How Tariffs and Economic Policy Are Shaping Mortgage Rates in 2025: What Homebuyers Need to Know

The year 2025 is proving to be a complex and often unpredictable landscape for prospective homebuyers. While traditional factors like inflation and Federal Reserve policy continue to play a central role, a new and powerful force has emerged to influence the cost of borrowing: tariffs and trade policy. For anyone looking to buy a home, understanding this dynamic is crucial for navigating a market defined by volatility and shifting affordability.

The Tariff-Driven “Mortgage Rate Roller Coaster”

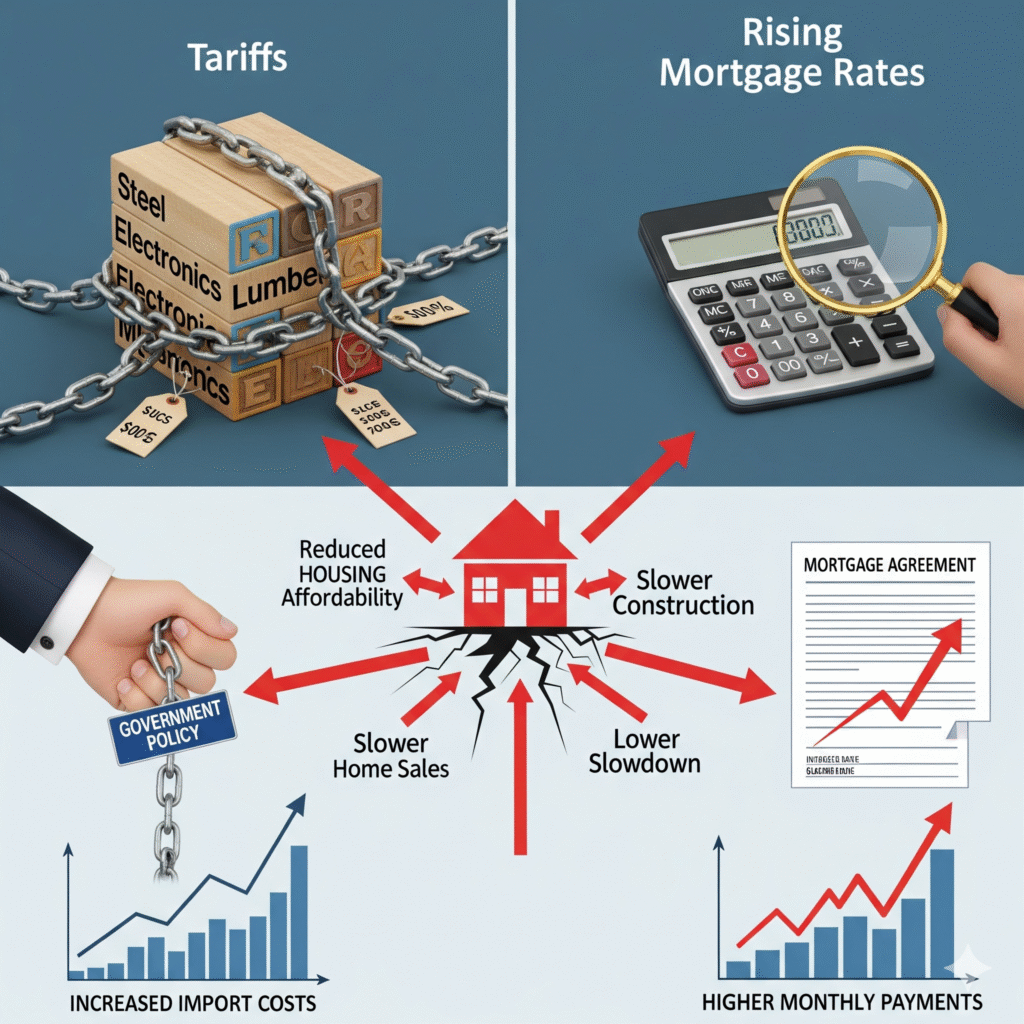

The aggressive use of tariffs as an economic tool, particularly on imported goods, is creating a ripple effect that is directly impacting mortgage rates. The link is not always straightforward, but it can be understood through two key mechanisms:

