Monthly Savings Calculator

Total contributions: +$${totalContributions.toFixed(2)}

Initial deposit: +$${principal.toFixed(2)}

`; updateChart(principal, totalContributions, interestEarned); } let chart; function updateChart(initial, contributions, interest) { const ctx = document.getElementById('savingsChart').getContext('2d'); if (chart) chart.destroy(); chart = new Chart(ctx, { type: 'bar', data: { labels: ['Initial Deposit', 'Contributions', 'Interest Earned'], datasets: [{ label: 'Amount', data: [initial, contributions, interest], backgroundColor: ['#375a9e', '#36b1c5', '#b5e3c8'] }] }, options: { responsive: true, plugins: { legend: { display: false }, tooltip: { callbacks: { label: ctx => `$${ctx.raw.toFixed(2)}` } } }, scales: { y: { beginAtZero: true } } } }); } calculate();Explore Our Free Tax Calculators and Tools

Monthly Savings Calculator USA: How it Works?

A monthly savings calculator is a financial planning tool that estimates how your savings grow over time based on key inputs such as starting deposit, monthly contributions, interest rate, and time period. This calculator helps individuals compare different savings strategies, understand the impact of compound interest, and project future balances with accuracy.

How Does the Monthly Savings Calculator Work?

Using the monthly savings calculator is straightforward and only requires a few basic inputs:

Initial Deposit (Starting Amount)

This is your current savings or the amount you’re planning to start with. It could be as little as $50 or as much as $10,000. Even a small initial deposit can make a big difference when combined with regular savings and compounding interest. (Federal Reserve on the importance of saving)Monthly Contribution

How much can you afford to save each month? Your consistent monthly contribution forms the core of your long-term savings. Adjust this figure to see how changes impact your total balance. (Consumer Financial Protection Bureau – Saving Habits).Interest Rate (Annual Percentage Yield)

Enter your expected interest rate. You can typically find this rate from your bank or savings provider. Be sure to confirm if the interest is compounded monthly, quarterly, or annually. (FDIC on APY Explained)Time Period (Months or Years)

Input how long you plan to save for. Whether it’s 12 months or 10 years, the longer you save, the more you’ll benefit from compounding interest. (SEC – Understanding Interest)

Once you’ve entered these details, the monthly savings calculator will provide the following results:

