Mortgage Payoff Calculator

Monthly Payment Breakdown

Explore Our Free Tax Calculators and Tools

Sponsored Ads:

Mortgage Payoff Calculator

A Mortgage Payoff Calculator is a financial tool that shows homeowners how long it will take to pay off their mortgage and how much they can save by making extra payments. By entering loan details such as balance, interest rate, and term, the calculator analyzes repayment timelines and interest costs. For example, an extra $200 per month on a $250,000 mortgage at 6% interest can shorten the payoff period by over 7 years and save more than $60,000 in interest. Homeowners use it to compare payoff scenarios, estimate savings, and create a clear strategy for becoming debt-free sooner.

What is a Mortgage Payoff Calculator?

A Mortgage Payoff Calculator is a specialised financial tool used to determine how additional monthly payments, lump sums, or payment frequency adjustments can affect your mortgage timeline. It gives you a clear picture of how long it will take to pay off your loan and how much interest you can save by making early or extra payments.

This calculator simplifies the decision-making process, allowing you to play with various figures such as loan amount, interest rate, term length, and extra payments. The result? A comprehensive breakdown of your loan’s payoff schedule.

Learn more about how mortgages work from the Consumer Financial Protection Bureau (CFPB)

Why Use a Mortgage Payoff Calculator?

Paying off a mortgage is often one of the biggest financial goals for homeowners. A Mortgage Payoff Calculator enables you to:

Visualize your mortgage timeline

Estimate total interest savings

Assess the impact of biweekly or extra payments

Plan your financial future with confidence

It’s especially useful when deciding between staying on your current payment plan or making strategic changes. See the Federal Reserve’s guide on mortgages for more background on loan repayment strategies.

How to Use Our Mortgage Payoff Calculator

Using our Mortgage Payoff Calculator is straightforward. Here’s a step-by-step guide:

Enter your original loan amount – This is the amount you borrowed from your lender.

Enter your interest rate – Input your current annual interest rate.

Enter your loan term – Common terms are 10, 15, 20, or 30 years.

Input your start date – This helps calculate how many payments you’ve already made.

Add extra payments (optional) – Include any additional amounts you pay monthly or annually.

Click Calculate – Our calculator will show you how early you can pay off the mortgage and how much interest you’ll save.

The beauty of this tool lies in its flexibility. You can modify numbers as many times as needed to explore different repayment scenarios.

Key Features of Our Calculator

Amortisation Schedule: Get a detailed monthly or annual breakdown.

Savings Estimator: See how much interest you save with extra payments.

Flexible Payment Options: Choose monthly or mortgage calculator biweekly options.

Mobile-Friendly Design: Use the calculator on any device, anywhere.

Whether you’re experimenting with mortgage calculator games to learn more or making serious financial plans, this tool is invaluable.

