Georgia Tax Calculator

Income Tax Calculator

Income Tax Results

Sales Tax Calculator

Sales Tax Results

After Standard Deduction ($${deduction.toFixed(2)}): $${taxableIncome.toFixed(2)}

${taxBreakdown}Total Income Tax: $${totalTax.toFixed(2)}

Effective Tax Rate: ${effectiveTaxRate.toFixed(2)}%

Annual Take-home Pay: $${(annualIncome - totalTax - preTaxDeductions).toFixed(2)}

`; resultsDiv.style.display = 'block'; } function calculateSalesTax() { const purchaseAmount = parseFloat(container.querySelector('#purchaseAmount').value); const countySelect = container.querySelector('#countySelect'); const selectedOption = countySelect.options[countySelect.selectedIndex].text; let taxRate = parseFloat(container.querySelector('#customRate').value) || 4; // If a specific county is selected, use its rate unless custom rate is changed if (countySelect.value !== "4" && container.querySelector('#customRate').value === "4") { taxRate = parseFloat(countySelect.value); } // Validate inputs if (isNaN(purchaseAmount)) { alert("Please enter a valid purchase amount"); return; } if (purchaseAmount < 0) { alert("Purchase amount cannot be negative"); return; } if (taxRate < 4 || taxRate > 10) { alert("Sales tax rate must be between 4% and 10%"); return; } // Calculate sales tax const salesTax = purchaseAmount * (taxRate / 100); const totalAmount = purchaseAmount + salesTax; // Display results const resultsDiv = container.querySelector('#salesTaxResults'); const breakdownDiv = container.querySelector('#salesTaxBreakdown'); breakdownDiv.innerHTML = `Location: ${selectedOption}

Sales Tax Rate: ${taxRate}%

Sales Tax Amount: $${salesTax.toFixed(2)}

Total Amount: $${totalAmount.toFixed(2)}

`; resultsDiv.style.display = 'block'; } // Add event listeners when the page loads container.querySelector('#calculateIncomeBtn').addEventListener('click', calculateIncomeTax); container.querySelector('#calculateSalesBtn').addEventListener('click', calculateSalesTax); // Allow custom rate entry to override county selection container.querySelector('#customRate').addEventListener('input', function() { if (this.value !== "4") { container.querySelector('#countySelect').value = "4"; } }); // Reset custom rate when a specific county is selected container.querySelector('#countySelect').addEventListener('change', function() { if (this.value !== "4") { container.querySelector('#customRate').value = this.value; } }); })();Explore Our Free Tax Calculators and Tools

Georgia Tax Calculator: A Complete Guide to Understand Everything

A Georgia income tax calculator is an online tool that helps residents estimate state income tax obligations with precision. Employees, freelancers, and business owners in Georgia can use this calculator to determine withholding amounts, annual tax liability, and potential refunds. By entering income, deductions, and filing status, taxpayers receive instant calculations aligned with Georgia Department of Revenue guidelines. This reliable resource simplifies planning for paycheck management, quarterly payments, and year-end filing across the Peach State.

Why Understanding Georgia’s Taxes Matters More Now

In the state of Georgia, managing your personal finances effectively requires more than just a passing knowledge of tax law. With ongoing legislative changes and varying local rates, having reliable tools to estimate your tax burden is crucial. This guide provides a comprehensive overview of the essential Georgia tax calculators available to you, explaining their purpose, benefits, and how they can empower you to take control of your financial life.

This content has been reviewed for accuracy and is grounded in information from authoritative sources, including the Georgia Department of Revenue (DOR) and IRS. However, it is important to note that this is for informational purposes only and is not a substitute for professional tax advice from a Certified Public Accountant (CPA).

The Georgia State Income Tax Calculator: A Tool for Financial Forecasting

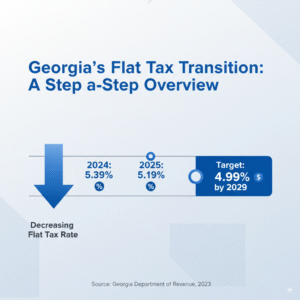

Georgia operates on a progressive income tax system, which means your tax rate is tied directly to your taxable income. While the state is in the process of transitioning to a flat tax rate, understanding the current structure is vital. As of the current tax year, Georgia’s income tax rates range from 1% to 5.75%.

