Virginia Tax Calculator 2025

Estimate your Virginia state taxes for 2025 (Projected Rates)

Virginia State Income Tax Calculator 2025

Income Tax Results

Projected 2025 Virginia Income Tax Brackets

| Filing Status | Tax Rate | Projected Income Range |

|---|---|---|

| Single | 2.0% | $0 - $3,500 |

| 3.0% | $3,501 - $5,500 | |

| 5.0% | $5,501 - $18,000 | |

| 5.75% | $18,001+ | |

| Married Filing Jointly | 2.0% | $0 - $7,000 |

| 3.0% | $7,001 - $11,000 | |

| 5.0% | $11,001 - $36,000 | |

| 5.75% | $36,001+ |

Virginia Sales Tax Calculator 2025

Sales Tax Results

Virginia Paycheck Withholding Calculator 2025

Paycheck Results

Virginia Combined Tax Estimator 2025

Combined Tax Results

Virginia Projected 2025 Tax Rates

Income Tax Rates

| Filing Status | Tax Rate | Projected Income Range |

|---|---|---|

| Single | 2.0% | $0 - $3,500 |

| 3.0% | $3,501 - $5,500 | |

| 5.0% | $5,501 - $18,000 | |

| 5.75% | $18,001+ | |

| Married Filing Jointly | 2.0% | $0 - $7,000 |

| 3.0% | $7,001 - $11,000 | |

| 5.0% | $11,001 - $36,000 | |

| 5.75% | $36,001+ |

Projected 2025 Sales Tax Rates

| Jurisdiction | State Rate | Local Rate | Combined Rate |

|---|---|---|---|

| Statewide Base | 4.3% | 0.0% | 4.3% |

| Most Counties | 4.3% | 1.0% | 5.3% |

| Northern Virginia | 4.3% | 1.9% | 6.2% |

| Hampton Roads | 4.3% | 1.9% | 6.2% |

Projected 2025 Withholding Information

Virginia will likely continue using a percentage method for withholding state income tax from wages. The withholding rates mirror the income tax brackets.

Each allowance claimed is projected to reduce taxable income by $1,000 annually ($83.33 monthly, $38.46 bi-weekly, or $19.23 weekly).

Explore Our Free Tax Calculators and Tools

Virginia Tax Calculator

The Virginia Tax Calculator for 2025 provides accurate estimates of state income tax, paycheck withholdings, and sales tax based on the latest Virginia Department of Taxation rates. Designed for residents, workers, and businesses, this tool helps calculate liabilities across tax brackets, deductions, and allowances, making financial planning more precise.

What is a Virginia Income Tax Calculator?

Navigating Virginia’s tax system can feel complex, but with the right tools, you can manage your finances with confidence. This guide will serve as your comprehensive resource for understanding and using various tax calculators, providing insights that go beyond a simple number. Whether you’re a new resident, a small business owner, or simply planning for the future, we’ll help you demystify state taxes and make smarter financial decisions.

It’s ideal for anyone searching for:

-

Virginia income tax calculator

-

Virginia state income tax calculator

-

Income tax calculator Virginia

How Does the Virginia State Tax System Work?

