Dividend Tax Calculator USA 2025

Your Dividend Tax Results

Tax Savings from Qualified Dividends

- ';

for (const bracket of brackets) {

let inBracket = '';

if (taxableIncome > bracket.min && incomeWithoutQD < bracket.max) {

inBracket = ' (Your dividends fall in this bracket)';

}

bracketInfo += `

- ${formatCurrency(bracket.min)} - ${bracket.max === Infinity ? 'Above' : formatCurrency(bracket.max)}: ${(bracket.rate * 100)}%${inBracket} `; } bracketInfo += '

Explore Our Free Tax Calculators and Tools

Dividend Tax Calculator: Easily Calculate Your Dividend Taxes in the USA (2025)

A dividend tax calculator is an online tool for estimating how much federal tax you will owe on dividend income in the United States. It factors in your total income, IRS filing status, and whether the dividends are qualified or ordinary to provide accurate tax estimates. For example, qualified dividends are taxed at long-term capital gains rates of 0%, 15%, or 20%, depending on your tax bracket, while ordinary dividends are taxed at your regular income tax rate, which can reach 37%. Investors use this calculator to plan for tax liabilities, compare scenarios across tax brackets, and reduce taxes legally through strategies such as contributing to retirement accounts or using tax-loss harvesting.

What Is a Dividend Tax Calculator?

A dividend tax calculator is an online tool that helps you estimate how much tax you’ll owe on dividend income. You simply input:

The amount of dividend income you earned

Whether the dividends are qualified or non-qualified

Your filing status

Your annual income

(Optional) Your state of residence

The calculator then estimates your federal taxes and state tax obligations based on current rates.

Why Use a Calculator?

Saves time and eliminates guesswork

Helps you plan quarterly tax payments

Useful for long-term investment and retirement planning

How Are Dividends Taxed in the US?

Understanding how dividends are taxed is key to using the calculator effectively.

