Calculate the total hours worked per day and per week. Apply whichever rule gives the employee more pay, not both.

Step 3: Apply the Correct Overtime Rate

Multiply:

Overtime hours at 1.5x

Additional overtime hours at 2x

Step 4: Calculate Total Overtime Compensation

Add the total regular pay and overtime pay to get the full earnings for the pay period.

California Overtime Calculator Tool

A California Overtime Calculator simplifies the math. You just need to input:

Hourly wage

Total hours worked per day

Number of days worked in the week

The tool will show:

Regular pay

Overtime pay (1.5x)

Double time pay (2x)

Total estimated earnings

Why California Overtime Laws Are Stricter Than Federal Rules

Unlike the Fair Labor Standards Act (FLSA) which only considers weekly overtime, California enforces daily thresholds too. This means you can earn overtime even if you worked less than 40 hours a week—if you crossed the 8-hour daily limit.

Example:

4 days × 10 hours/day = 40 hours/week

You still get 8 hours of overtime pay (2 extra hours each day)

Common Mistakes When Calculating Overtime in California

Assuming overtime is only calculated weekly

Ignoring 7th consecutive day rule

Not counting bonuses in regular rate

Misclassifying exempt vs. non-exempt employees

To avoid fines and payroll issues, always follow the California Division of Labor Standards Enforcement (DLSE) rules. For compliance, see DLSE Enforcement Policies and Interpretations Manual

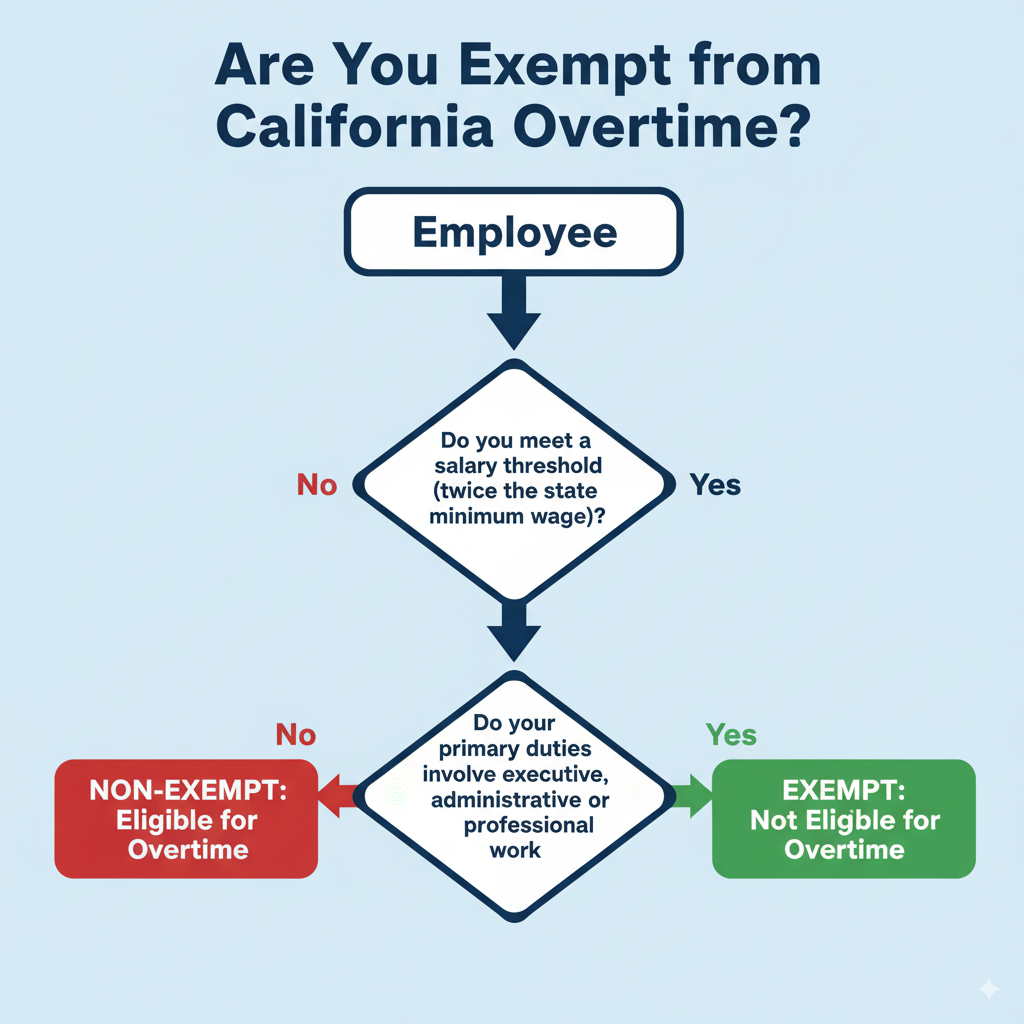

Who Is Exempt From California Overtime Rules?

v

Some employees are exempt from overtime, including:

Executives and managers

Licensed professionals (e.g., lawyers, doctors)

Independent contractors

Salaried employees earning at least twice the state minimum wage and meeting other criteria

Always verify exemptions through California Wage Orders.

FAQ: California Overtime Pay

How do you calculate overtime in California manually?

Use the daily and weekly rules. Count hours worked above 8/day or 40/week, apply 1.5x or 2x pay rates.

What is double time pay in California?

Double time is paid at 2x your regular rate for:

Hours beyond 12 in a day

Hours beyond 8 on the 7th consecutive workday

Does California have an overtime calculator?

Yes! Many online tools help you estimate your California overtime pay. You can use ours here.

Is overtime after 8 hours or 40 hours in California?

Both. California requires overtime after 8 hours per day or 40 hours per week, whichever benefits the employee more.

How is overtime taxed in California?

Overtime is taxed like regular income. Use a California paycheck tax calculator to estimate take-home pay.

Bottom Line

California’s overtime laws are among the most comprehensive in the country. Whether you’re a worker ensuring fair compensation or an employer managing compliance, it’s essential to understand how to calculate overtime pay in California.

Use our California Overtime Calculator to simplify the process, stay compliant, and ensure you’re being paid or paying correctly.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.