New York Income Tax Calculator 2025

Estimate your New York State and local income tax liability

Income

Deductions & Adjustments

Credits

Residency

Tax Estimate Results

Estimated NY State Tax Due: $0.00

Estimated Local Tax Due: $0.00 ()

Effective Tax Rate: 0.00%

Estimated Federal Tax (for comparison): $0.00

Disclaimer: This tool provides estimates only based on the information you provide. Tax laws are complex and subject to change. Consult a tax professional for official filings.

NYC residents must file Form IT-201; non-residents use IT-203.

* This calculator uses 2025 New York State tax brackets and rates.

Explore Our Free Tax Calculators and Tools

NY Income Tax Calculator

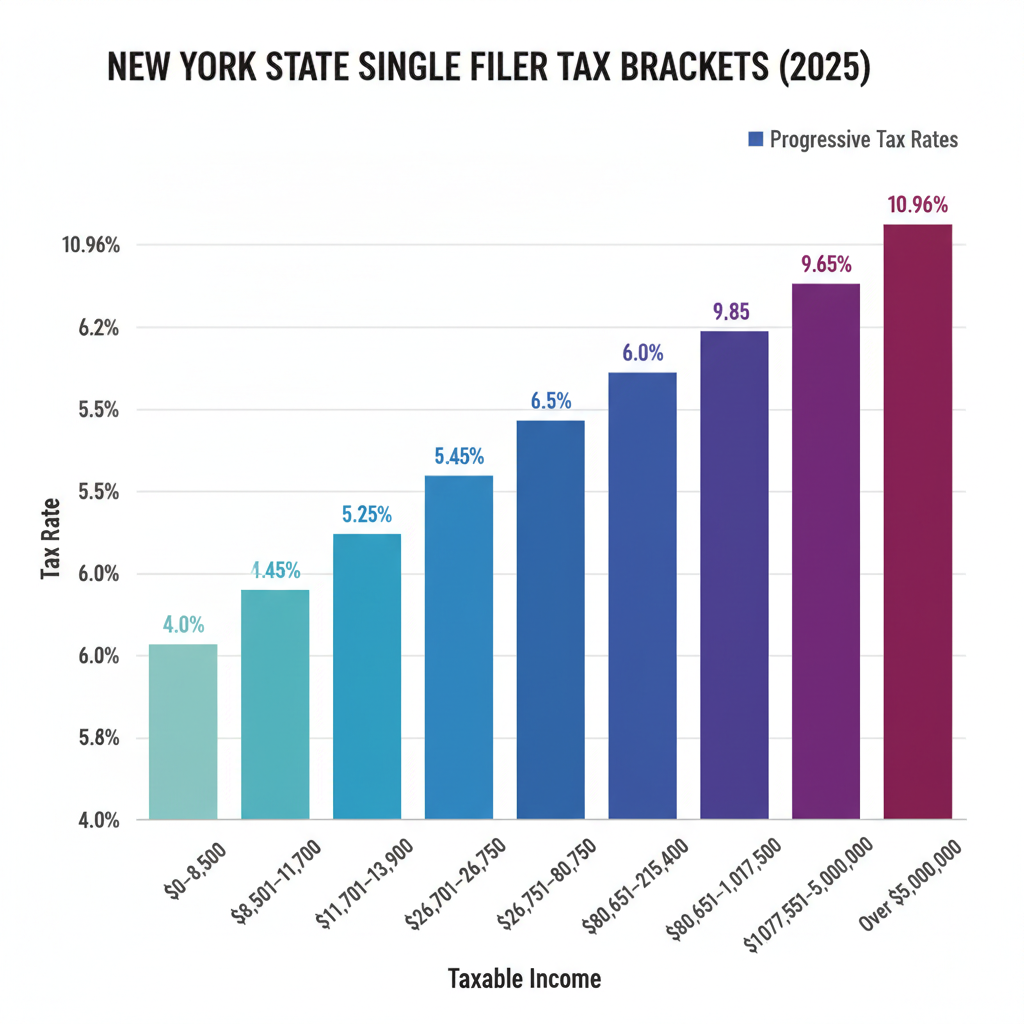

New York income tax calculators help residents and workers estimate state and New York City income tax liability based on current tax brackets, filing status, and annual income. New York State imposes progressive income tax rates ranging from 4% to 10.9%, while New York City adds local income taxes from 3.078% to 3.876% for residents. Freelancers, W-2 employees, and commuters can use an NY income tax calculator to quickly project paycheck withholdings, plan quarterly estimated payments, and compare scenarios. By combining state and city rates, these calculators provide a clear estimate of total tax obligations without manual math.

