Crypto Tax Calculator USA (2025)

Total Income: $${totalIncome.toLocaleString()}

Estimated Tax on Crypto Gain: $${tax.toLocaleString()}

`; // Draw chart let ctx = document.getElementById("taxChart").getContext("2d"); if (window.taxChartInstance) window.taxChartInstance.destroy(); window.taxChartInstance = new Chart(ctx, { type: 'bar', data: { labels: breakdown.map(b => b.bracket), datasets: [{ label: "Tax Paid ($)", data: breakdown.map(b => b.amount), backgroundColor: "rgba(0, 115, 170, 0.7)" }] }, options: { responsive: true, plugins: { legend: { display: false } }, scales: { y: { beginAtZero: true } } } }); }Explore Our Free Tax Calculators and Tools

Crypto Tax Calculator USA for U.S. Investors

Cryptocurrency tax calculators are specialized tools for tracking, reporting, and filing crypto-related taxes in compliance with IRS rules. In the United States, the IRS classifies digital assets like Bitcoin, Ethereum, NFTs, and DeFi tokens as property, making each trade, swap, or staking reward a taxable event. A crypto tax calculator simplifies this process by automatically importing transactions from exchanges and wallets, calculating capital gains, and generating IRS-ready forms such as Form 8949. Investors in 2025 can choose from leading platforms like Koinly, CoinTracker, and TokenTax, including free options, to ensure accurate tax reporting and minimize audit risks.

