Washington State Sales Tax Calculator

Calculate the total cost including state, local, and special district taxes

Results

Explore Our Free Tax Calculators and Tools

Washington Sales Tax Calculator: Easily Calculate Sales Tax in Washington State

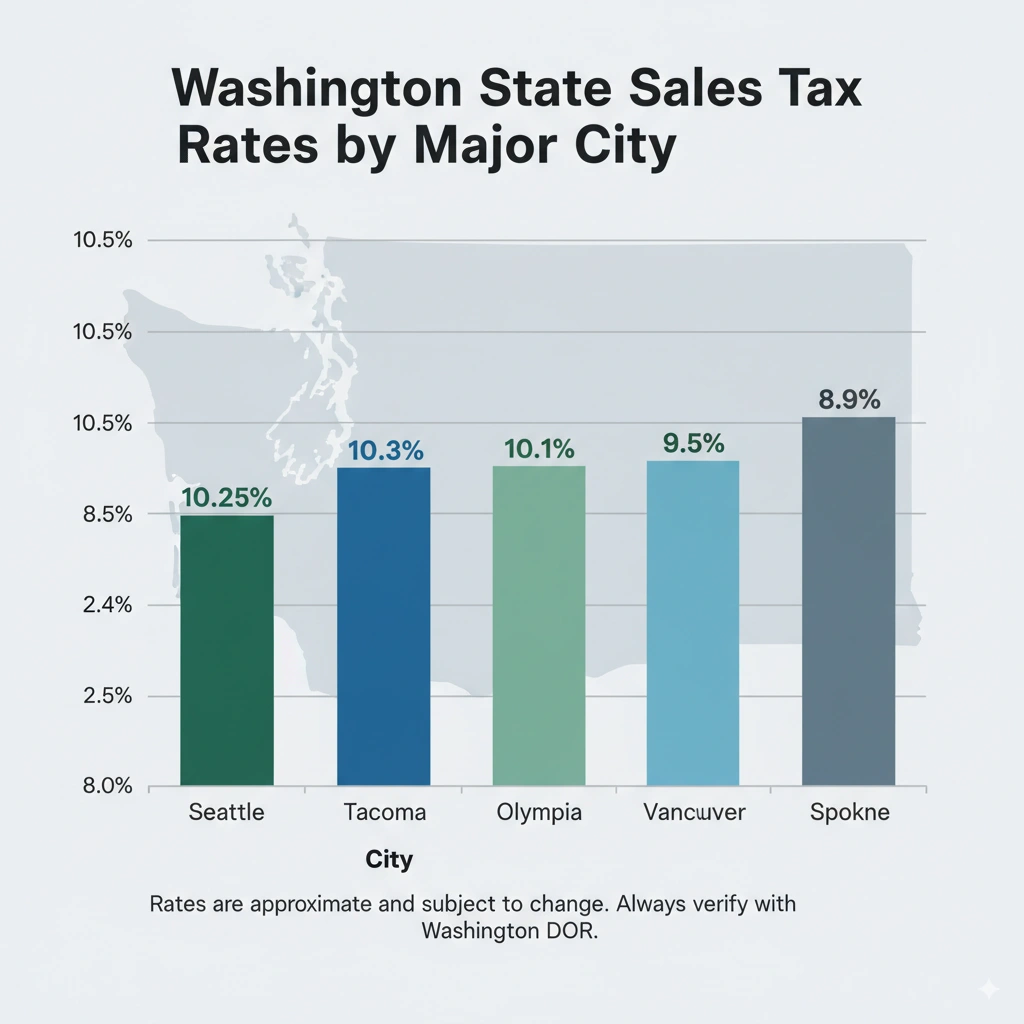

Washington sales tax calculator helps shoppers, businesses, and online sellers determine the exact tax owed on purchases across the state. Washington imposes a 6.5% state sales tax, with local city and county rates pushing the total tax as high as 10.5% in certain areas like Seattle and Tacoma. Because rates vary widely, using a calculator ensures accurate totals for retail sales, restaurant bills, or e-commerce transactions. This guide explains how Washington sales tax works and shows how to use the calculator for quick, precise results.

What Is Washington Sales Tax? A Comprehensive Overview

Sales tax is a consumption tax that the government imposes on the sale of goods and services. In Washington, the system is a blend of a statewide rate and local-level taxes, which can vary dramatically from city to city and even from one neighborhood to another.