What Is a Graduated Income Tax?

New York operates on a graduated income tax system, which means your tax rate increases as your taxable income rises. Instead of a single flat rate, your income is divided into segments, or tax brackets, with each segment taxed at a different percentage. This is a progressive system designed to tax higher earners at a greater rate.

For example, for single filers in 2025, the first portion of your income is taxed at 4%, while income in higher brackets can be taxed at rates up to 10.9%. This tiered approach is why it’s difficult to calculate your final tax bill manually.

Who Pays NY State Income Tax?

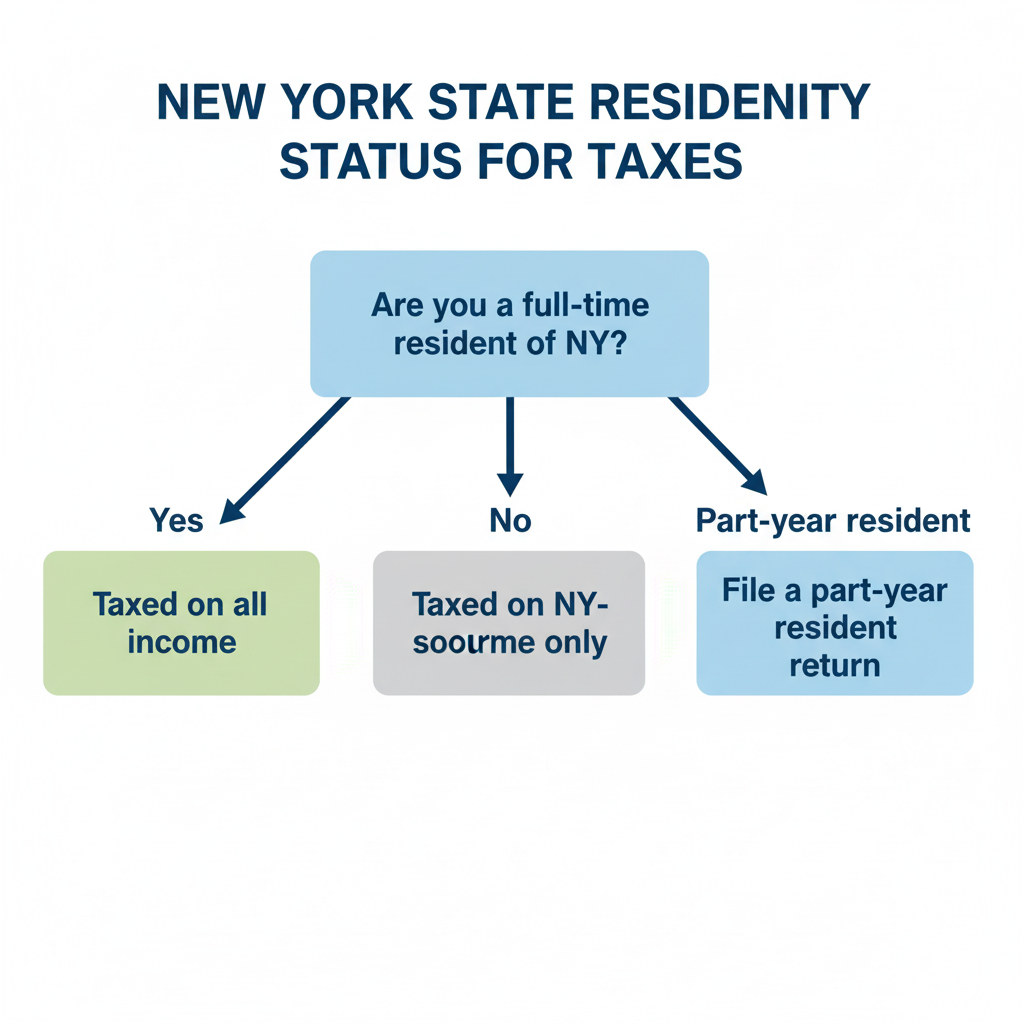

Your New York tax liability depends on your residency status. The state categorizes taxpayers into three main groups:

-

Full-time residents: If you live in New York for the entire year, you’re taxed on all of your income, regardless of where it was earned. This includes income from a remote job for an out-of-state company or a rental property you own in another state.

