Reverse Tax Calculator USA

Calculate the gross income needed to achieve your desired net income after taxes

Optional Deductions (Click to Expand)

+Results

Explore Our Free Tax Calculators and Tools

Reverse Tax Calculator USA: How it Works and How to Use it?

A reverse sales tax calculator is a financial tool that determines the original pre-tax price from a total that already includes sales tax. Businesses, accountants, and consumers use it to separate taxable amounts from receipts, invoices, or financial records. By applying the correct tax rate in reverse, the calculator quickly reveals the net cost of goods or services before tax, making expense tracking and compliance more accurate.

What Is a Reverse Tax Calculator?

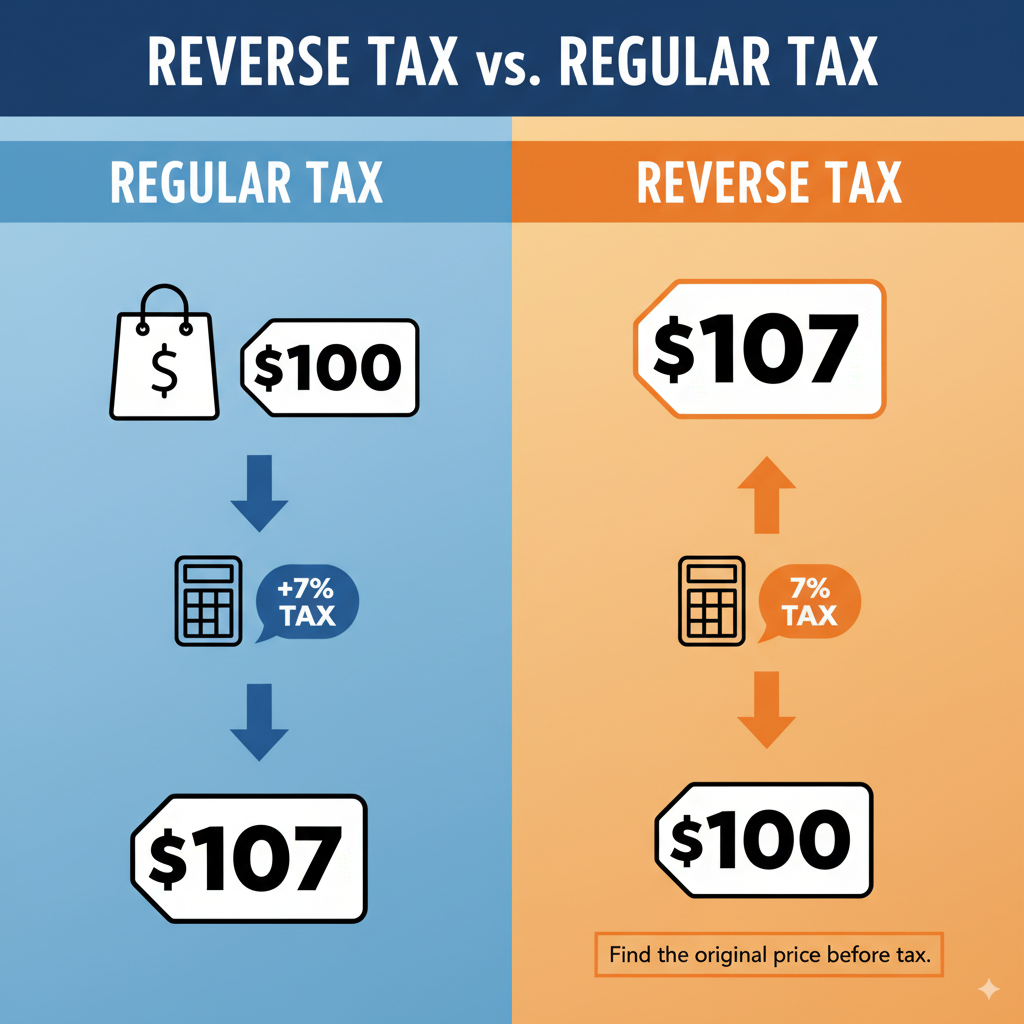

A reverse tax calculator helps determine the original amount before tax when you only know the final price (after tax). Unlike a traditional tax calculator that adds tax to a subtotal, this tool works backward.

For example:

If you paid $107 for something with a 7% sales tax, a reverse sales tax calculator tells you the original price was $100.

What Is a Reverse Sales Tax Calculator?

