AARP Tax Calculator 2025

This tool helps estimate your federal tax liability with special attention to retirement income, Social Security benefits, and senior-specific deductions/credits.

Basic Information

Income Sources

Deductions & Adjustments

Senior-Specific Credits

Your Tax Summary

| Total Income | $0 |

|---|---|

| Total Deductions | $0 |

| Taxable Income | $0 |

| Estimated Federal Tax | $0 |

| Taxable Social Security | $0 |

| Effective Tax Rate | 0% |

Disclaimer

This calculator provides estimates only based on the information you provided. Tax laws are complex and change frequently. AARP recommends consulting a tax professional for personalized advice.

For official IRS information, please refer to IRS Publication 554 (Tax Guide for Seniors) and IRS Publication 915 (Social Security and Equivalent Railroad Retirement Benefits).

Explore Our Free Tax Calculators and Tools

AARP Tax Calculator

The AARP Tax Calculator is a free online tool for retirees to estimate federal income taxes on Social Security benefits, pensions, and retirement account withdrawals. Under IRS rules, up to 85% of Social Security benefits may be taxable depending on total income, while pension distributions and IRA or 401(k) withdrawals are generally taxed as ordinary income. The calculator shows how these income streams combine to affect overall tax liability, including estimated 2025 tax brackets and deductions. Retirees can use the tool to compare scenarios, plan withdrawals, and prepare strategies for 2025, reducing unexpected tax bills. With step-by-step guidance, the calculator simplifies complex retirement tax rules into clear, actionable results.

Whether you’re looking at this year’s taxes (2025) or planning ahead for 2026, this guide will walk you through everything you need to know—in plain English.

1. What Exactly is the AARP Tax Calculator?

Think of the AARP Tax Calculator as your personal tax assistant. It’s a simple online tool that helps retirees estimate how much they’ll owe in federal (and sometimes state) taxes based on:

Social Security benefits (yes, they can be taxed!)

Pension payments

IRA or 401(k) withdrawals

Part-time work income (if you’re still earning a little extra)

Investments (like dividends or capital gains)

Why It’s Helpful:

Basically, it’s like having a tax pro give you a quick estimate without the appointment (or the bill).

