Credit Card Balance Transfer Calculator

Your Balance Transfer Results

Cost Comparison

| Old Card | New Card | |

|---|---|---|

| Total Interest | $0 | $0 |

| Fees | $0 | $0 |

| Total Cost | $0 | $0 |

Important Disclaimers

• Calculations assume no additional purchases on the new card.

• Late payments may void promotional APR offers.

• This is an estimate only and not financial advice.

• Actual terms may vary by credit card issuer.

Explore Our Free Tax Calculators and Tools

Credit card Balance Transfer Calculator USA

A balance transfer calculator is a financial tool for estimating potential savings when moving high-interest credit card balances to a card with a lower or 0% introductory Annual Percentage Rate (APR). For example, transferring a $5,000 balance from a card charging 18% APR to a card offering 0% APR for 18 months could save more than $1,200 in interest if paid off within the promotional period. By entering your current balance, interest rate, and transfer details, the calculator shows how much money you can save, how quickly you can pay off debt, and whether a transfer fee is worth the cost. This makes it easier to compare credit card offers, plan repayment timelines, and make confident decisions about consolidating debt with a balance transfer.

What is a Balance Transfer Calculator?

At its core, a balance transfer calculator is a digital tool designed to help consumers understand the potential financial implications of transferring credit card balances. Its primary purpose is to provide a clear, data-driven picture of how a balance transfer can impact your debt payoff journey. Tools like a “credit card balance transfer calculator” and a “balance transfer savings calculator” empower individuals to make smart financial decisions by illustrating potential interest savings, payoff timelines, and overall costs.

Types of Balance Transfer Calculators

The world of balance transfer calculators is more nuanced than you might initially think, with various tools designed to address specific aspects of the transfer process:

- Credit Card Balance Transfer Calculator: This fundamental tool is ideal for comparing your current high-interest credit card debt with a new balance transfer offer. It calculates the interest you stand to save by moving your debt to a card with a lower APR.

- Balance Transfer Fee Calculator: Most balance transfer cards charge a fee, typically ranging from 3% to 5% of the transferred amount. This calculator helps you determine the exact fee you’ll incur. It’s crucial for deciding whether the potential interest savings outweigh this upfront cost.

- Balance Transfer Card Calculator: Going beyond basic calculations, this tool helps you estimate the total costs and savings across different balance transfer cards. It considers various factors to provide a more holistic view, allowing for a more comprehensive comparison.

- Balance Transfer Savings Calculator: Particularly useful when considering promotional 0% APR offers, this calculator estimates your total savings over the promotional period and beyond. It helps you visualize the long-term financial benefit of a strategic transfer.

- Balance Transfer Comparison Calculator: For those with multiple balance transfer offers on the table, this calculator is a game-changer. It allows you to compare various offers side-by-side, making it easier to identify the most advantageous option based on your specific financial situation.

How to Use a Balance Transfer Calculator Effectively

Using a balance transfer calculator is straightforward, but its effectiveness hinges on providing accurate information. Here’s a step-by-step guide:

- Gather Your Details: You’ll need information about your current debt, including:

- Current balance(s) on the credit card(s) you wish to transfer.

- Current interest rate(s) (APR) on those cards. (Federal Reserve).

- The promotional APR of the new balance transfer card (e.g., 0% for 12 months).

- The regular APR of the new balance transfer card (what the rate will be after the promotional period).

- The balance transfer fee percentage.

- Your desired monthly payment amount.

- Input the Data: Enter these details into the respective fields of your chosen calculator.