A Georgia state income tax calculator serves as a powerful financial forecasting tool. It allows you to:

Estimate Your Tax Liability: By inputting your salary, deductions, credits, and filing status, you can get a real-time, accurate estimate of what you may owe the state.

Plan for Your Tax Season: Knowing your potential tax burden in advance helps you set aside the appropriate funds, preventing last-minute financial stress and allowing you to plan for a potential refund.

Ensure Accuracy: Using a calculator can help you double-check figures before you file, minimizing the risk of costly errors.

Whether you’re a single filer, married filing jointly, or head of household, a reliable Georgia state tax calculator provides the clarity you need to navigate tax season with confidence.

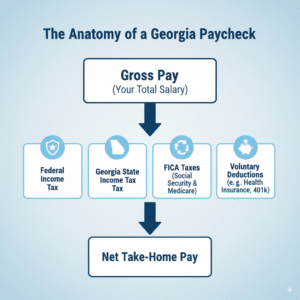

The Georgia Paycheck Tax Calculator: Deconstructing Your Take-Home Pay

Have you ever wondered why your take-home pay is significantly less than your gross salary? The Georgia paycheck tax calculator provides a transparent breakdown of your earnings. This tool estimates your net pay by accounting for all the standard deductions, including:

Federal Income Tax: Your portion of the U.S. federal income tax. (IRS Withholding Tables)

Georgia State Income Tax: The amount withheld specifically for the state of Georgia. (GA DOR Employee’s Tax Guide)

FICA Taxes: This includes your contributions to Social Security and Medicare.

Voluntary Contributions: Deductions for retirement plans (like a 401(k)), health insurance, and other benefits.

For salaried employees, this calculator offers a clear and practical view of your monthly cash flow, helping with household budgeting and financial planning.

Georgia Salary vs. Income Tax Calculators: Understanding the Difference

While the terms may seem interchangeable, the Georgia salary tax calculator and Georgia income tax calculator serve distinct purposes, and understanding this distinction is a key part of financial literacy.

The salary tax calculator is specifically designed for W-2 employees. It focuses on your earned wages and how they are impacted by standard payroll taxes and deductions. It’s a tool for understanding your gross vs. net salary.

The income tax calculator is a broader tool that accounts for all sources of taxable income. This is essential for individuals with complex financial situations, such as freelancers, small business owners, or those with significant investment gains or passive income.

For dual-income households, part-time workers, or anyone with multiple income streams, using both calculators can provide a more holistic financial picture.

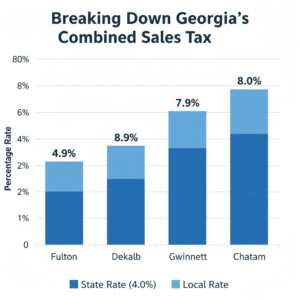

The Georgia Sales Tax Calculator: Avoiding Hidden Costs

Sales tax in Georgia is often more complex than the flat 4% state rate. Local jurisdictions, including counties and cities, can add additional rates, bringing the total combined sales tax to anywhere from 4% to 8.9%, depending on your location.

A Georgia sales tax calculator is an invaluable tool for consumers and small business owners alike. It helps you accurately compute:

The final price of retail purchases.

The total cost of large-ticket items like vehicles or appliances.

The tax breakdown for expense reporting and business accounting.

By knowing the exact amount of sales tax you’ll pay, you can make more informed purchasing decisions and budget more effectively.

Best Practices for Finding Georgia Tax Calculator Tools

When searching for a reliable online tax calculator, look for the following features to ensure accuracy and trustworthiness:

Georgia-Specific Tax Settings: The calculator should be designed for Georgia residents, not a generic national tool.

Regular Updates: Ensure the tool is updated to reflect the latest tax laws specially under House Bill 1437, including any changes announced by the Georgia General Assembly or the DOR.

Mobile and Desktop Compatibility: A good tool works seamlessly across all devices.

Source Credibility: The best calculators are often affiliated with reputable financial institutions, government bodies, or well-known tax software providers.

Bottom Line: Your Pathway to Financial Clarity

From estimating your take-home pay with a Georgia paycheck tax calculator to budgeting for major purchases with a Georgia sales tax calculator, these digital tools are essential for any resident. They eliminate guesswork, provide clarity, and empower you to make informed financial decisions.

Taxes may be a certainty of life, but confusion is not. By leveraging these resources, you can transform a complex, intimidating subject into a clear and manageable part of your financial journey.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.