-

Statewide Base Rate: The foundation is a flat 6.5% statewide sales tax.

-

Local Additions: Local municipalities—including counties, cities, and special districts (like transit or stadium districts)—can levy their own taxes on top of the state rate.

-

Total Tax Rate: This combination means your total rate could range from a minimum of 7.0% to over 10.5%, making location the single most important factor in your calculation.

For example, a purchase made in downtown Seattle (ZIP code 98101) is subject to a different rate than the same purchase made in Olympia or Spokane.

-

Seattle: The total rate is approximately 10.25%.

-

Bellevue: The rate is around 10.1%.

-

Spokane: The rate is roughly 8.9%.

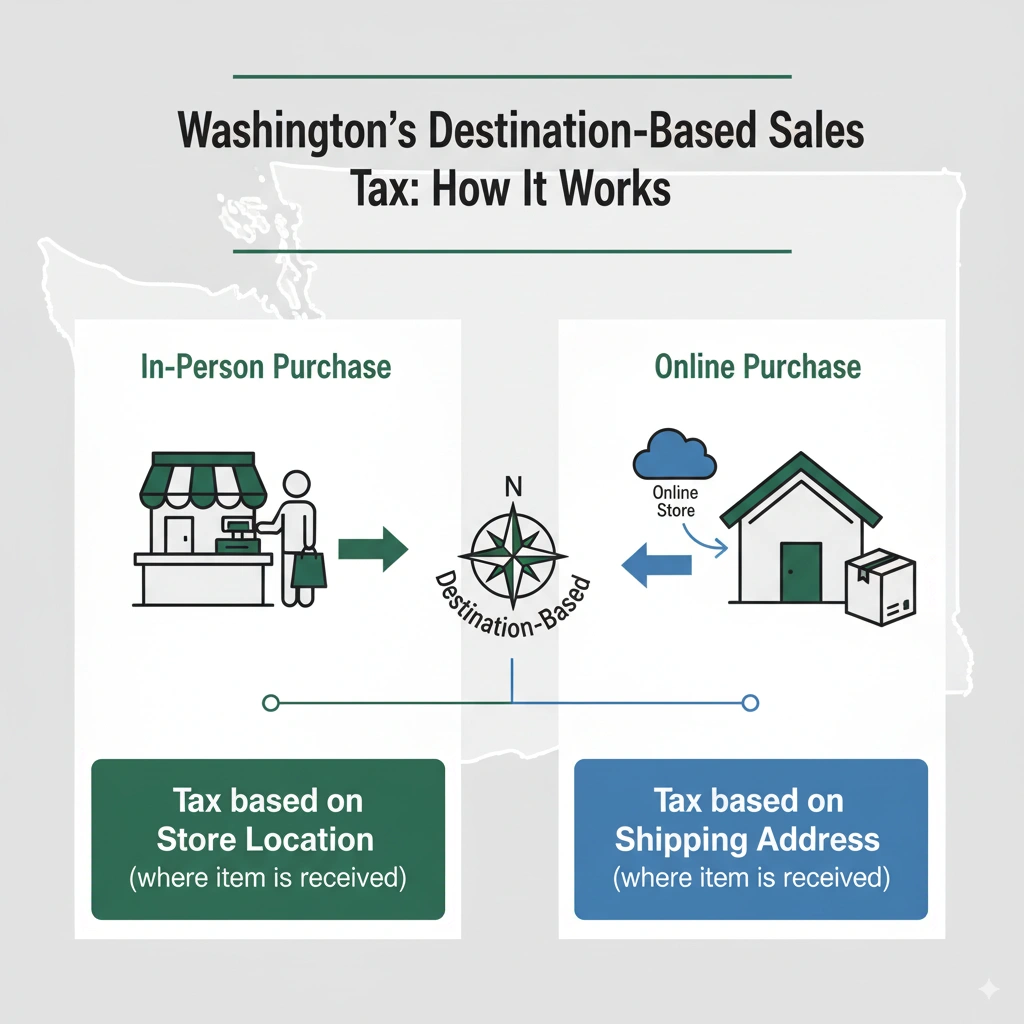

How Washington’s Destination-Based System Works

Washington employs a destination-based sales tax system. This key principle dictates that the total tax rate is determined by the location where the buyer receives the item, not the location of the seller.