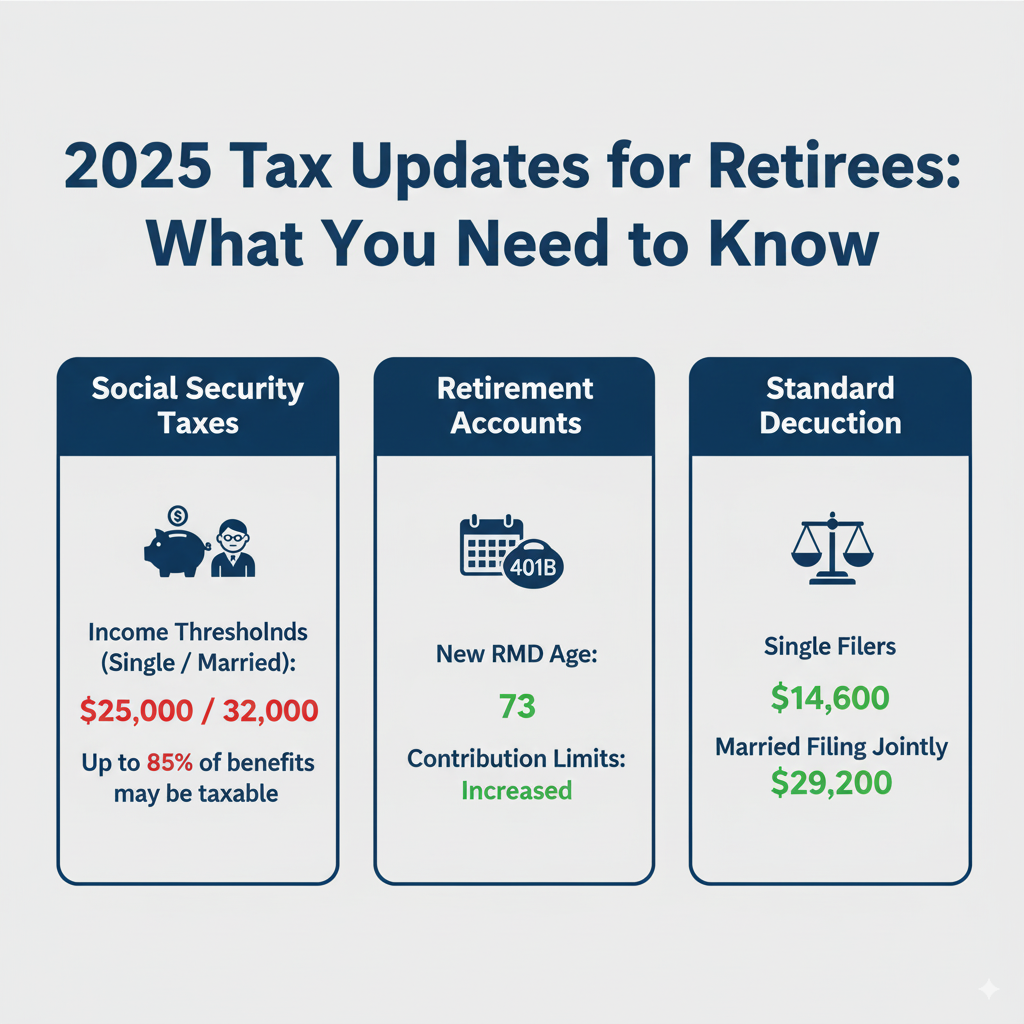

2. What’s New for 2025? (And Why It Matters for Retirees)

Tax rules change a little every year, and 2024 is no exception. Here’s what you should know:

Social Security Taxes

If your income is above a certain amount, up to 85% of your benefits could be taxed.

The thresholds haven’t changed:

Single filers: Taxes kick in if your income is over $25,000.

Married filing jointly: Over $32,000.

Retirement Account Updates

RMDs (Required Minimum Distributions) now start at age 73 (for those born between 1951-1959).

IRA/401(k) contribution limits went up slightly—good news if you’re still working.

Standard Deduction Increased (Again!)

Single filers: $14,600 (up from $13,850)

Married filing jointly: $29,200 (up from $27,700)

Bottom line? The AARP 2025 tax calculator can help you see how these changes affect your bottom line.

3. Looking Ahead to 2026: What Retirees Should Watch For

2025 could be a big year for tax changes—some old rules might come back, and that could mean higher taxes for some retirees. Here’s the scoop:

Possible Changes Coming in 2026:

Tax rates might go up (unless Congress extends current laws).

Standard deduction could shrink, meaning more people will need to itemize.

Capital gains taxes may increase for higher earners.

What You Can Do Now:

If you’ve been thinking about a Roth IRA conversion, 2024 might be the year to do it (before rates potentially rise).

Use the AARP tax calculator for 2025 to run different scenarios.