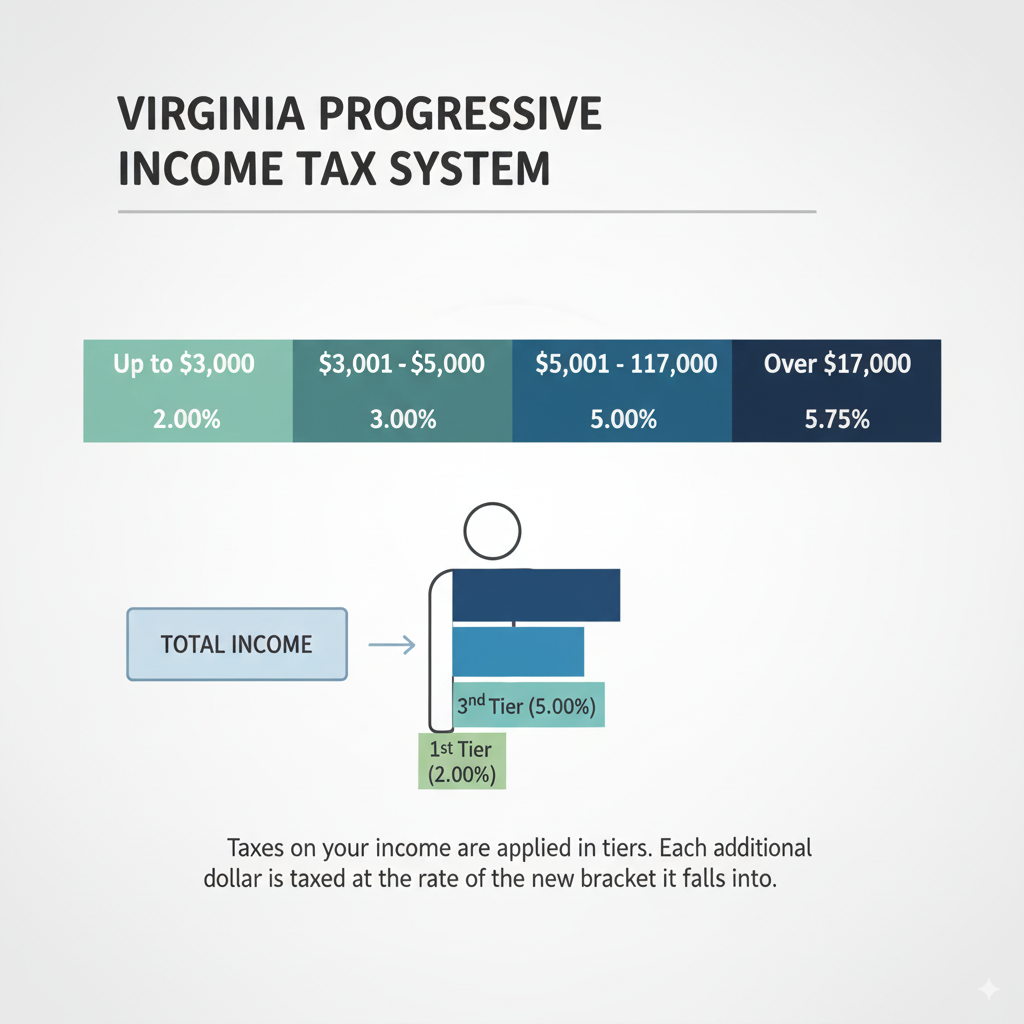

Virginia’s tax structure is based on a progressive system, meaning the more you earn, the higher your tax rate on each additional dollar. This system is designed to distribute the tax burden fairly across different income levels. The state’s tax law uses a series of four tax brackets, with rates ranging from 2% to 5.75%.

Here’s an updated breakdown of the tax brackets for single filers, as of the most recent tax year:

| Taxable Income | Tax Rate |

| Up to $3,000 | 2.00% |

| $3,001 – $5,000 | 3.00% |

| $5,001 – $17,000 | 5.00% |

| Over $17,000 | 5.75% |

For more detailed information on tax brackets and filing requirements, we recommend consulting the official Virginia Department of Taxation website. This ensures you’re always using the most accurate and up-to-date data.

A Virginia income tax calculator simplifies this process by automatically applying these brackets and factoring in your personal information, such as filing status and deductions. It’s an essential tool for forecasting your tax liability and planning for your future.

Essential Tax Calculators for Virginians

While a general income tax calculator is helpful, various specialized tools address specific financial situations.