Key Concepts:

-

In-Person Purchase: If you’re buying a coffee in a cafe, you pay the sales tax rate of the city where that cafe is physically located.

-

Online/Mail Order: For e-commerce transactions, the tax rate is calculated based on the shipping address where the goods are delivered. This is particularly important for online businesses to ensure compliance.

The Washington Department of Revenue (DOR) is the state agency responsible for collecting and distributing these tax revenues to the appropriate local governments.

Why a Washington Sales Tax Calculator is an Essential Tool

Manual calculations are prone to error and can be a hassle, especially with the state’s variable rates. A dedicated calculator simplifies this process and provides immediate value for a range of users:

-

For Shoppers: Avoid surprises at checkout and budget accurately for major purchases like furniture or electronics.

-

For Businesses: Ensure accurate invoicing, maintain compliance with state and local tax laws, and streamline accounting for both B2B and B2C sales.

-

For E-commerce Sellers: Instantly determine the correct tax to charge based on the customer’s delivery ZIP code, mitigating risk and ensuring proper tax remittance.

Instead of manually searching for a local rate and performing the math, this tool provides a fast and reliable solution.

Using the Washington State Sales Tax Calculator

Our calculator is designed for simplicity. Here’s how to use it:

-

Enter the Purchase Amount: Input the subtotal of your purchase (the price before tax is added).

-

Input Your ZIP Code or City: The tool will automatically look up the correct local tax rate.

-

View Results: The calculator displays the total sales tax amount and the final price you will pay.

Example Calculation:

-

Purchase Amount: $200

-

ZIP Code: 98101 (Seattle)