-

Non-residents: You only pay New York State income tax on income from New York-based sources. This includes wages from a job performed in NY, income from a business located in the state, or earnings from New York real estate.

-

Part-year residents: If you moved into or out of New York during the tax year, you’ll be taxed as a resident for the portion of the year you lived there and as a non-resident for the remainder.

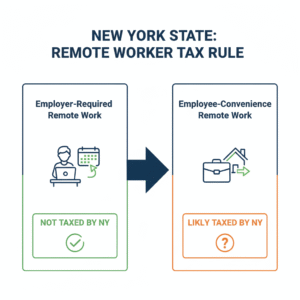

The “Convenience of the Employer” Rule

New York State has a unique and often confusing rule that can affect non-residents who work for a New York-based company. The “convenience of the employer” rule states that if you live outside of New York but work remotely for a New York company, your income may still be considered “New York-sourced” and therefore taxable by the state.

This rule applies unless your employer requires you to work remotely for their business needs, as opposed to you choosing to work remotely for your own convenience. The New York State Department of Taxation and Finance is aggressive about enforcing this, and it can be a significant point of confusion for remote workers.

The NYC Local Income Tax: A Separate Layer

For those living or working in the five boroughs, there’s a separate New York City local income tax. This tax is in addition to the New York State income tax.

Unlike the state, New York City does not tax non-residents on their income, even if they work for a company based in NYC. You only pay NYC tax if you are a resident of the city or a city government employee. This is a crucial distinction and a common point of confusion.

How to Accurately Estimate Your NY Taxes

While using an NY income tax calculator is the easiest way to get an accurate estimate, understanding the process can help you plan and budget. Here are the key steps:

-

Determine Your Filing Status: Your tax bracket and standard deduction are based on your filing status (e.g., single, married filing jointly, head of household).

-

Calculate Taxable Income: Start with your gross income and subtract any eligible deductions. This could include things like student loan interest or contributions to a retirement account.

-

Apply NY Tax Brackets: Use the official state tax rates to calculate the tax owed on each portion of your taxable income. For example, for a single filer earning $60,000, your income would be taxed at various rates for each bracket.

-

Subtract Credits: Certain credits, such as the Earned Income Tax Credit, can directly reduce your tax bill.

Example: A single filer with a taxable income of $60,000 would pay:

-

$340 (4% of first $8,500)

-

$144 (4.5% of next $3,200)

-

…and so on, until the full amount is accounted for.

This multi-step calculation highlights why a reliable New York state tax calculator is an invaluable tool.

Paycheck Withholdings: Are You on Track?

If you’re an employee, your employer withholds a portion of your wages for state and federal taxes. But it’s your responsibility to ensure the amount is correct to avoid a large tax bill or a lack of refund come tax season.

-

Check Your Withholdings: Use a NY state income tax withholding calculator to see if your employer is taking out enough.

-

Adjust Your Form IT-2104: This is the New York version of the federal W-4 form. You can submit a new Form IT-2104 to your employer to adjust the amount of tax withheld from your paychecks.

Common Misconceptions to Avoid

-

NYC Remote Work Tax: The misconception that remote workers for NYC-based companies automatically owe NYC tax is incorrect. NYC income tax is for residents only. However, New York State has a separate, complex rule that may still apply.

-

Missing Deductions: Don’t forget to claim all eligible deductions and credits. These can significantly lower your taxable income and your final tax bill.

FAQs (Frequently Asked Questions)

Q: How is NY tax different from federal tax?

A: Federal taxes are handled by the IRS with their own set of rules, brackets, and deductions. New York State has its own separate tax system. While some rules are similar, you must file a separate return for each.

Q: If I work remotely for a NYC company, do I owe NYC taxes?

A: No, you do not owe NYC income tax unless you are a resident of the city. However, you may still owe New York State income tax on your earnings due to the state’s “convenience of the employer” rule, as discussed above.

Q: Can I use these calculators for estimated tax payments?

A: Yes. Freelancers and independent contractors who make quarterly estimated tax payments can use an NY estimated tax calculator to help determine their tax liability and avoid penalties.

Bottom Line: Trust the Tools and the Experts

Navigating New York State taxes requires attention to detail. The state’s graduated rates and unique rules, like the “convenience of the employer” rule, can make things tricky. While this guide provides a strong foundation, the most reliable way to handle your taxes is to use a trusted New York income tax calculator and, for personalized advice, consult with a qualified tax professional.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.