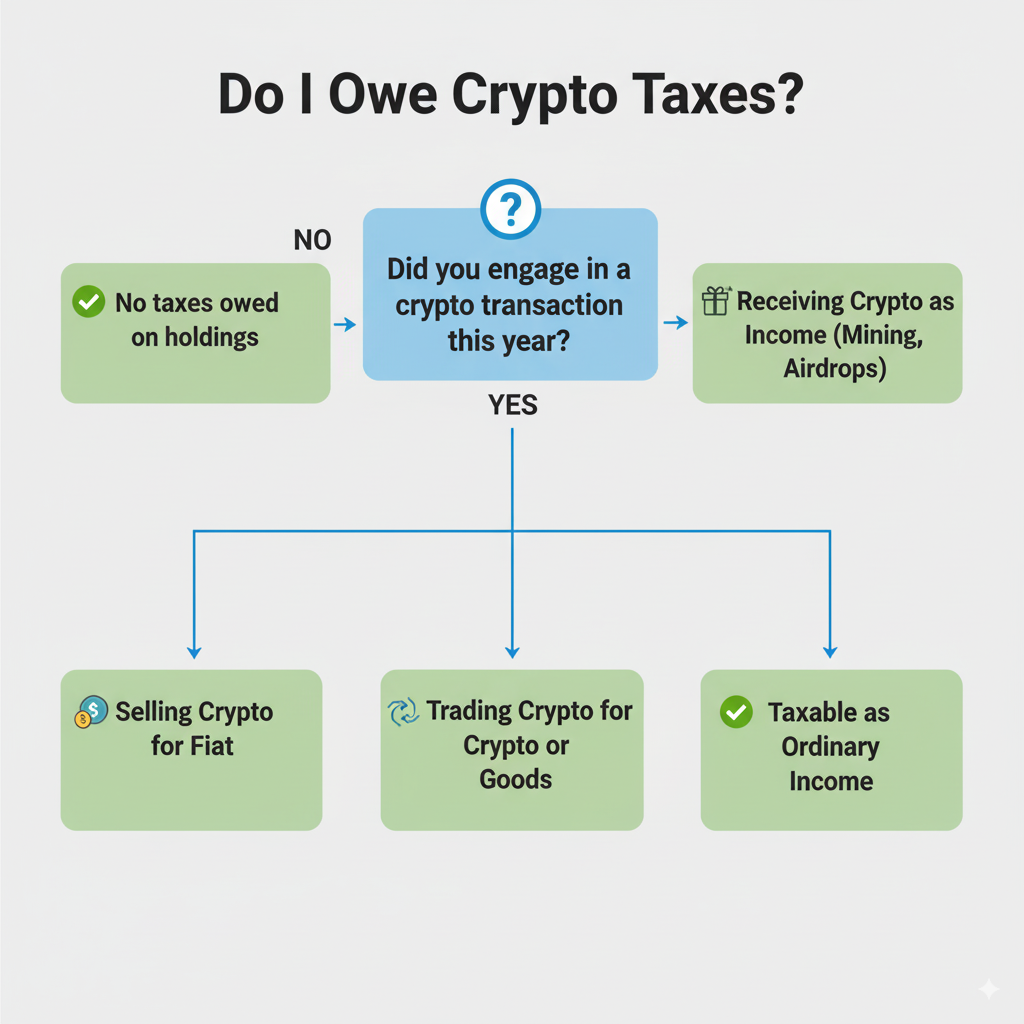

As a U.S. taxpayer, understanding your obligations for cryptocurrency is crucial. The IRS views virtual currency as property, which means you must report all transactions that result in a gain or loss on your tax return. This isn’t just about selling for cash; it’s about any event that triggers a taxable gain.

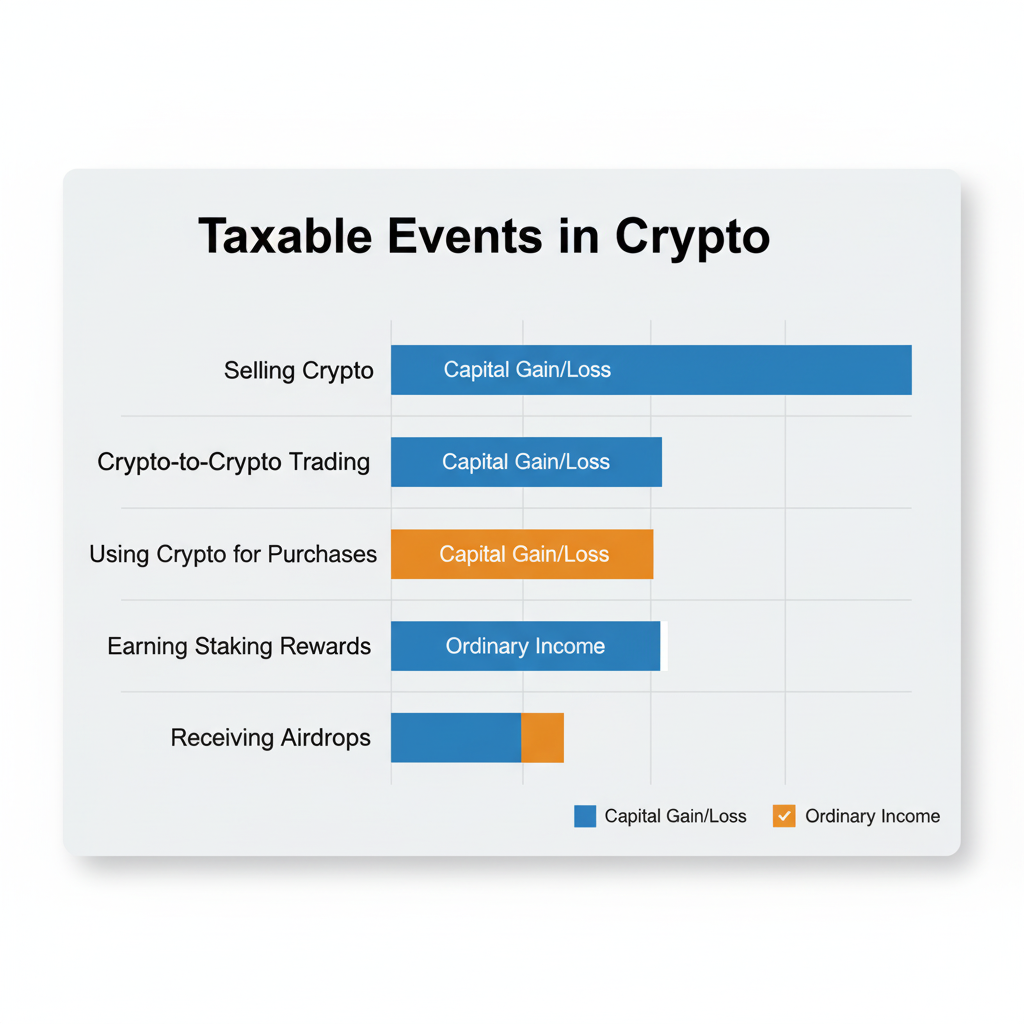

Taxable events in the crypto world include:

-

Selling crypto for U.S. dollars (fiat).