- Inflationary Pressure: Tariffs are, in essence, a tax on imported goods. When the cost of everything from construction materials like steel and lumber to household appliances increases, these costs are often passed on to consumers. This fuels broader inflation, which the Federal Reserve is mandated to control. If inflation rises too quickly, the Fed may be forced to keep its benchmark interest rate higher for longer, which in turn keeps mortgage rates elevated. The National Association of Home Builders, for instance, has estimated that tariffs could add thousands of dollars to the cost of a new home.

- Bond Market Volatility: Mortgage rates are not directly set by the Federal Reserve; instead, they closely track the yield of the 10-year Treasury bond. When tariffs and the threat of a trade war create economic uncertainty, investors often flee from the volatile stock market and seek the safety of U.S. Treasury bonds. This increased demand for bonds pushes their prices up and their yields down. A drop in the 10-year Treasury yield can, at least in the short term, cause mortgage rates to fall. However, this is often a temporary effect. As markets digest the inflationary impact of the tariffs, yields can spike, causing mortgage rates to surge in a “roller coaster” effect. This unpredictability makes it difficult for homebuyers to time their purchase.

Economic Policy Beyond Tariffs

While tariffs are a significant new variable, they are not the only economic policy influencing mortgage rates in 2025.

- Federal Reserve’s Cautious Stance: After a period of aggressive rate hikes, the Federal Reserve has adopted a more cautious, data-dependent approach. The Fed’s primary concern remains taming inflation, and it is hesitant to cut its federal funds rate unless it is confident that inflation is on a sustainable path back to its 2% target. This cautious stance means that while some modest rate cuts may occur, they are likely to be gradual, keeping mortgage rates from returning to the low levels of the past decade.

- Economic Growth and Unemployment: The state of the broader economy also plays a crucial role. A strong economy with low unemployment typically leads to higher demand for homes and, consequently, higher mortgage rates. Conversely, a weakening economy or a recession might prompt the Fed to cut rates to stimulate growth, which could push mortgage rates down. In 2025, there are signs of economic slowdown, which could lead to a future easing of monetary policy and a subsequent drop in mortgage rates.

What Homebuyers Need to Know and Do

The current economic climate demands a strategic approach from homebuyers. Here are some key takeaways and actionable steps:

- Expect Volatility, Not a Steady Decline: Mortgage rates are likely to fluctuate in the mid-to-high 6% range, with potential for sharp, short-term drops and equally sharp spikes. A return to the rates of the early 2020s is not expected in the near future.

- Lock in Your Rate: In this unpredictable environment, securing a rate lock is more important than ever. A rate lock protects you from sudden increases in interest rates while you are in the process of closing on a home.

- Strengthen Your Financial Profile: Your personal financial situation remains a critical factor. A higher credit score (typically 740+) and a lower debt-to-income ratio will help you qualify for the best possible interest rate, regardless of market conditions.

- Consider Your Loan Options: While fixed-rate mortgages offer stability, adjustable-rate mortgages (ARMs) may provide a lower initial rate for those who plan to sell or refinance within the initial fixed period.

- Stay Informed: Keep a close eye on economic news, particularly inflation reports and Federal Reserve announcements. Understanding the underlying forces at play will help you anticipate market shifts and make informed decisions.

In conclusion, the housing market in 2025 is being shaped by a complex interplay of traditional economic indicators and new geopolitical forces. Tariffs are not just a trade issue; they are a direct factor in the cost of borrowing for millions of Americans. By understanding this new reality and taking proactive steps, homebuyers can better navigate the challenges and opportunities of the current market.