-

Tax Rate: 10.25%

-

Calculation: Tax = $200 * 0.1025 = $20.50

-

Total Price: $200 + $20.50 = $220.50

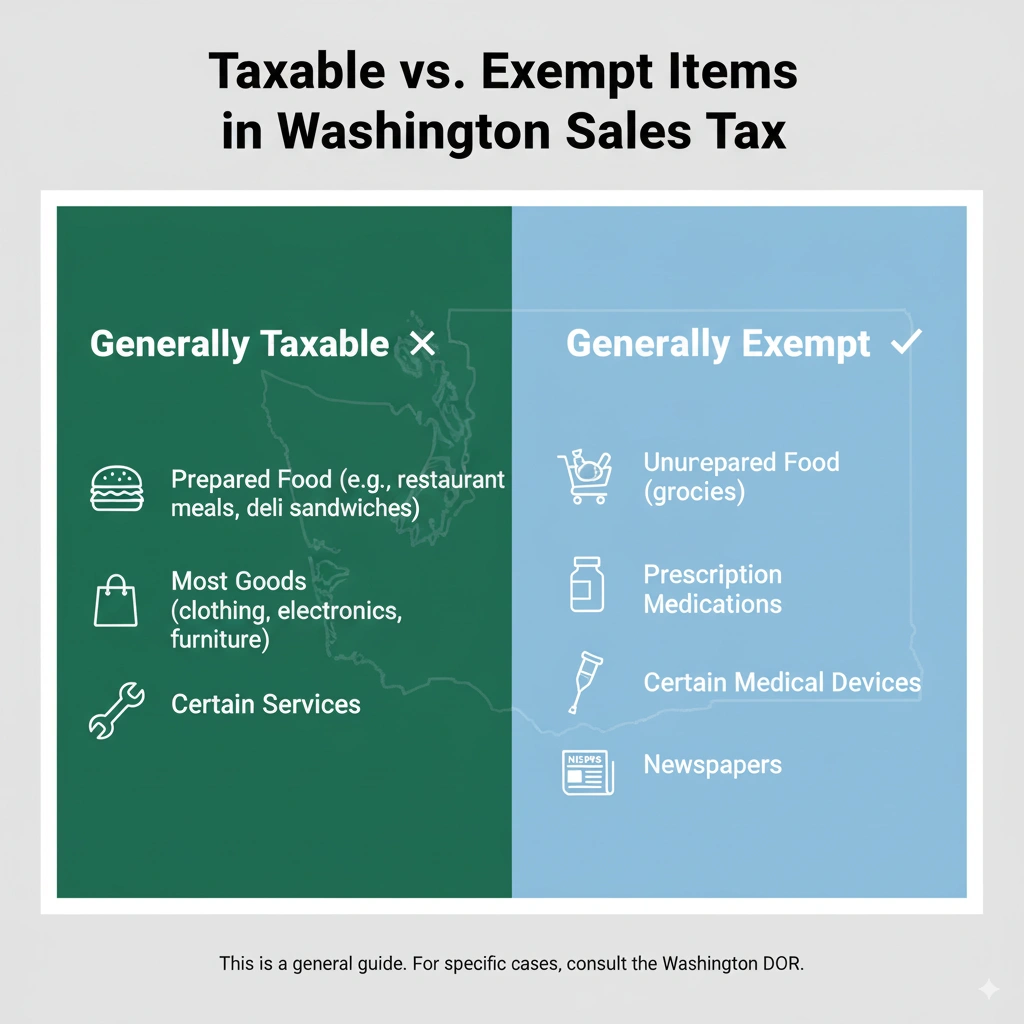

A Deeper Look: Washington’s Taxable vs. Exempt Items

While most goods are subject to sales tax, Washington provides specific exemptions. This is a common area of confusion for both consumers and business owners.

Common Non-Taxable Items:

-

Unprepared Food: Groceries, including fruits, vegetables, meat, dairy, and canned goods, are generally exempt. Prepared food, like a deli sandwich or a hot meal, is typically taxable. See the DOR Food & Food Ingredients guidance.

-

Prescription Drugs: All prescription medications for humans are exempt from sales tax.

-

Certain Medical Devices: This can include items like mobility aids, prosthetics, and oxygen equipment.

-

Newspapers: The sale of newspapers is not subject to sales tax.

For a comprehensive list of exemptions, always refer to the official Washington DOR website.

Sales Tax Rates by Washington Localities

Here’s a snapshot of local tax rates in major Washington cities:

| City | Total Sales Tax Rate |

|---|---|

| Seattle | 10.25% |

| Spokane | 8.9% |

| Tacoma | 10.3% |

| Bellevue | 10.1% |

| Vancouver | 8.5% |

| Olympia | 9.4% |

Always check the Washington DOR Local Sales Tax Lookup Tool for the most accurate rates..

Beyond Sales Tax: A Note on Washington’s B&O Tax

It’s important to distinguish sales tax from the state’s Business and Occupation (B&O) tax. While sales tax is a tax on the consumer collected by the business, the B&O tax is a tax on the privilege of doing business in Washington. It is measured by the value of products, gross proceeds of sales, or gross income of a business. This is a key semantic distinction that highlights the complexity of Washington’s tax code and is crucial for business owners to understand.

Common Questions About Washington Sales Tax

Q: What is the current sales tax in Washington State?

A: The base state rate is 6.5%, but total rates can exceed 10% due to local additions. Use a calculator to find the precise rate for any location.

Q: Are groceries taxed in Washington?

A: No, unprepared food items are generally exempt from sales tax.

Q: How do I find my local sales tax rate?

A: The fastest way is to use a sales tax calculator for Washington and enter your ZIP code. Alternatively, you can use the official ZIP Code Lookup Tool on the Washington Department of Revenue website.

Q: Do online sellers need to collect sales tax in Washington?

A: Yes. Washington has nexus laws that require online retailers and marketplace facilitators (like Amazon and Etsy) to collect and remit sales tax on sales made to customers in the state. This is based on the customer’s delivery address.

Q: What is the difference between sales tax and use tax?

A: Sales tax is applied when a seller collects tax on a sale. Use tax is a complementary tax paid by a consumer who purchased an item without paying sales tax, often from an out-of-state retailer. The use tax is owed to the DOR and is at the same rate as the sales tax would have been.

Bottom Line: Accuracy and Authority in Tax Calculation

Sales tax in Washington is a nuanced system defined by location, specific exemptions, and a clear distinction between the buyer’s and seller’s responsibilities. Whether you are a resident, a business owner, or an online shopper, accurately calculating sales tax is essential for financial clarity and compliance.

Our Washington sales tax calculator is designed to provide that accuracy and peace of mind, saving you time and preventing costly errors. Use it as your go-to tool for everyday purchases and business transactions, and bookmark this page as your definitive guide to understanding tax in the Evergreen State.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.