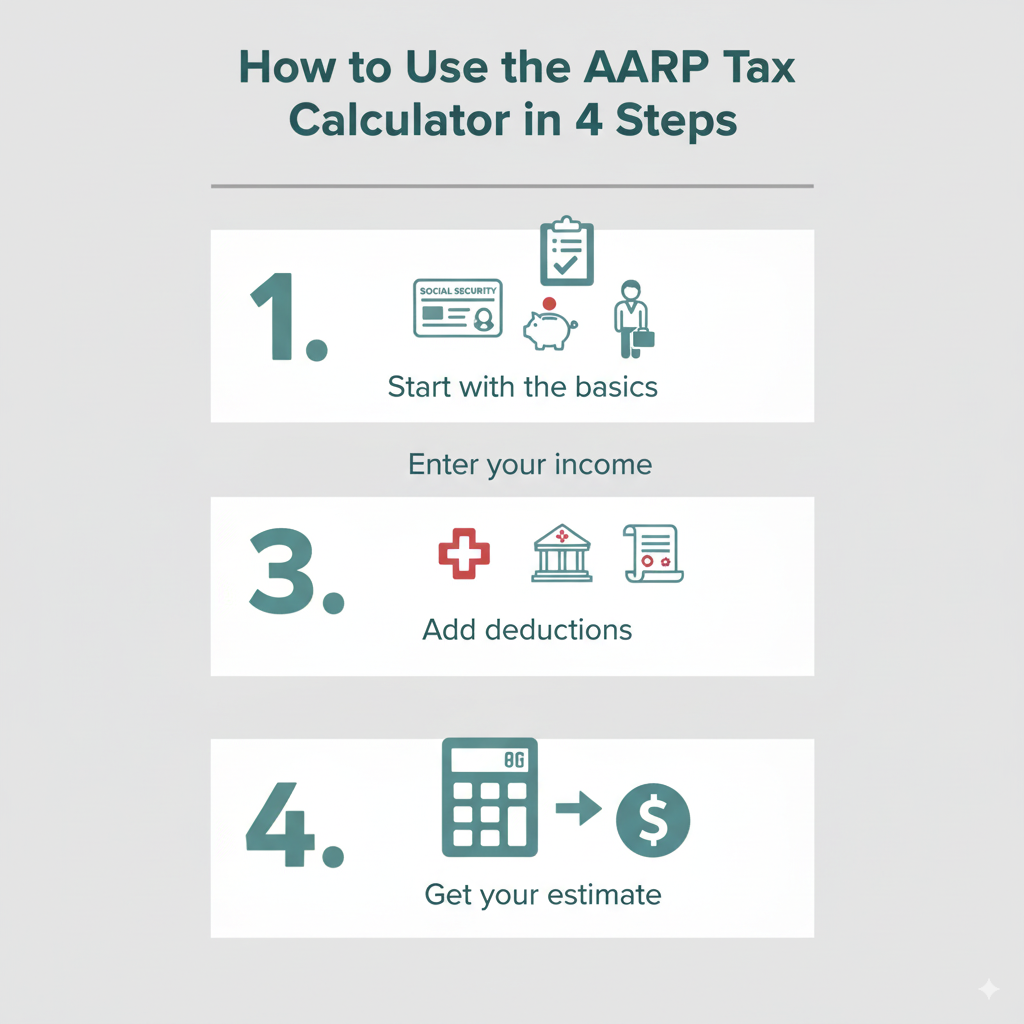

4. How to Use the AARP Tax Calculator (Step by Step)

I’ll walk you through it—it’s easier than you think!

Start with the basics – Are you single? Married? Head of household?

Enter your income – Social Security, pensions, part-time work, etc.

Add deductions – Medical expenses, charity donations, etc.

Get your estimate – The calculator shows what you’ll likely owe (or get back).

Pro tip: If you’re not sure about a number, just give your best guess—you can always adjust later.