Explore Our Free Tax Calculators and Tools

Understanding Mortgage Repayment: Key Components

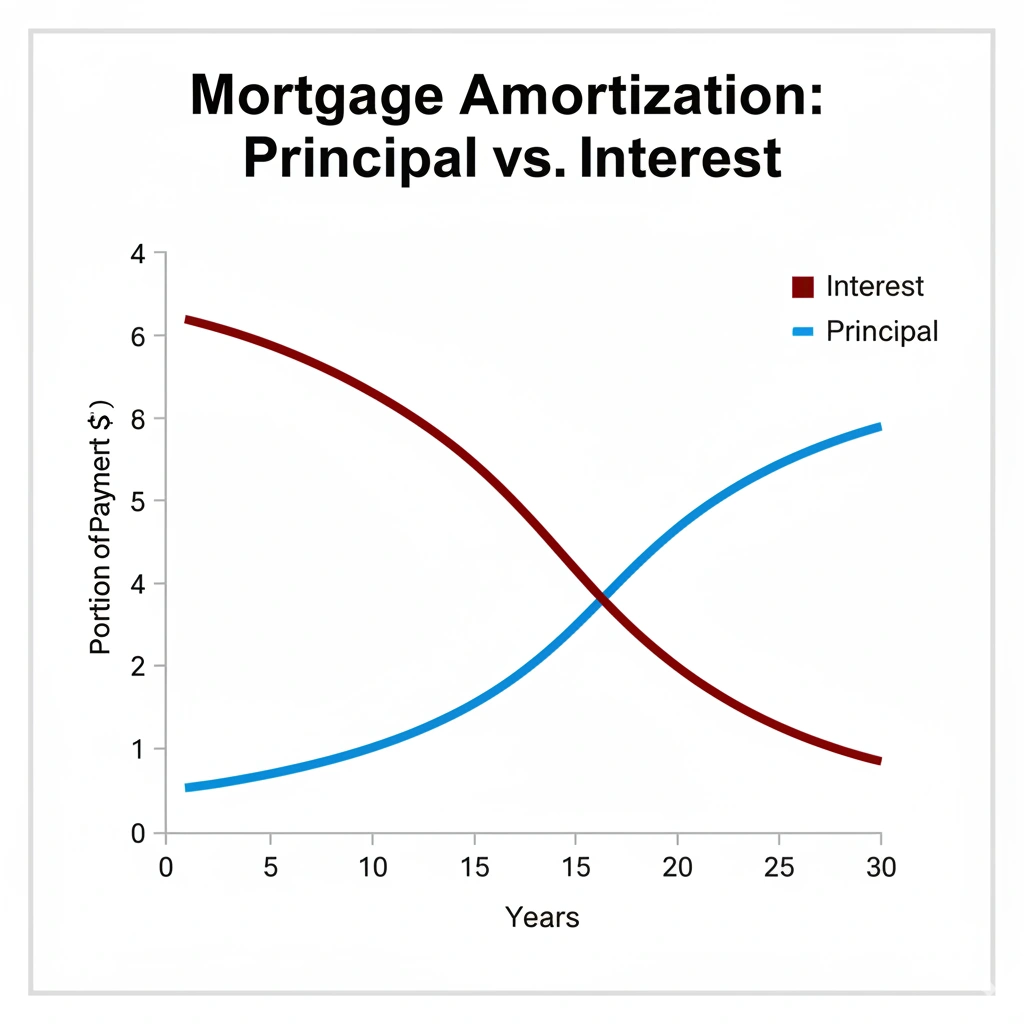

When you use the Mortgage Payoff Calculator, it’s essential to understand what goes into your monthly repayment:

Principal: The original loan amount

Interest: Charged by your lender, based on your rate and remaining balance

Taxes and Insurance: Typically added to your monthly mortgage through escrow

Knowing these components helps you make informed decisions and lets you focus on reducing the interest portion over time.

Advantages of Paying Off Your Mortgage Early

The idea of being debt-free is attractive. Here’s why early payoff makes sense:

Save thousands in interest

Free up monthly cash flow

Build equity faster

Achieve financial independence sooner

Our Mortgage Payoff Calculator makes it easy to visualise these benefits. You’ll see how even modest extra payments can shave years off your loan.

Biweekly Payments: A Smart Strategy

Choosing a mortgage calculator biweekly repayment option can significantly reduce your loan term. Instead of making 12 monthly payments, you’ll make 26 half-payments (equivalent to 13 full payments) annually. This simple adjustment can save thousands in interest over the life of the loan.

Try this feature in our Mortgage Payoff Calculator and watch your payoff date move closer.

Verified by the CFPB on making extra mortgage payments

What About Land Mortgages?

Planning to buy a plot of land instead of a house? Use our land mortgage calculator feature within the tool. It works the same way but is tailored for land loans, which may have different terms and interest rates. Whether you’re investing in a rural plot or planning future construction, this tool helps you plan accordingly.

RBC Mortgage Payment and Canadian Comparisons

While our calculator is built for U.S. users, it offers a similar experience to tools like the RBC mortgage payment calculator used in Canada. Both provide valuable insights into payment schedules and interest savings. If you’re comparing international options or looking to relocate, the similarities make cross-border planning easier.

Learn Through Play: Mortgage Calculator Games

Understanding mortgage concepts can be overwhelming. That’s why many users explore mortgage calculator games, interactive tools and simulations that teach you how mortgages work in a fun, engaging way.

While our calculator is designed for accuracy and real planning, it also serves as a great learning tool. Experiment with figures to see the impact of different scenarios, just like in a game.

Common Questions About Our Mortgage Payoff Calculator

1. Can I trust the figures shown?

Absolutely. Our Mortgage Payoff Calculator uses standard mortgage formulas and amortisation schedules to deliver reliable estimates. (For formula details, see the U.S. Department of Housing and Urban Development (HUD).)

2. Will it work for refinancing?

Yes. If you’re refinancing, simply enter the new loan amount, interest rate, and term. Use extra payments to model how soon you could repay the refinanced mortgage.

3. Can it factor in taxes and insurance?

While it focuses on principal and interest, you can manually add estimates for property taxes and homeowners insurance for a more complete picture.

4. What if I change my payment frequency later?

You can revisit the calculator any time and adjust the figures. It’s built to accommodate your evolving financial strategy.