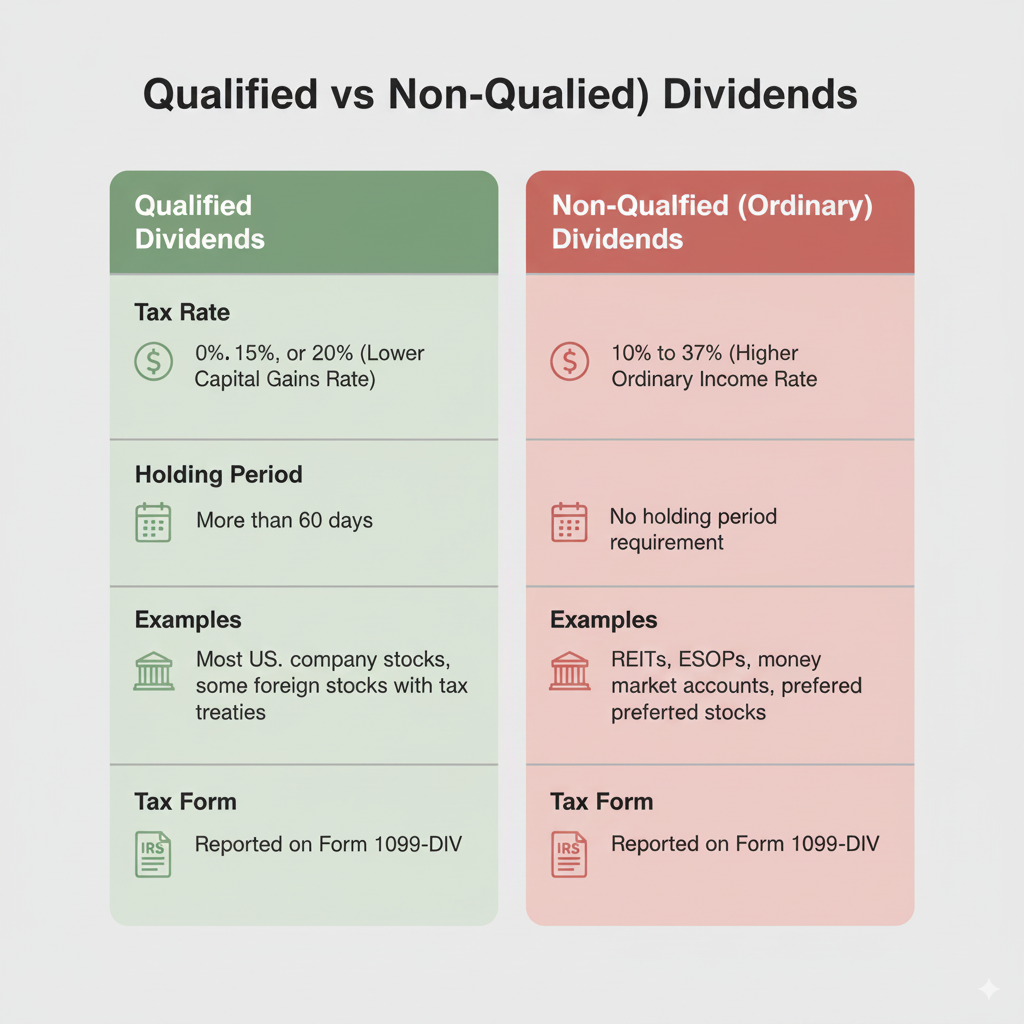

Qualified vs. Non-Qualified Dividends

| Dividend Type | Tax Rate | Example |

|---|---|---|

| Qualified | 0%, 15%, or 20% (depends on income) | Dividends from U.S. corporations |

| Non-Qualified (Ordinary) | Taxed as ordinary income (10%–37%) | Dividends from REITs, foreign companies |

Qualified dividends are taxed at the lower capital gains rate, while non-qualified dividends are taxed at your ordinary income rate.

Holding Period Matters

To be considered qualified, you must hold the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date.

Federal Dividend Tax Rates for 2025

| Filing Status | Income Range | Qualified Dividend Tax Rate |

|---|---|---|

| All Filers | Up to $44,625 | 0% |

| All Filers | $44,626 to $492,300 | 15% |

| All Filers | Over $492,300 | 20% |

Non-qualified dividends are taxed as regular income, so they follow the standard income tax brackets (10%–37%).

State Taxes on Dividends

Some states do not tax dividend income, such as:

Florida

Texas

Nevada

Alaska

Washington

Others, like California and New York, do impose state-level taxes. Our dividend tax calculator includes state options to reflect your local tax rate.

How to Use the Dividend Tax Calculator (Step-by-Step)

Enter your total dividend income.

Select the type of dividends: qualified or non-qualified.

Input your filing status: single, married filing jointly, etc.

Add your total annual income.

(Optional) Choose your state to factor in local tax rates.

Click “Calculate” to view your estimated taxes owed.

Example:

Example:

Total Dividends: $3,000

Filing Status: Single

Annual Income: $50,000

Type: Qualified

Estimated Tax: $450 (15% rate)

How to Calculate Dividend Taxes Manually

To manually estimate your taxes:

Identify type of dividends (qualified or not)

Find your tax bracket based on annual income

Apply the tax rate to your total dividend income

Formula:

Dividend Tax = Dividend Amount × Applicable Tax Rate

Manual methods are useful for rough estimates, but calculators are far more accurate—especially if you have multiple sources of income.

Factors That Affect Your Dividend Tax Rate

Filing Status: Married couples often fall into different brackets than single filers.

Total Income: Your ordinary and qualified tax rates depend on how much you earn.

Dividend Type: Qualified = lower rate; non-qualified = higher rate.

State of Residence: Not all states treat dividend income the same.

Related Tools You Might Find Useful

Frequently Asked Questions (FAQs)

Q1. Do I pay taxes on dividends if I reinvest them?

Yes. Reinvested dividends are still considered income and are taxable in the year they are paid.

Q2. Are dividend taxes higher for short-term holdings?

Yes. If you don’t meet the qualified holding period, your dividends are taxed as ordinary income.

Q3. How can I reduce my dividend tax burden legally?

Hold stocks in tax-advantaged accounts (like Roth IRA)

Invest in qualified dividend stocks

Offset income with capital losses

Q4. Are all dividends qualified?

No. Many REITs, MLPs, and foreign dividends are non-qualified and taxed at a higher rate.

Q5. Do all states tax dividends?

No. States like Florida and Texas do not tax dividend income, while others like California do.

Conclusion

Understanding your tax obligation on dividend income can help you better plan your finances and investments. Using a dividend tax calculator allows you to get quick, accurate estimates based on your unique situation—including federal and state taxes.

Take advantage of this tool to stay compliant and minimize surprises during tax season. And don’t forget to explore our other free calculators to plan your full tax outlook effectively!

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.