Total amount saved

Total interest earned

Total contributions made

Ending balance

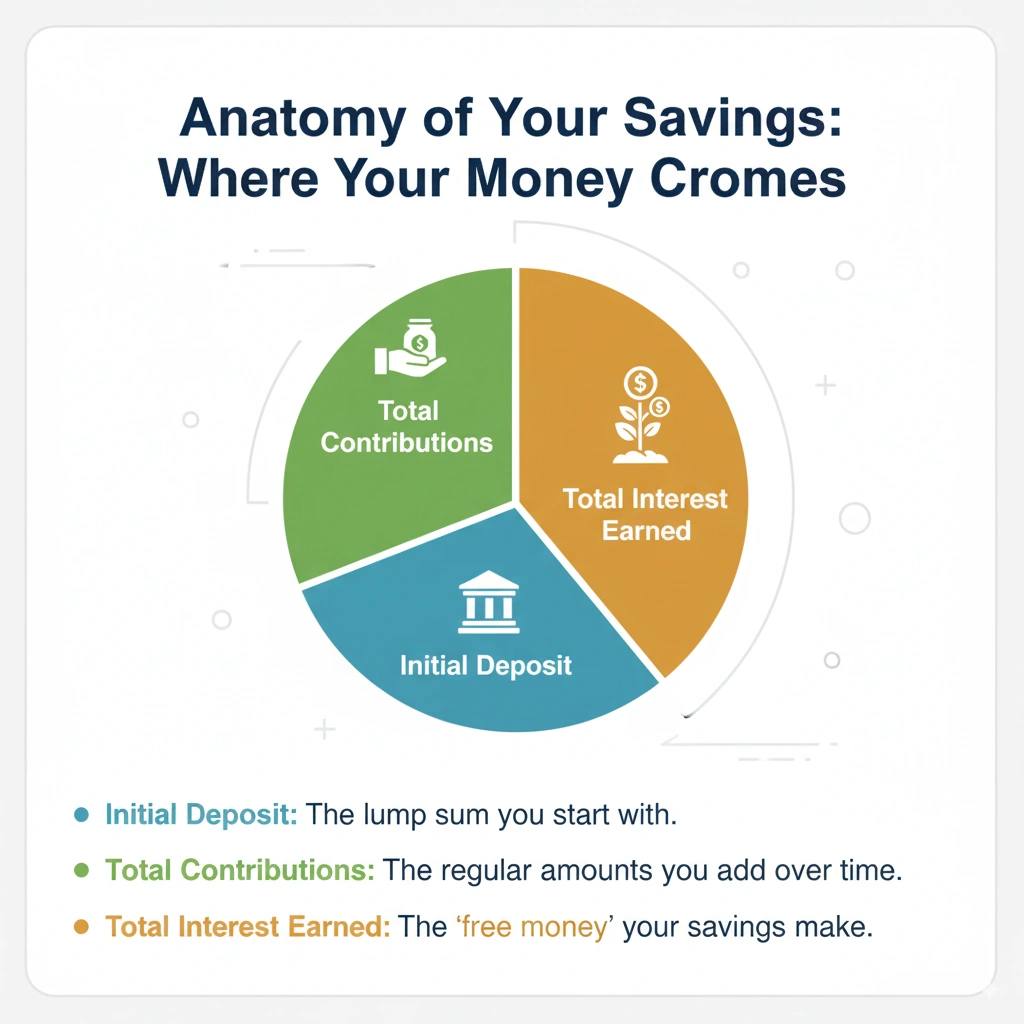

Quick Definitions to Know

Before diving deeper into savings strategies, here are some key terms that will help you make the most of the monthly savings calculator:

Initial Amount: The amount of money you have at the beginning of your savings plan.

Monthly Contribution: The amount you add to your savings each month.

Annual Interest Rate (APY): The yearly rate your savings will earn, often offered by banks or credit unions.

Time Horizon: The length of time you plan to save for, typically in months or years.

Compounding Interest: Interest earned not just on the initial deposit, but also on accumulated interest from previous periods.

Understanding Your Savings Potential

The beauty of saving money lies in consistency and time. With the monthly savings calculator, you can clearly see how small, steady deposits add up over time.

Let’s break it down with an example:

Imagine you start with $1,000, and you contribute $200 every month at an interest rate of 4.5% annually. In five years, your savings could grow to nearly $14,650. Without monthly contributions, you’d only reach around $1,246 — a significant difference.

What does this show? That regular deposits have a far greater impact than just a large initial deposit. And when combined with a decent interest rate, your savings grow even faster due to compounding.

Comparing Savings Tools: Monthly Savings vs. FICA Loan & SEER Savings

There are many financial calculators available today, including the FICA loan savings calculator and the SEER savings calculator. While each has its specific use, the monthly savings calculator offers the most practical, everyday value for anyone looking to consistently build savings.

FICA Loan Savings Calculator

The FICA loan savings calculator focuses on estimating how much you could save on taxes by adjusting your pre-tax income allocations (e.g., retirement contributions). While it’s helpful for tax planning, it doesn’t show how your actual savings grow over time like the monthly savings calculator does. (IRS Retirement Savings Plans)

SEER Savings Calculator

The SEER savings calculator is typically used in the energy and utility sector to evaluate how much money you can save through energy-efficient upgrades (e.g., better insulation or efficient air conditioning). Again, it’s useful in a specific context, but it doesn’t track your cash savings growth like our monthly savings calculator does. (U.S. Department of Energy – SEER Ratings)

The Power of Compounding

One of the most exciting aspects of saving money is watching it grow through compound interest. The monthly savings calculator gives you a glimpse into how your money will work for you over time.

Here’s how compound interest helps:

You earn interest on your deposit.

The next period, you earn interest on your deposit and the previous interest.

This cycle continues, multiplying your total earnings.

The more frequently the interest is compounded (monthly, quarterly), the greater your total savings will be. Always choose a savings account with a favourable compounding frequency to maximize your returns.