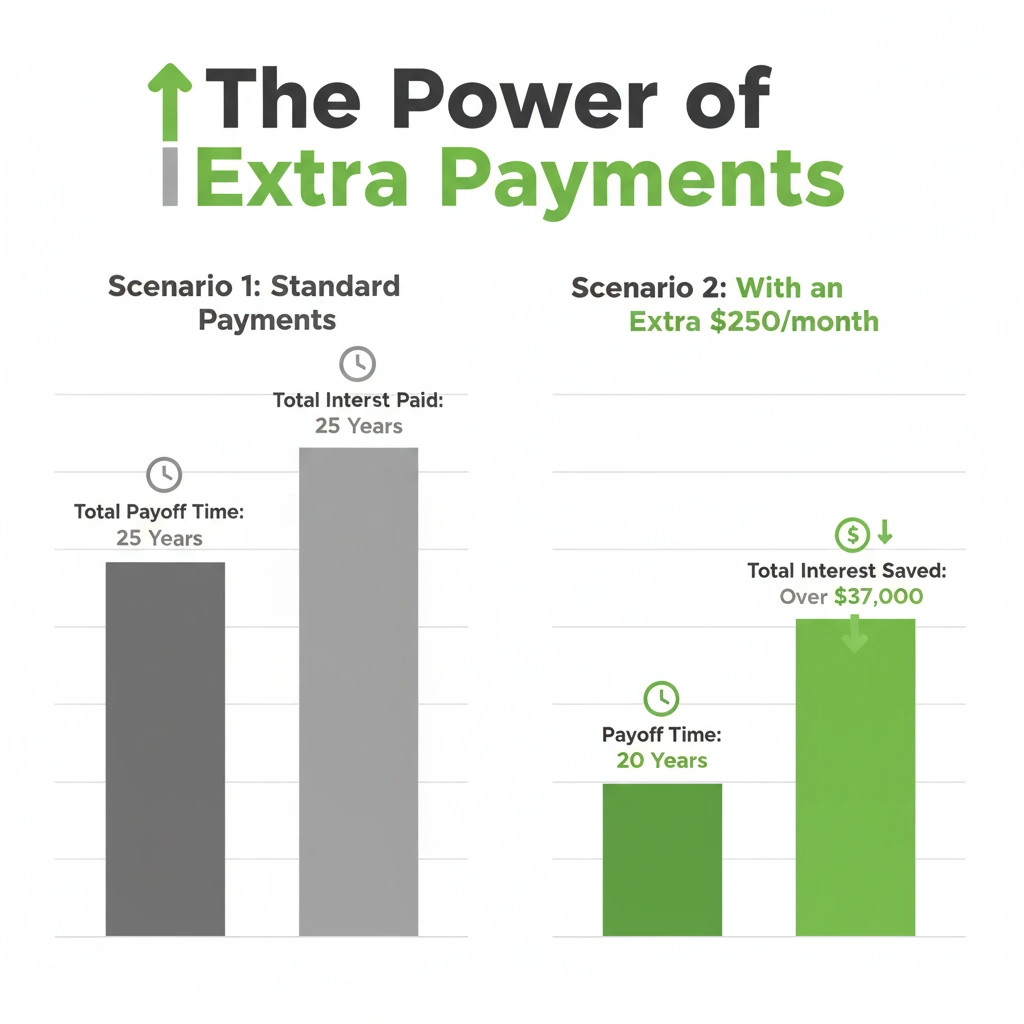

Real-Life Example: Meet Sarah

Sarah has a $300,000 mortgage at a 4.2% interest rate with 25 years remaining. She’s considering paying an extra $250 each month. Using our Mortgage Payoff Calculator, she finds that:

Her payoff time drops by 5 years

She saves over $37,000 in interest

This gives Sarah the confidence to make those extra payments, knowing it’s a financially sound decision.

Final Thoughts: The Power of Planning

Our Mortgage Payoff Calculator is more than just a tool – it’s your financial planning companion. Whether you want to pay off your mortgage sooner, compare interest savings, explore land mortgage calculator scenarios, or experiment with mortgage calculator games, you’ll find everything you need in one place.

You don’t need to be a financial expert to make smart decisions. Use our calculator regularly to check your progress, adjust your strategy, and stay motivated. Remember, every small extra payment brings you closer to owning your home outright.

Start Using the Mortgage Payoff Calculator Now

Take control of your mortgage and future today. Use our Mortgage Payoff Calculator to:

Explore payoff timelines

Calculate interest savings

Test mortgage calculator biweekly plans

Compare options with tools like the RBC mortgage payment calculator

Understand mortgage terms through mortgage calculator games

No sign-up required. No financial jargon. Just real numbers and powerful insight.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.