-

Trading one cryptocurrency for another (e.g., Bitcoin for Ethereum).

-

Using crypto to purchase goods or services.

-

Earning crypto as income (e.g., through mining, staking, airdrops, or interest).

Depending on how long you’ve held the asset, your gains will be classified as either short-term (held for one year or less) or long-term (held for more than one year). The tax rate for these gains can vary significantly.

The Manual Method: A CPA's Perspective

Calculating crypto taxes by hand is a technically correct but highly complex process, especially for active traders. Here’s a simplified breakdown of the steps involved, as a tax professional would approach them:

-

Determine the Cost Basis: This is the original value of the crypto in U.S. dollars at the time of acquisition. It includes the purchase price plus any transaction fees.

-

Identify the Sale Price: This is the fair market value of the crypto in U.S. dollars at the time of the disposition (sale, trade, or spend).

-

Calculate the Gain or Loss: Subtract your cost basis from the sale price to determine your capital gain or loss.

-

Classify the Gain/Loss: Use the holding period to classify each transaction as either a short-term or long-term capital event.

-

Reconcile Transactions: Repeat this process for every single transaction across all exchanges, wallets, and platforms you use. This is where the process becomes unmanageable, as a single year can involve thousands of data points.

Given the potential for human error and the time commitment, using specialized software is not just a convenience—it’s a best practice for ensuring accuracy and compliance.

Why a Crypto Tax Calculator is an Essential Tool

For anyone serious about tax compliance, a dedicated crypto tax calculator is the most efficient and reliable solution. Here’s why it’s a smart decision:

-

Automation & Efficiency: It automatically imports transaction data via secure API connections or CSV file uploads from all your exchanges and wallets, saving you countless hours.

-

Precision and Accuracy: The software accurately tracks gains, losses, and cost basis using various accounting methods (like FIFO, LIFO, or HIFO) to optimize your tax outcome.

-

Professional-Grade Reporting: It generates ready-to-file IRS forms, such as Form 8949 and Schedule D, which are critical for reporting capital gains and losses correctly.

-

Comprehensive Support: The best tools are designed to handle complex transactions from decentralized finance (DeFi), NFTs, staking, and liquidity pools, which are notoriously difficult to calculate manually.

Key Features to Vet When Choosing a Crypto Tax Tool

Selecting the right tool is a critical step. When evaluating your options, look for a platform that demonstrates a deep understanding of complex tax scenarios. Consider these key features:

-

Exchange & Wallet Connectivity: A robust platform will support hundreds of integrations, including major centralized exchanges (Coinbase, Binance), and popular wallets (MetaMask, Ledger).

-

Capital Gains & Loss Reporting: The tool should offer detailed, transparent reports for both short- and long-term gains, allowing you to see the calculation behind every number.

-

Advanced Transaction Support: Look for explicit support for DeFi protocols, NFT marketplaces, and staking rewards, which are common sources of taxable income for many users.

-

Pricing & Transparency: Many calculators offer a generous free tier for a limited number of transactions, but be sure to understand the pricing model for your specific needs.

-

Security & Privacy: Given the sensitive nature of financial data, always choose a platform that uses “read-only” API access and bank-grade encryption to protect your information.