Explore Our Free Tax Calculators and Tools

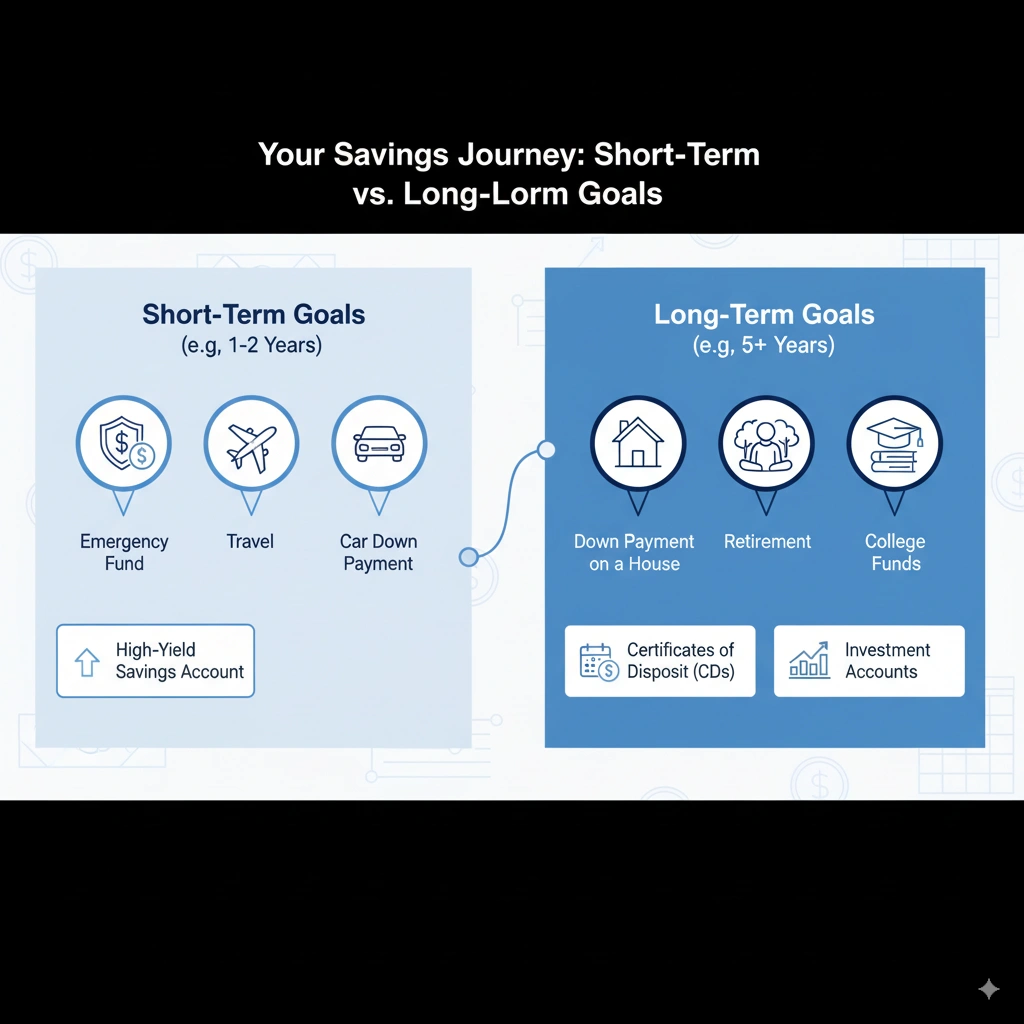

Saving for Short-Term vs. Long-Term Goals

The monthly savings calculator can help you plan for both short-term and long-term goals.

Short-Term Savings Goals

Emergency Fund

Car Maintenance

Holiday or Travel Plans

Weddings or Special Occasions

Short-term savings often require liquidity — easy access to your funds. Use high-yield savings accounts or money market accounts for these.

Long-Term Savings Goals

Home Down Payment

Retirement Planning

Education Funds

Investment Reserves

Longer-term savings benefit more from compound interest. You might consider certificates of deposit (CDs) or other interest-bearing accounts for this type of savings.

How to Use the Monthly Savings Calculator Effectively

To get the most from our monthly savings calculator, follow these simple tips:

Be Honest With Your Numbers

Input a realistic starting amount and monthly contribution. It’s okay if you start small — the key is consistency.Experiment With Interest Rates

Try different interest rates to see how they impact your savings. This will help you evaluate which savings accounts or financial products suit your goals.Adjust Time Periods

Planning to save for 2 years? 5 years? 10? The longer the term, the more powerful the compounding. Adjust the time frame to fit your specific goal.Recalculate Frequently

Your financial situation may change. Make it a habit to revisit the monthly savings calculator every few months to stay on track.

Tips to Increase Your Monthly Savings

Want to make the most of the monthly savings calculator? Start by increasing your actual savings. Here are a few tips to help you boost your monthly deposits:

Automate Your Savings

Set up an automatic transfer from your checking account to your savings every payday.Review Subscriptions & Expenses

Cut back on unnecessary monthly costs (like unused subscriptions) and divert those funds to your savings.Apply the 50/30/20 Rule

Save 20% of your income wherever possible. Use the calculator to see how this grows over time.Challenge Yourself

Try a “no-spend” week or save your spare change using savings apps.Use Multiple Tools

While the monthly savings calculator is perfect for overall planning, you can also explore the FICA loan savings calculator to reduce taxes or the SEER savings calculator to save on utilities and redirect those funds to your monthly savings.

Financial Products That Affect Your Savings

The type of savings account you choose plays a major role in how your money grows. Let’s look at some options you can compare using the monthly savings calculator:

Traditional Savings Account

Lower interest rates

Easy access

Ideal for short-term goals

High-Yield Savings Account

Higher APYs

Great for growing savings faster

FDIC insured for safety

Certificates of Deposit (CDs)

Fixed interest rate and term

Early withdrawal penalties

Suitable for long-term goals

Money Market Accounts

Higher APYs than traditional savings

Some cheque-writing privileges

Ideal for medium-term savings

The monthly savings calculator helps you test each account’s earning potential by comparing different APYs and durations.

Start Saving Today

Your financial goals are not fixed , they evolve. That’s why using the monthly savings calculator regularly is essential. By tracking your savings growth, adjusting inputs, and staying committed to your strategy, you can achieve everything from small purchases to major life milestones.

Combine this calculator with other tools such as the FICA loan savings calculator and SEER savings calculator to get a comprehensive picture of your financial health. But when it comes to simple, consistent monthly saving , the monthly savings calculator is your go-to solution.

The sooner you start, the more time your money has to grow. Whether you’re saving for something specific or just trying to build a better financial future, our monthly savings calculator is here to help.

Take five minutes today to plug in your numbers, explore different saving scenarios, and take the first step toward financial confidence. Remember: it’s not about how much you start with, but how committed you are to the journey.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.