A reverse sales tax calculator is specifically used to remove sales tax from a total price. This is especially useful in situations like:

Pricing retail items

Invoicing

Auditing and accounting

eCommerce product listings

Common Use Case Example

If a product costs $214.20 and includes 7% sales tax, the reverse sales tax calculator tells you the original price was $200.

Formula:

Original Price = Total Price / (1 + Sales Tax Rate)

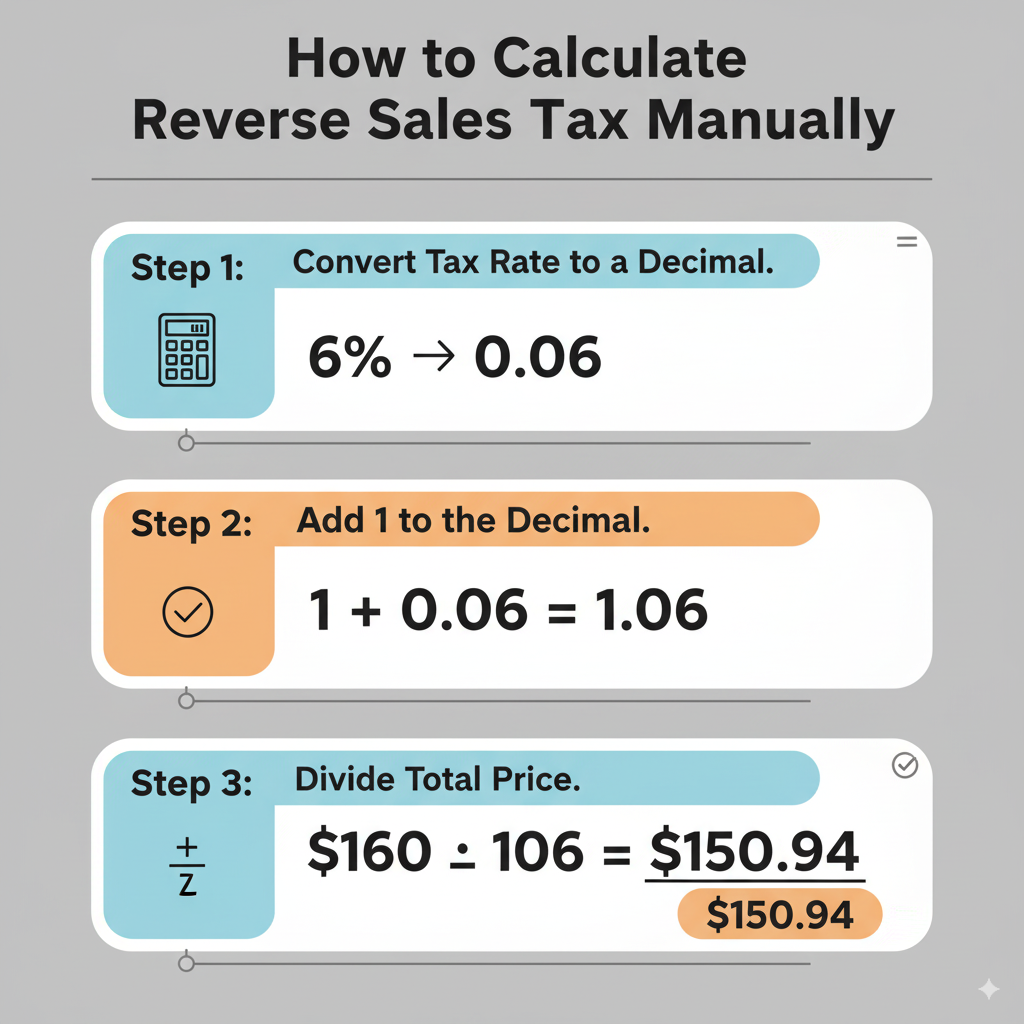

How to Calculate Reverse Sales Tax Manually

Let’s say you spent $160 on an item, and sales tax in your state is 6%.

Step-by-step:

Convert the sales tax to a decimal: 6% → 0.06

Add 1 to the tax rate: 1 + 0.06 = 1.06

Divide the total price by this number: 160 ÷ 1.06 = $150.94 (original price)

That means sales tax was $9.06.