Top-Rated Free Crypto Tax Calculators for the U.S. Market

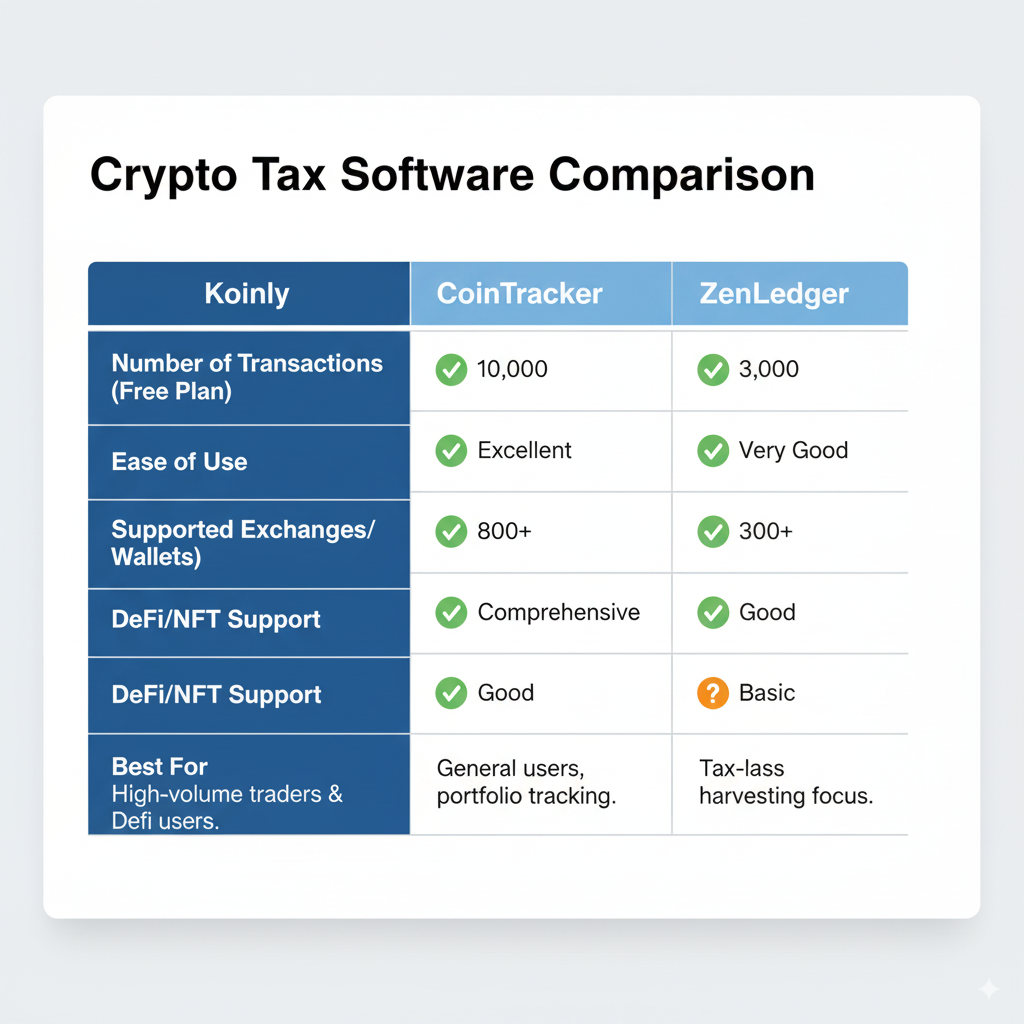

Here are three highly-regarded platforms that offer reliable, IRS-compliant tax reporting and free-tier options for users in the United States.

-

Koinly: Known for its user-friendly interface, Koinly offers a free plan that allows you to import and view up to 10,000 transactions. It’s a great option for both newcomers and seasoned traders due to its extensive support for over 300+ exchanges and wallets.

-

CoinTracker: With a strong mobile app and seamless integration with popular tax software like TurboTax, CoinTracker is an excellent choice for casual traders or those with a small number of NFT transactions. Its free tier covers up to 25 transactions.

-

ZenLedger: Ideal for active traders, ZenLedger provides advanced reporting features and robust support for DeFi, making it a powerful tool for those with more complex crypto portfolios. It also offers a limited free plan to get you started.

All three of these tools are considered industry leaders, providing both free and paid plans to suit a variety of user needs.

A Tax Professional's Guide to Using Crypto Tax Software

Using a crypto tax calculator effectively requires a clear process. Follow these steps to ensure you’re generating accurate reports:

-

Create an Account: Sign up for a free account on the platform of your choice.

-

Connect Your Data: Link your exchanges and wallets via API keys. This is the most secure and efficient method. For platforms without API access, use the CSV import feature.

-

Verify & Review: The software will automatically import your transactions. Take the time to review the data for any missing information or duplicates.

-

Generate Reports: Once all data is imported and reconciled, generate your capital gains report. This is the foundation for your tax filing.

-

Export & File: Download the IRS-compliant forms (Form 8949, Schedule D) and either submit them to your accountant or use them to file your taxes directly.

Real-World Crypto Tax Scenarios: Case Studies

To demonstrate how these rules apply, let’s look at a few common scenarios for a U.S.-based investor.

Case Study 1: The Casual Investor

Trader A buys 1 ETH for $3,000 on January 15th, 2025.

-

Scenario A (Selling for a profit): On March 20th, 2025, Trader A sells the 1 ETH for $4,500.