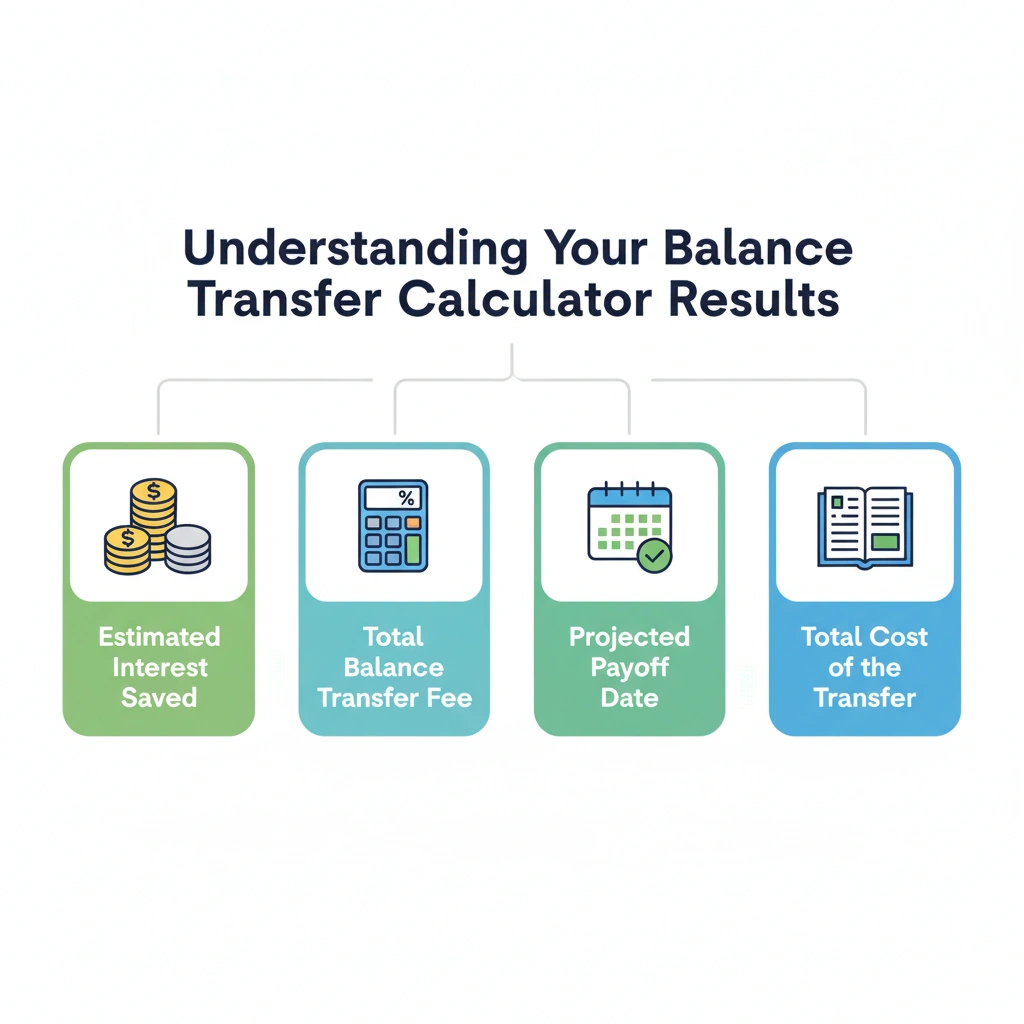

- Analyze the Results: The calculator will then provide insights such as:

- Estimated interest saved.

- Total balance transfer fee.

- Projected payoff date.

- Total cost of the transfer.

Real Example: Let’s say you have a $5,000 balance at 18% APR. A new card offers 0% APR for 15 months with a 3% balance transfer fee, then a 15% ongoing APR. Inputting these figures into a calculator will show you how much you’d save in interest over the promotional period, the upfront fee ($150), and your estimated payoff timeline if you make consistent payments. (CFPB Example)

Benefits of Using a Balance Transfer Credit Card Calculator

The advantages of leveraging these calculators are numerous:

- Avoid Unnecessary Interest: By clearly illustrating potential interest savings, calculators help you make decisions that can significantly reduce the amount you pay in interest.

- Clear Debt Faster: Seeing a projected payoff date motivates you to stick to your payment plan and helps you understand how quickly you can become debt-free.

- Make Smarter Financial Decisions: Calculators provide the data you need to assess whether a balance transfer is truly beneficial for your unique financial situation.

- Track Payoff Timeline: Having a clear timeline empowers you to set realistic goals and stay on track with your debt repayment.