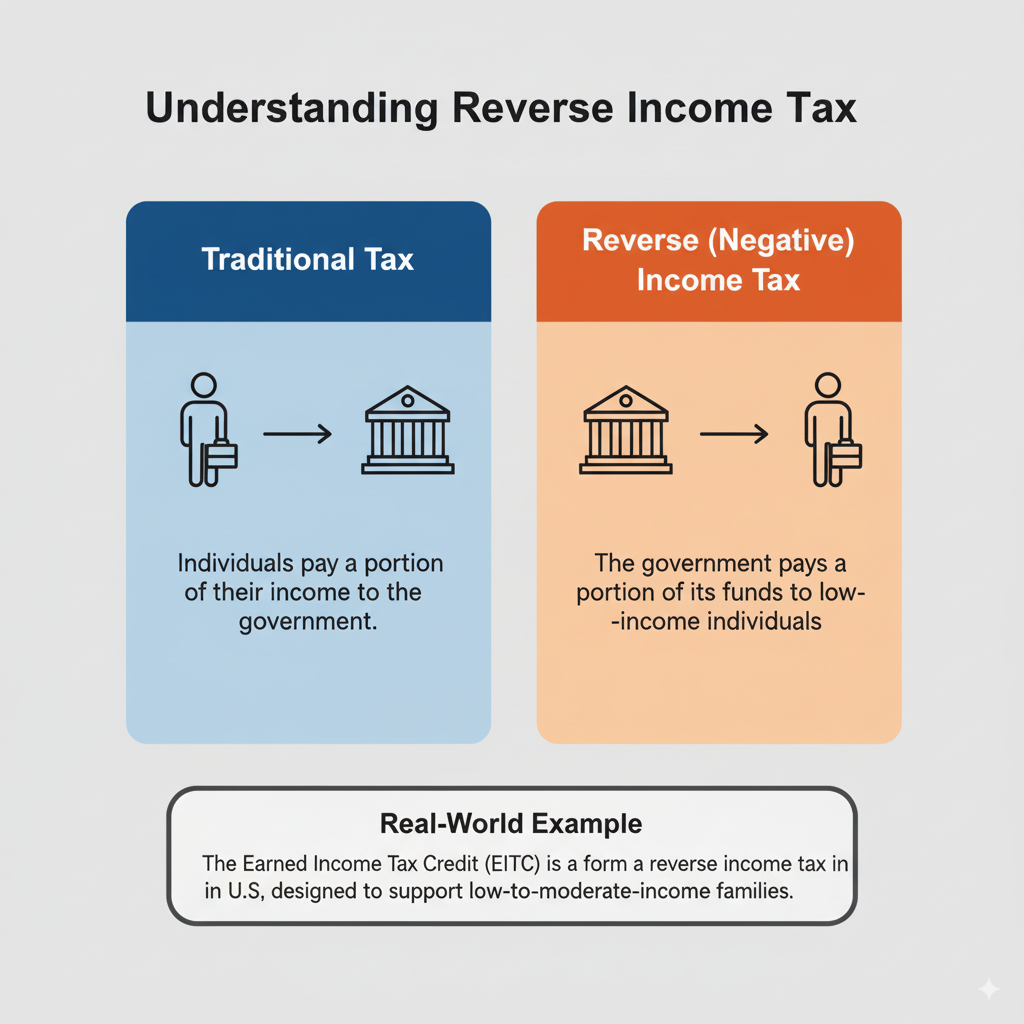

What Is Reverse Income Tax?

Reverse income tax is a separate concept often used in economic theory. Unlike typical income tax where individuals pay taxes on their earnings, reverse income tax is where the government gives money to low-income earners.

It was first proposed by economist Milton Friedman and later inspired real-world policies like the Earned Income Tax Credit (EITC) in the U.S.

While it’s not commonly used by individuals to calculate take-home pay, it’s a crucial concept in tax policy and economic support systems.

FAQs About Reverse Tax & Sales Tax Calculators

How do I calculate reverse tax?

How do I calculate reverse tax?

Divide the total (tax-inclusive) price by (1 + tax rate). For example: $107 ÷ 1.07 = $100.

What is the difference between sales tax and reverse sales tax?

What is the difference between sales tax and reverse sales tax?

Sales tax adds tax to the base price.

Reverse sales tax removes the tax portion from a total price.

What is reverse income tax?

What is reverse income tax?

It’s a concept where the government pays income to low earners rather than collecting it. Think of it as negative income tax.

Can I calculate reverse tax using Excel?

Can I calculate reverse tax using Excel?

Yes. Use this formula: =Total_Price / (1 + Tax_Rate)

Final Thoughts

Whether you’re reviewing receipts or setting prices, using a reverse sales tax calculator can simplify your finances and improve transparency. It’s a must-have tool for anyone in retail, accounting, or eCommerce. And understanding concepts like reverse income tax gives you a clearer view of how taxes can work both ways—sometimes even in your favor.

Want to try it now? Use our free reverse tax calculator to instantly see the pre-tax price of any amount.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.