-

Calculation: The cost basis is $3,000. The sale price is $4,500.

-

Taxable Gain: $4,500 – $3,000 = $1,500.

-

Classification: Since the ETH was held for less than one year, this is a short-term capital gain. This $1,500 will be added to Trader A’s ordinary income and taxed at their regular income tax rate.

-

-

Scenario B (Selling for a loss): On February 1st, 2025, Trader A sells the 1 ETH for $2,500.

-

Calculation: The cost basis is $3,000. The sale price is $2,500.

-

Taxable Loss: $2,500 – $3,000 = -$500.

-

Classification: This is a short-term capital loss. Trader A can use this loss to offset other capital gains and, if there are no other gains, deduct up to $3,000 from their ordinary income.

-

Case Study 2: The Active Trader

Trader B buys 1 BTC for $50,000 on June 1st, 2024. A few weeks later, they buy another 1 BTC for $60,000.

-

Scenario A (Trading crypto-to-crypto): On November 1st, 2024, Trader B trades 1 BTC for 20 ETH. At the time of the trade, 1 BTC is worth $70,000.

-

Calculation: This is a key point—the trade is a taxable event. The cost basis of the BTC depends on which unit is sold. Assuming a common method like First-In, First-Out (FIFO), the first BTC purchased at $50,000 is sold. The sale price is the fair market value of the BTC at the time of the trade, which is $70,000.

-

Taxable Gain: $70,000 – $50,000 = $20,000.

-

Classification: Since the BTC was held for less than a year, this is a short-term capital gain.

-

-

Scenario B (Earning staking income): Trader B stakes 1000 ADA. Throughout the year, they earn 50 ADA in staking rewards.

-

Calculation: Each time a reward is received, it must be valued at its fair market value in USD on that day. If the 50 ADA was received when ADA was worth $0.50, the income is $25.

-

Taxable Income: $25.

-

Classification: This is ordinary income, taxed at the same rate as a salary. When Trader B later sells the 50 ADA, they will have a separate capital gain or loss calculation, with the cost basis being the original $25 of income.

-

Is My Financial Data Safe with These Calculators?

This is a valid and important question. When you use a reputable platform, the answer is an unequivocal yes. The security measures employed by leading crypto tax calculators are designed to protect your sensitive financial data.

-

Read-Only API Access: The primary method for connecting your accounts is via “read-only” API keys. This means the software can view your transaction history but has no ability to move or withdraw your funds.

-

Bank-Grade Encryption: Your data is protected using high-level encryption protocols, similar to those used by major financial institutions.

-

Clear Privacy Policies: Reputable companies are transparent about their data handling practices and are compliant with regulations like GDPR and CCPA.

For your own security, always remember to:

-

Never share your private keys or seed phrases with anyone.

-

Enable two-factor authentication (2FA) on all your crypto accounts.

Frequently Asked Questions (FAQ)

1. How do I calculate my crypto taxes? You calculate crypto taxes by determining your capital gains or losses on each transaction. A reliable crypto tax calculator automates this complex process by calculating the difference between your cost basis and your selling price for every trade, sale, or spend.

2. What is the best free crypto tax calculator? For a robust free tier, we highly recommend Koinly, which allows up to 10,000 transactions to be imported and viewed. CoinTracker is also a strong choice for those with a smaller number of transactions.

3. Do I owe taxes if I only held my crypto and didn’t sell? No. If you simply purchased and held crypto without selling, trading, or spending it, no taxable event has occurred, and you do not need to pay capital gains taxes.

4. Can these tools handle NFT or DeFi taxes? Yes, leading platforms like ZenLedger and Koinly have dedicated features to handle the unique tax implications of NFTs and DeFi transactions. These are often included in their paid plans due to the complexity involved.

5. How accurate are crypto tax calculators? Their accuracy depends on the data provided. As long as you connect all your wallets and exchanges correctly, these tools are highly accurate and are a standard for tax professionals and individual filers alike.

Conclusion

Tackling crypto taxes doesn’t have to be a source of stress. By leveraging a reliable crypto tax calculator, you can navigate the complexities of digital asset reporting with confidence. These tools save you time, improve accuracy, and generate the necessary IRS-compliant reports. Whether you’re a long-term investor or an active day trader, a free crypto tax calculator is the first step toward simplifying your tax season.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.