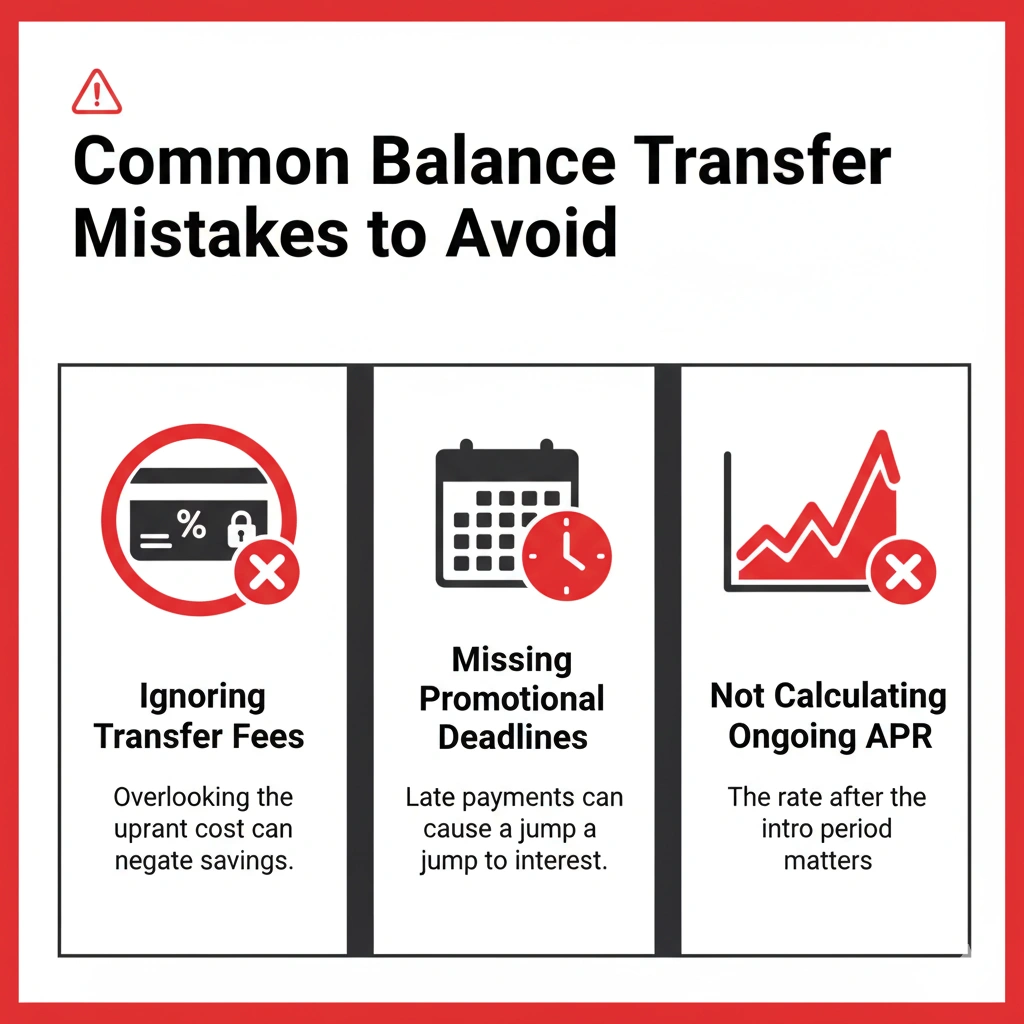

Common Mistakes to Avoid

Even with the aid of calculators, pitfalls exist:

- Ignoring Transfer Fees: Many people focus solely on the 0% APR and overlook the upfront balance transfer fee, which can negate some of the savings.

- Missing Promotional Deadlines: Failing to pay off the transferred balance before the promotional APR expires can lead to a sudden jump in interest rates.

- Not Calculating Ongoing APR After Promo Period: It’s crucial to understand what your interest rate will be once the introductory period ends, as this can significantly impact your long-term costs.

Best Practices for Credit Card Balance Transfers

To maximize the benefits of a balance transfer:

- Only Transfer if Savings Outweigh Fees: Use a calculator to confirm that the interest you save will be greater than the balance transfer fee.

- Always Pay on Time to Keep 0% APR: Most balance transfer offers require on-time payments to maintain the promotional rate. A single late payment could revert your rate to the higher ongoing APR. (CPFB Warning)

- Don’t Add New Purchases on the Transfer Card: Focus on paying down the transferred debt. Adding new purchases can complicate your payoff plan and potentially negate your savings.

Bottom Line

In conclusion, a balance transfer can be a powerful tool for managing and reducing credit card debt, but its effectiveness is significantly enhanced by the intelligent use of balance transfer calculators. These tools provide the clarity and data necessary to make informed decisions, avoid common pitfalls, and ultimately pave your way to financial freedom. Before you commit to any balance transfer, take the crucial step of utilizing these calculators to compare offers and understand the true cost and benefit. Your financial future will thank you for it.

Frequently Asked Question (FAQs):

- What is the best balance transfer calculator?

The “best” calculator depends on your specific needs. Look for calculators that allow you to input all relevant details (current balance, APRs, fees) and provide clear output on interest savings and payoff timelines. Reputable financial websites often offer excellent free options. - How do I calculate a balance transfer fee?

The balance transfer fee is typically a percentage of the amount you transfer, usually between 3% and 5%.23 To calculate it, multiply your transfer amount by the fee percentage (e.g., $5,000 balance x 0.03 = $150 fee). - Do all cards charge a balance transfer fee?

No, while most balance transfer cards do charge a fee, some rare offers may waive it.25 It’s crucial to always read the terms and conditions carefully. - Is it always worth doing a balance transfer?

Not always. It’s only worth it if the interest you save over the promotional period and beyond outweighs the balance transfer fee and any potential ongoing interest after the introductory period. A calculator will help you determine this. - How accurate are online balance transfer calculators?

Online calculators are generally very accurate, provided you input correct and up-to-date information. They are designed to give you a strong estimate of potential savings and payoff timelines.26

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the latest tax laws.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.