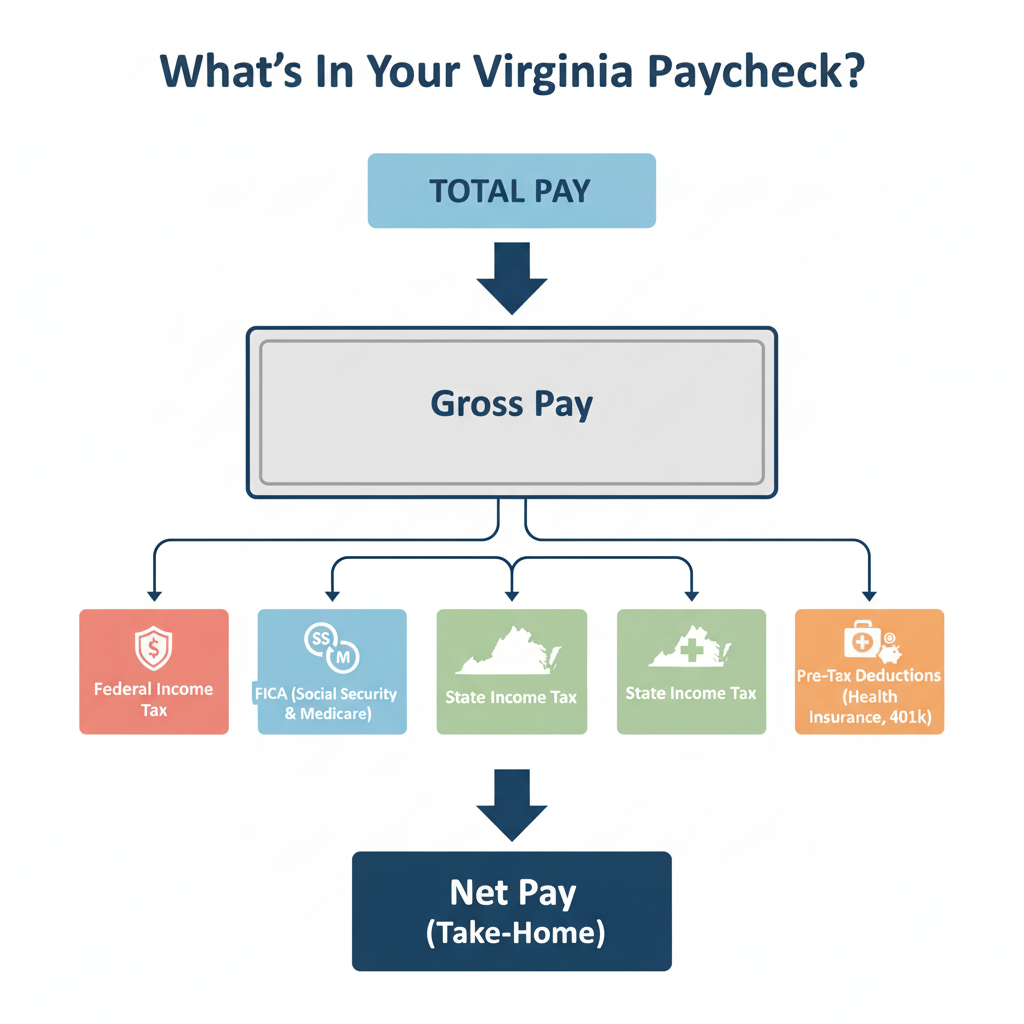

Virginia Paycheck & Withholding Calculator

Have you ever wondered why your take-home pay seems smaller than your salary? A Virginia paycheck tax calculator reveals exactly how much is withheld for federal, state, and FICA taxes (Social Security and Medicare) (IRS – Understanding Taxes). This tool is invaluable for:

-

Budgeting: Accurately plan your monthly budget based on your actual net pay.

-

Job Offers: Compare take-home pay from different employers or job opportunities.

-

Tax Withholding Adjustments: If you’re getting a huge tax refund or owe a large amount at the end of the year, a IRS’ Virginia tax withholding calculator can help you adjust your W-4 form to better match your tax liability throughout the year.

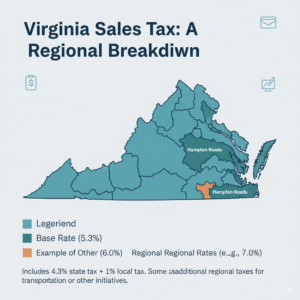

Virginia Sales Tax Calculator

Beyond income, sales tax affects everyday purchases. Virginia has a state sales tax rate of 4.3% and an additional 1% local tax, resulting in a base rate of 5.3%. However, some regions, like Northern Virginia and Hampton Roads, have an additional regional tax, bringing the total to 6%.

A Virginia sales tax calculator instantly computes the final cost of an item, including all applicable state and regional taxes. This is especially useful for:

-

Retail shoppers to avoid surprises at the register.

-

Business owners when setting prices or calculating receipts.

Step-by-Step Guide: How to Use an Online Tax Calculator

Using these online tools is straightforward. Here’s a typical workflow:

-

Input your Gross Income: Enter your total annual or monthly income before any deductions.

-

Select Filing Status: Choose your tax filing status (e.g., single, married filing jointly, head of household).

-

Add Deductions and Credits: Enter any deductions or credits you qualify for.

-

Click “Calculate”: The tool will instantly provide an estimate of your total tax liability, effective tax rate, and potential refund or amount owed.

For a Virginia paycheck calculator, you’ll also need to input your pay frequency (bi-weekly, monthly, etc.) and any pre-tax deductions like 401(k) contributions or health insurance premiums.

Frequently Asked Questions

Q1: Do I have to pay Virginia state taxes if I work remotely for an out-of-state company?

A: Yes. If you are a resident of Virginia, you are generally required to pay Virginia income tax on all your income, regardless of where the company you work for is located. (Virginia Residency & Filing Guide)

Q2: How does a tax calculator account for deductions and credits?

A: A tax calculator subtracts eligible deductions from your gross income to determine your taxable income. It then applies any applicable credits, which directly reduce the amount of tax you owe, to give you an accurate estimate. (IRS Credits & Deductions)

Q3: Are Virginia tax rates the same everywhere for sales tax?

A: No. While the state and local base rates are consistent, some areas have additional regional taxes. Always check Virginia Tax Regional Rates that accounts for your specific location.

Bottom Line

Tax planning in Virginia doesn’t have to be overwhelming. By leveraging reliable online calculators, you can take control of your financial health. These tools, when used as part of a broader understanding of the state’s tax system, can empower you to budget more effectively, plan for the future, and make informed financial decisions.

Disclaimer: The tools and content on USATaxCalculator.com are for informational purposes only and do not constitute tax or financial advice. Our calculators provide basic estimates and may not reflect the exact tax results.

We recommend consulting a certified tax professional or the Internal Revenue Service (IRS) for accurate guidance. USATaxCalculator.com is not responsible for any decisions made based on the information provided.