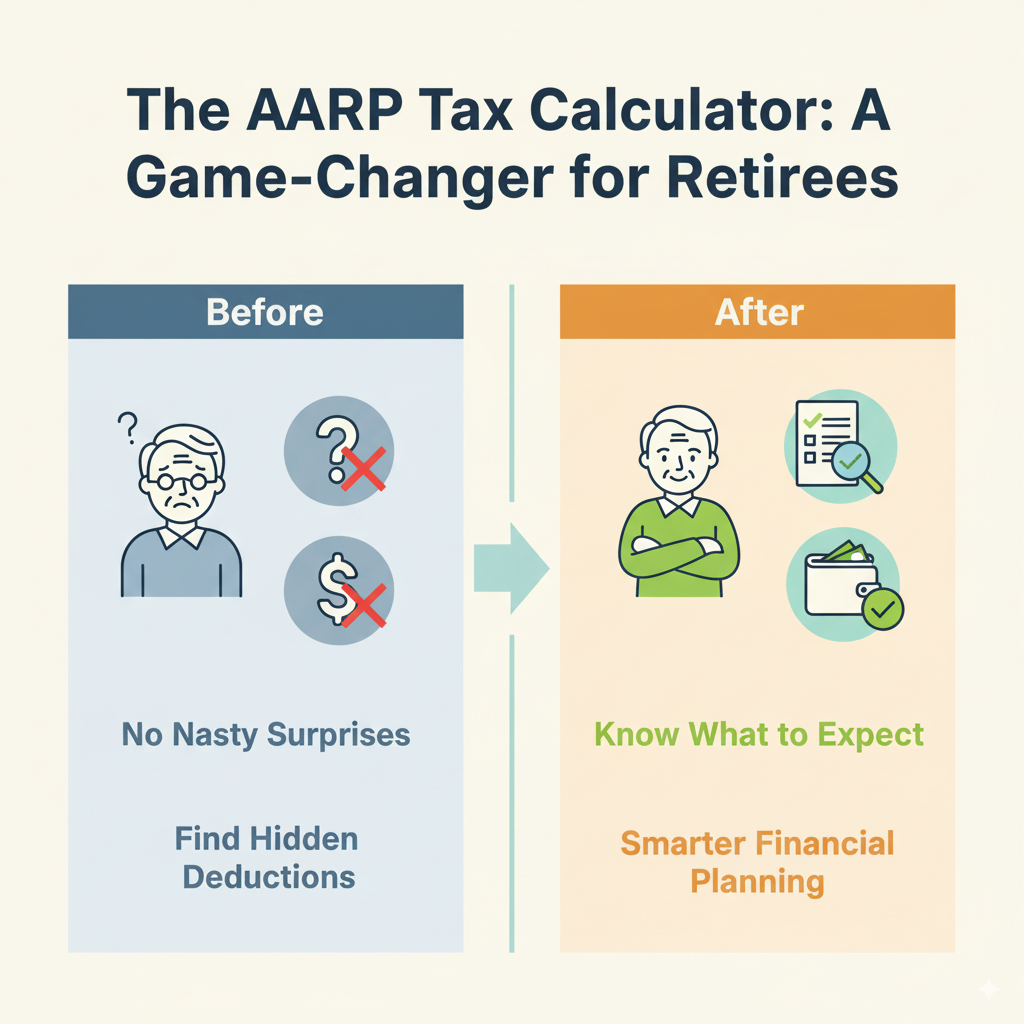

5. Why This Calculator is a Game-Changer for Retirees

6. Other Tax Tools (And How They Compare)

| Tool | Best For | Downsides |

|---|---|---|

| IRS Tax Withholding Estimator | Quick paycheck checks | Doesn’t cover retirement taxes well |

| TurboTax TaxCaster | Detailed estimates | Upsells paid versions |

| H&R Block Calculator | Easy to use | Less retirement-focused |

The AARP calculator wins for retirees because it’s simple, free, and made with seniors in mind.

7. Common Questions (Answered Simply)

Q: Do I have to pay to use AARP’s tax tool?

A: Nope! It’s 100% free—no membership needed.

Q: Will it calculate state taxes too?

A: Sometimes, but it’s best for federal taxes. Check your state’s tax website for details.

Q: How accurate is it?

A: It’s great for estimates, but if you have a complicated situation (like rental income or a small business), a tax pro can fine-tune it.

Final Thoughts: Take the Guesswork Out of Retirement Taxes

Taxes don’t have to be stressful. The AARP Tax Calculator gives you a clear picture of what to expect, whether you’re filing for 2025 or planning for 2026.

Your next step?

Try the calculator yourself: AARP Tax Tools

If something looks off, talk to a tax advisor—they can help you save even more.

Remember, a little planning now can save you a lot of headaches later. Happy calculating!

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.